Asia Morning Briefing: Ethereum Leads Recovery After $20B Liquidation Shock

Ethereum is leading a cautious recovery in the crypto market after last week’s record $20 billion liquidation shock. Ether has rebounded above $4,100, while Bitcoin is stabilizing near $115,000 as traders regain confidence. The uptick signals a tentative return of risk appetite following one of the most volatile trading weeks of the year.

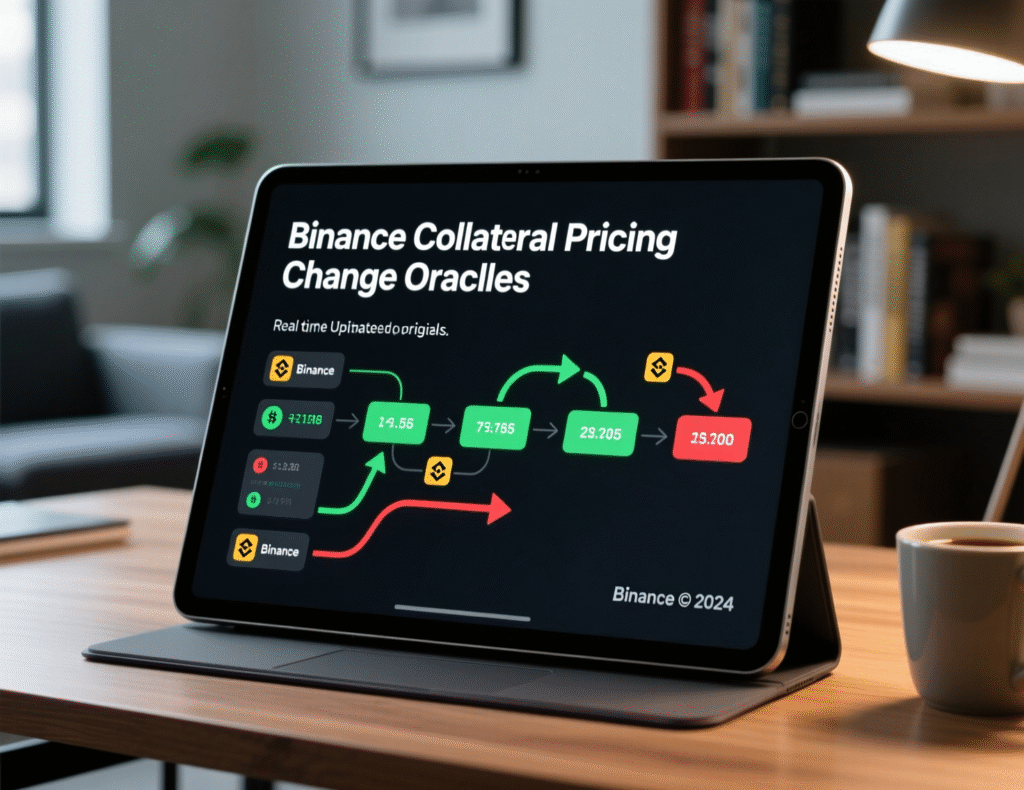

Analysts now suggest that the late-week crash was intensified by an exchange-side structural flaw specifically, how collateral was priced on Binance rather than a broader stablecoin or liquidity failure. This distinction has eased concerns about deeper systemic risks. “Ethereum Leads Recovery After $20B Liquidation Shock” is emerging as the key theme in early Asian trading, with investors watching whether this rebound can sustain into the U.S. session.

Market Snapshot: Prices and Flows

Bitcoin traded around $115,000 in early Asia hours, while Ether reclaimed the $4,100 handle. High-beta tokens including Solana and Bittensor outperformed as leverage reset and risk-taking cautiously resumed.

What Sparked the Rout?

Analyses over the weekend point to a flaw in how Binance marked collateral using internal order-book data rather than external oracles allowing a localized collapse in certain wrapped assets and synthetic dollars to cascade into forced liquidations. Binance has since acknowledged platform issues and accelerated a shift toward oracle-based pricing. Blockonomi+1

Did USDe Really Depeg?

Dragonfly’s Haseeb Qureshi argues USDe’s plunge to the mid-$0.60s was largely a Binance-only phenomenon; on on-chain venues like Curve and on other exchanges, pricing held closer to $1 and redemptions remained available. That implies an exchange-side failure versus a protocol-level collapse.

Gold at Records on Trade Tensions

Beyond crypto, gold surged to fresh records above $4,060 per ounce as investors priced in escalating U.S.–China trade frictions and potential Federal Reserve rate cuts an environment that can tighten financial conditions for risk assets while boosting safe havens.

Ethereum Leads Recovery After $20B Liquidation Shock: What’s Changed at Binance

Binance said it experienced “platform-related issues,” adjusted how it prices collateral, and pledged compensation for users demonstrably harmed by exchange-side failures (not ordinary market losses). Independent and industry media report compensation figures in the ~$280 million range to date.

Ethereum Leads Recovery After $20B Liquidation Shock: Why ETH Outpaced BTC

ETH’s rebound outpaced BTC as leverage in long-tail tokens cleared and DeFi activity normalized. Structural frictions such as a large share of ETH staked may have slowed panic selling versus fully free-float assets, aiding recovery momentum once forced unwinds subsided.

Context & Analysis

If postmortems hold, last week’s “depegs” were less a stablecoin design failure and more a stress test of centralized exchange plumbing. The episode underscores venue concentration risk and the importance of transparent, oracle-based margining. It also highlights how staking dynamics can introduce friction that, paradoxically, slows crashes—at the cost of liquidity when markets seize.

Conclusion

The sharp market cleanout now appears largely complete, with Ethereum spearheading the rebound following last week’s $20 billion liquidation shock. Prices have steadied as traders cautiously reenter positions, signaling a fragile return of confidence across major crypto assets.

However, sentiment remains guarded amid record-high gold prices and persistent macro uncertainties. Market participants are closely watching how exchanges tighten risk management, enforce leverage limits, and implement safeguards after Binance’s collateral-pricing flaw intensified the crash. Whether these adjustments are enough to prevent another disruption will likely shape short-term market behavior and broader institutional participation.

FAQs

Q : What caused Friday’s crypto crash?

A : A combination of macro shocks and a collateral-pricing flaw on Binance that amplified forced liquidations.

Q : Did USDe truly depeg?

A : Evidence suggests the sharp drop was largely confined to Binance order books; on-chain venues held closer to $1 and redemptions continued.

Q : How much compensation has Binance paid?

A : Reports indicate over $280 million in compensation for users affected by exchange-side issues; ordinary market losses aren’t covered.

Q : Why is Ethereum rebounding faster than Bitcoin?

A : Leverage clearing and staking-related frictions may have slowed ETH’s downside, aiding the rebound as markets stabilized.

Q : What’s next for gold prices?

A : With U.S.–China tensions elevated and rate-cut bets rising, safe-haven demand remains supportive near record levels.

Q : Does this mean centralized exchanges are unsafe?

A : Not categorically, but venue risk is real; platforms using robust oracle-based margining may mitigate similar episodes.

Q : Where can I track the move if Ethereum leads recovery after $20B liquidation shock?

A : Follow reputable market dashboards and price feeds from outlets like Barron’s and Reuters for verified updates.

Facts

Event

Crypto market selloff and rebound; exchange-side pricing flaw blamed for cascading liquidationsDate/Time

2025-10-13T07:04:00+05:00Entities

Binance; Ethereum (ETH); Bitcoin (BTC); Ethena (USDe); Dragonfly (Haseeb Qureshi)Figures

BTC ≈ $115K; ETH ≈ $4.1K; Compensation > $280M; Gold > $4,060/oz (spot)Quotes

“USDe did not decouple.” Haseeb Qureshi, Dragonfly (analysis thread) BeInCryptoSources

Barron’s (btc/eth rebound) https://www.barrons.com/; Reuters (gold record) https://www.reuters.com/; CoinDesk (Asia Briefing & Binance remarks) https://www.coindesk.com/; Blockonomi (Binance pricing/oracle shift) https://blockonomi.com/ Blockonomi+3Barron’s+3Reuters+3