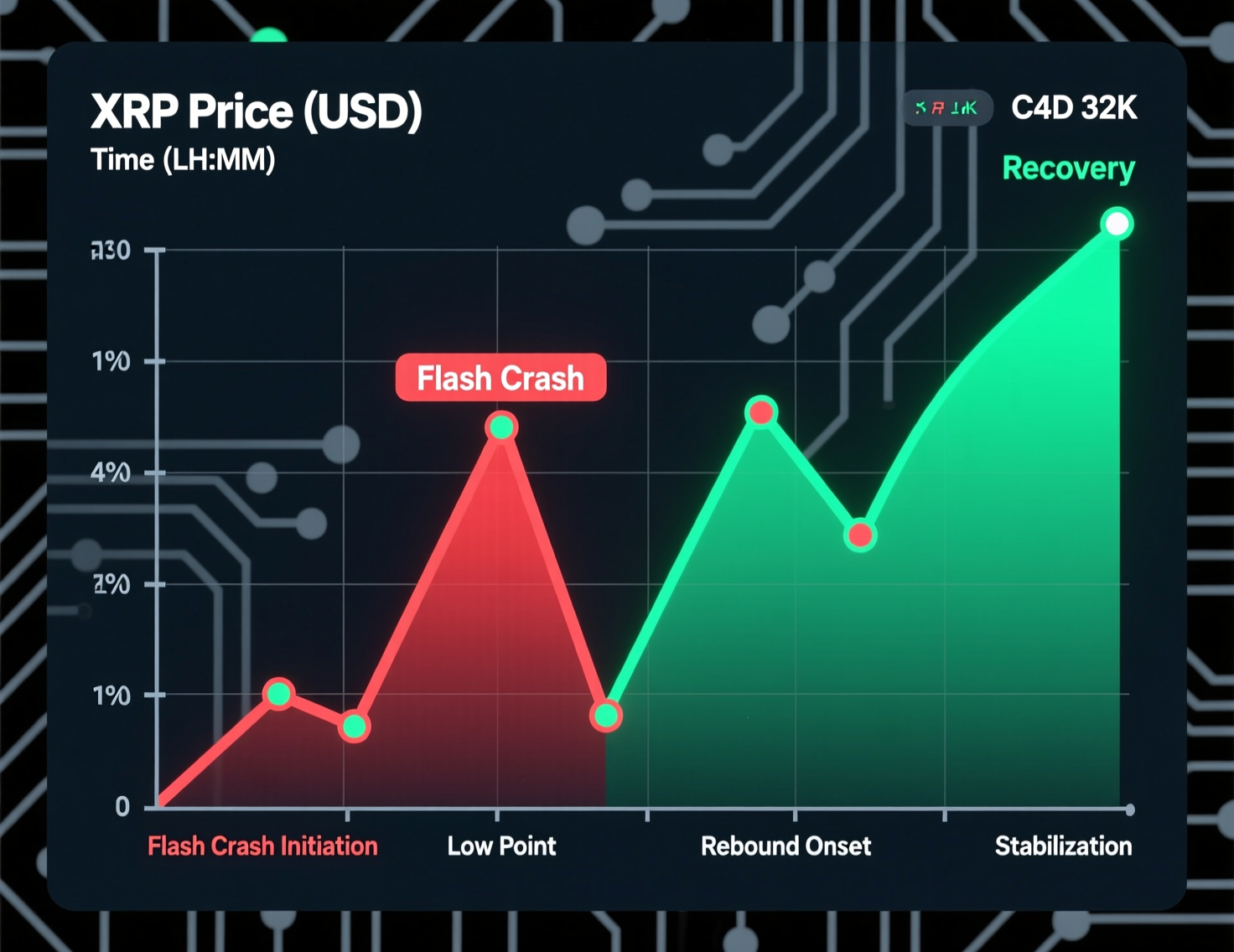

XRP Rebounds Sharply After 41% Flash Crash, Reclaims $2.47 Support

NEW YORK 2025-10-12 XRP rebounded sharply after a 41% flash crash that briefly sent the token from around $2.77 to $1.64 before recovering above the $2.47 support zone. The sudden drop reflected broad market turbulence as traders rushed to unwind leveraged positions across major crypto assets.

The volatility followed renewed U.S. China trade tensions, including Washington’s proposal of a 100% tariff on Chinese imports, which triggered risk-off sentiment across global markets. Heavy liquidations rippled through crypto exchanges, amplifying the selloff before buyers stepped in to stabilize prices. XRP’s swift recovery highlighted both the market’s fragility and traders’ readiness to re-enter after steep corrections. CoinDesk+2Reuters+2

Market recap: panic, then absorption

Range & close

Session range near $1.14 (≈$2.77 high, $1.64 low) with a rebound to ~$2.49 by late session.Macro trigger

Markets sold off after the White House signaled an additional 100% tariff on Chinese imports starting in November, stoking risk aversion across equities and crypto.Liquidations

Industry trackers flagged an exceptionally large, market-wide wipeout, with XRP among the notable movers during the cascade.

Levels to watch

Support

$1.64 (capitulation low); near-term floor rebuilt ~$2.40–$2.45 with spot absorption.Resistance

$2.90–$3.05 as initial ceiling; a close above ~$3.05 would aid a structural recovery toward prior targets.Momentum

Post-rebound stabilization around $2.47–$2.48 suggested consolidation rather than persistent exit flows.

Order flow, futures & volumes

Derivatives stress

Elevated long liquidations and a sharp drawdown in open interest accompanied the slide, consistent with a macro-led de-risking impulse.Turnover

Intra-session volume spiked well above recent averages during the capitulation candle, reflecting forced unwinds and opportunistic bids.

What traders are watching next

Does $2.47 hold?

Bulls want repeated defenses of the reclaimed support through the early-week Asia sessions.Macro tape

Further headlines on U.S.–China tariffs and any spillovers to equities and crypto beta.Breakout barometer

A sustained push over $3.05 to re-open upside scenarios toward the mid-$3s.

XRP rebounds after 41% flash crash technical view

Pattern

Early signs of a bullish recovery channel as momentum indicators lift off oversold conditions; confirmation still requires trend-day follow-through.Risk factors

Macro shocks, funding resets, and correlation spikes could re-ignite volatility.

Context & Analysis

The timing and magnitude of the move align with a macro shock rather than idiosyncratic XRP news. Tariff headlines hit broad risk assets, compressed liquidity, and accelerated liquidations conditions that tend to amplify moves in high-beta tokens. A reclaim of $2.47 is constructive, but market structure likely needs a decisive close above ~$3.05 to validate a trend resumption.

Conclusion

XRP’s sharp rebound from a 41% intraday fall highlights solid dip buying, though sentiment remains fragile and heavily driven by headlines. The quick recovery shows traders’ willingness to re-enter after heavy liquidations, but short-term direction still hinges on broader risk conditions.

For bulls, maintaining support above $2.47 is key to building momentum toward a breakout above $3.05. Bears, however, may look for failed retests or renewed weakness if U.S.–China trade tensions intensify. With macro uncertainty still elevated, XRP’s next move will likely mirror shifts in overall market confidence and regulatory tone.

FAQs

Q : What caused XRP’s sudden drop?

A : A planned 100% U.S. tariff on Chinese imports spurred risk-off moves and crypto liquidations, contributing to XRP’s plunge.

Q : How low did XRP fall and where did it close?

A : It dropped to about $1.64 before rebounding to close above $2.47.

Q : Where are the key levels now?

A : Support sits near $2.47 and $2.40–$2.45; resistance is $2.90–$3.05.

Q : Did liquidations play a role?

A : Yes. The selloff coincided with a large market-wide liquidation event affecting major tokens, including XRP.

Q : Is the rebound sustainable?

A : A sustained close above ~$3.05 would strengthen recovery odds; failure to hold $2.47 risks further chop.

Q : What macro risks should traders monitor?

A : Tariff policy headlines, equity market stress, and cross-asset correlation spikes.

Q : Why do some headlines say ‘XRP rebounds after 41% flash crash’?

A : Because that phrase accurately describes the move from ~$2.77 to ~$1.64 and the subsequent recovery above $2.47.

Facts

Event

XRP plunged ~41% intraday, then reclaimed ~$2.47 support.Date/Time

2025-10-11T21:00:00+05:00 (peak volatility window)Entities

Ripple (XRP), United States, China, U.S. President Donald TrumpFigures

Low ~$1.64; range ≈$1.14; key resistance ~$3.05; elevated market-wide liquidations. CoinDesk+1Quotes

“Impose an additional 100% tariff on Chinese imports starting November.” — Announcement described in Reuters reporting. ReutersSources

Reuters (tariffs) | CoinDesk (XRP move & levels)