Crypto funds attract $3.2B inflows despite Friday’s flash crash

Crypto markets faced a sharp sell-off on Friday, yet investor appetite for digital assets remained strong. Despite the turbulence, exchange-traded crypto products (ETPs) continued to see solid demand, signaling confidence in the sector’s long-term potential.

According to CoinShares, crypto investment funds recorded around $3.17 billion in net inflows during the week, reflecting sustained institutional interest. Weekly trading volumes also hit a record high of roughly $53 billion, highlighting increased market participation even amid heightened volatility.

What happened this week

Digital-asset ETPs saw ~$3.17B of new money, lifting year-to-date inflows to about $48.7B already above last year’s pace. Trading activity spiked as the flash crash hit: weekly volumes reached an all-time high near $53B, with ~$15.3B changing hands on Friday. Assets under management dipped on price effects, but flows remained positive.

Why crypto funds attract $3.2B inflows despite turmoil

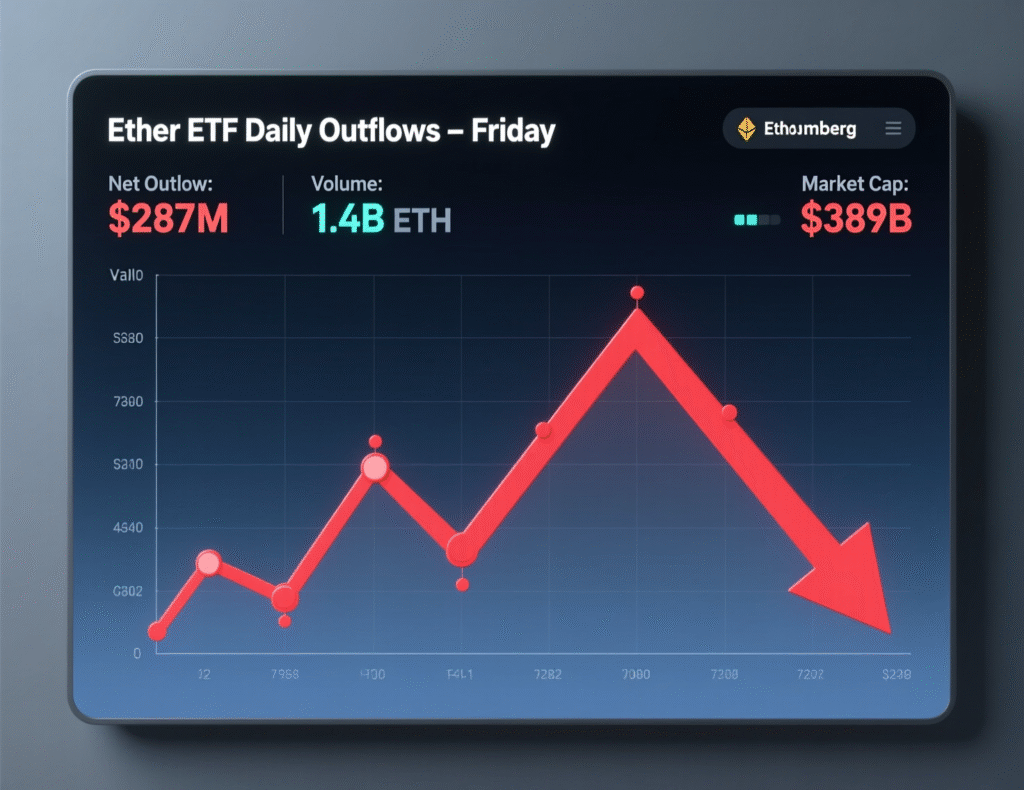

Investors continued allocating to listed products even as derivatives markets unwound. CoinShares data indicates Bitcoin products led with roughly $2.7B of weekly inflows, while Ether products posted net weekly inflows but suffered a sharp single-day outflow as volatility peaked.

Market reaction as crypto funds attract $3.2B inflows

Friday’s flash crash followed fresh tariff threats in the U.S.–China spat and triggered a wave of forced liquidations estimated near ~$19B. Despite the drawdown, fund flow data suggests investors used ETPs for price discovery and hedging rather than capitulating en masse. The Economic Times+1

Asset-level moves

Bitcoin (BTC)

~+$2.7B weekly inflows; leadership intact.Ether (ETH)

Net weekly inflows, but largest daily outflow among majors on Friday; Hong Kong ETH spot ETFs registered ~US$172M daily outflow around the episode.Altcoins (SOL, XRP)

Inflows slowed markedly from last week’s records as attention shifted back to BTC and ETH liquidity.

Policy & pipeline: ETF timelines in limbo

A federal government shutdown in the United States has slowed routine agency work, prolonging uncertainty around multiple pending crypto ETF applications. Industry analysts expect a batch of approvals once operations normalize, but timing remains contingent on Washington.

Context & Analysis

The split between price-driven AUM declines and steady net inflows suggests institutions are increasingly using listed ETPs as core exposure tools and liquidity buffers. The concentration of volumes during the crash indicates ETPs functioned as shock absorbers rather than amplifiers consistent with prior stress episodes. Pending U.S. ETF decisions remain a key near-term catalyst.

Conclusion

Despite a tariff-driven flash crash and widespread liquidations, regulated crypto products showed remarkable resilience. Investors continued to add exposure, with digital asset funds pulling in roughly $3.2 billion in weekly inflows as Bitcoin led allocations across major exchange-traded products.

Trading activity also surged to record highs, underscoring persistent institutional demand despite market turbulence. Attention now shifts to Washington’s efforts to resolve the government shutdown and upcoming ETF decisions, both seen as key catalysts for the next move in crypto markets.

FAQs

Q : Why did crypto funds attract $3.2B inflows during a market crash?

A : Because investors continued allocating via regulated ETPs even as derivatives unwound, pushing weekly net flows to around $3.17B.

Q : Which asset led the inflows?

A : Bitcoin products led with roughly $2.7B for the week.

Q : Did Ether see outflows or inflows?

A : There were net weekly inflows overall, but a sizeable single-day outflow on Friday; Hong Kong ETH spot ETFs saw about US$172M daily outflow.

Q : How big were the liquidations during the flash crash?

A : Around $19B was wiped out in liquidations as tariff headlines hit.

Q : What’s the status of U.S. crypto ETF approvals amid the shutdown?

A : Decisions are delayed while agencies operate with limited staffing; approvals could bunch up once normal operations resume.

Q : Do record volumes imply growing adoption?

A : They show heightened trading and liquidity; sustained inflows alongside record volumes signal deeper institutional participation.

Q : How can I monitor weekly flows myself?

A : Check CoinShares’ Monday reports and use ETF dashboards like SoSoValue for daily tracking.

Facts

Event

Weekly crypto fund flows show resilience after flash crashDate/Time

2025-10-13T14:00:00+05:00Entities

CoinShares (James Butterfill); Bitcoin (BTC); Ether (ETH); Solana (SOL); XRP; SoSoValue; U.S. SECFigures

~$3.17B net inflows (weekly); ~$53B weekly ETP volumes; ~$15.3B Friday volume; ~$19B liquidations; ETH HK spot ETF ~US$172M daily outflow (Fri).Quotes

“Digital asset investment products registered $3.17 billion in net inflows… weekly trading volumes surged to a record $53 billion.” — CoinShares weekly summary (as reported) The BlockSources

The Block (https://www.theblock.co/post/374324/crypto-investment-products-log-3-17-billion-in-weekly-inflows-despite-historic-liquidation-event-coinshares), BeInCrypto (https://beincrypto.com/digital-asset-fund-inflows-record-2025/)