Analysis: Market Is Undervaluing the Possibility Cardano (ADA) ETF Is Delayed Until 2026

The SEC’s approval of generic listing standards in September was intended to streamline the path for altcoin exchange-traded products (ETPs) and encourage faster market launches. However, the recent federal funding lapse has disrupted that timeline, leaving regulatory staff unable to review, process, or comment on new filings.

As a result, projects like a potential Cardano (ADA) ETF could face longer delays than investors anticipated. While current market sentiment leans toward an early approval, the practical slowdown in regulatory activity makes a postponement into 2026 increasingly likely. This shift highlights how even procedural government interruptions can ripple through the broader digital asset landscape and affect timelines that once seemed within reach.

What changed after September’s fast-track move

The Commission approved generic listing standards for commodity-based trust shares on Sept. 17, reducing the need for case-by-case Rule 19b-4 approvals in many scenarios. Commissioners and the SEC’s release framed this as continuity with the 2019 ETF rule framework—now extended to covered commodity-based ETPs potentially accelerating timelines for eligible crypto products.

Why that may not help during a shutdown

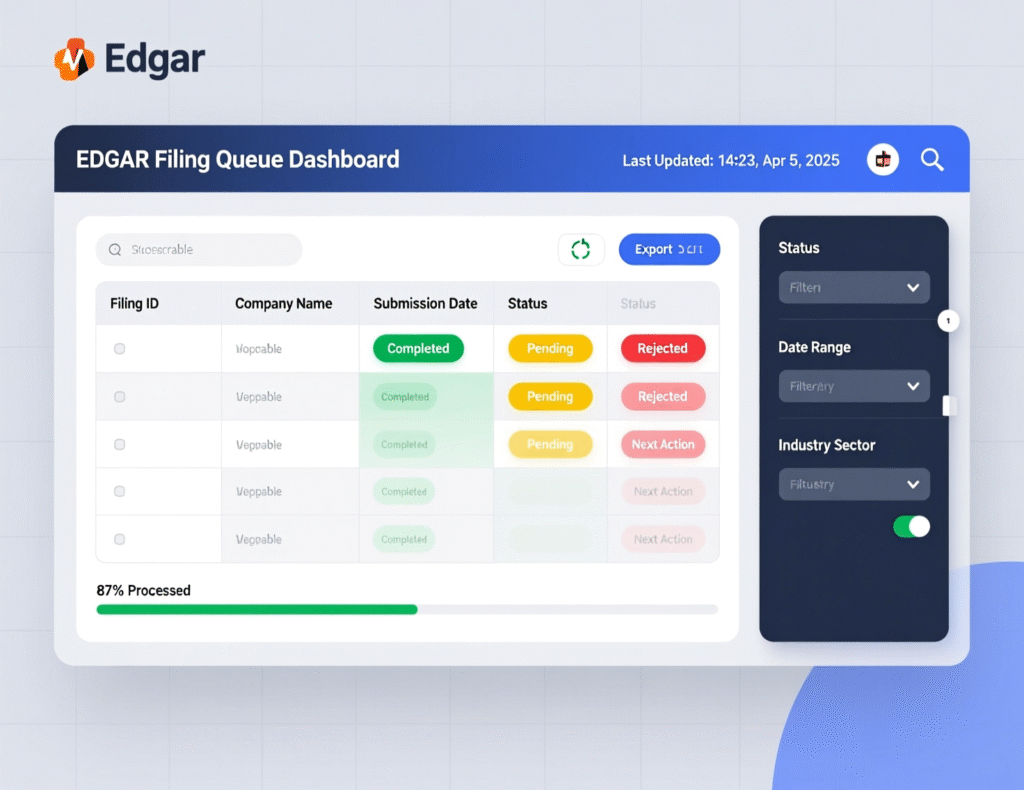

Even streamlined regimes require staff to review registration statements and listing notices. The SEC’s Trading & Markets guidance states that while EDGAR remains open, staff are unable to process filings or provide interpretive advice during a shutdown—functionally freezing momentum.

Shutdown mechanics: what’s actually paused

EDGAR stays up

Issuers can submit S-1s and updates.Reviews don’t

Staff cannot process, comment on, or accelerate filings; normal division activities are paused.IPO precedent

Parallel guidance for IPOs highlights how constrained reviews become when most personnel are furloughed an instructive analog for crypto ETPs.

Staffing reality

External summaries of the SEC’s operations plan indicate only ~393 of ~4,289 employees active focused on emergencies and market-integrity functions. That leaves limited capacity to advance new products.

Timeline math: how a short pause becomes a Cardano (ADA) ETF delay

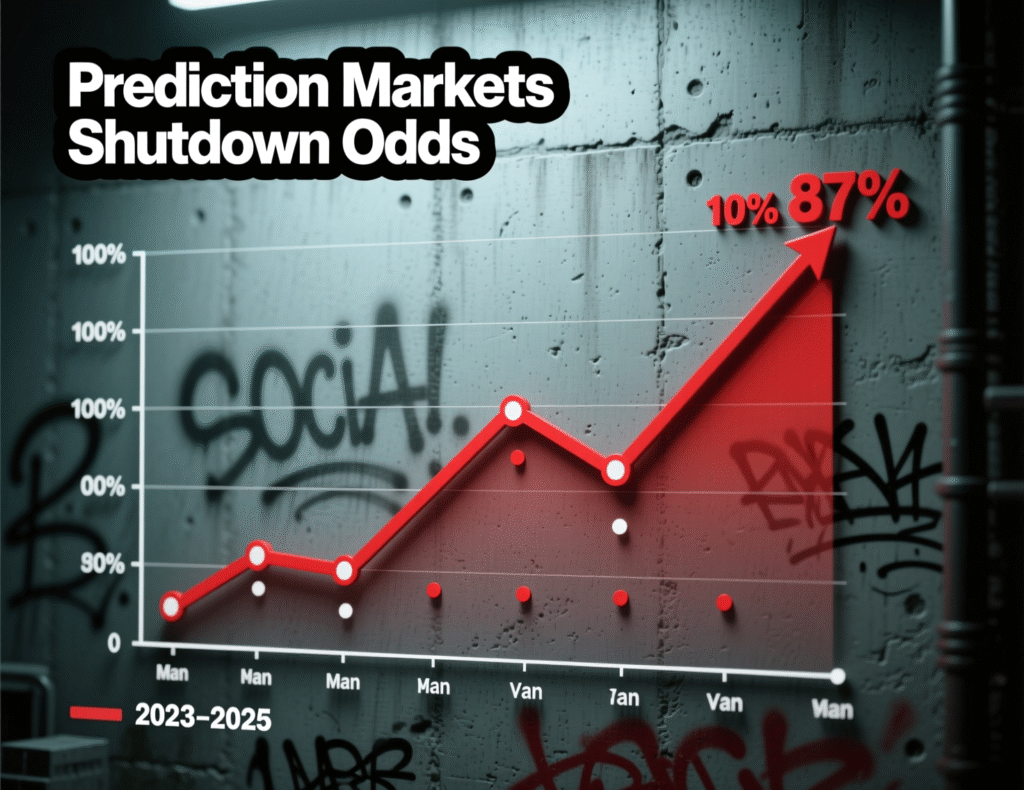

If the shutdown persists for multiple weeks, the practical calendar tightens: reopening would be followed by triage across IPOs, enforcement, and pending ETPs. With holidays compressing late-Q4, even modest slippage could push an ADA decision into early 2026. Prediction markets currently price meaningful odds of a prolonged shutdown, suggesting timing risk that may be underappreciated. Polymarket+1

Where ADA stands now

Coverage indicates issuers have oriented toward the generic-standards pathway (with prior 19b-4s withdrawn in some cases), but formal approval still requires effective registration and operational readiness steps that benefit from engaged staff.

Risks and scenarios for investors

Base case (reopening soon)

Reviews resume with backlog; year-end approval still possible but tighter.Prolonged shutdown

Backlog plus holiday calendar increases odds of a slip into Q1 2026.Policy variance

SEC could issue targeted relief (as seen for IPO mechanics), but there’s no substitute for staff review in crypto ETPs.

<section id=”howto”> <h3>How to monitor shutdown impact on ADA ETF timing</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Track the SEC’s shutdown pages and operational updates for when reviews restart.</li> <li id=”step2″><strong>Step 2:</strong> Check EDGAR for new S-1 amendments or effectiveness notices related to Cardano.</li> <li id=”step3″><strong>Step 3:</strong> Watch the SEC’s “Trading & Markets” and “CorpFin” updates for review policy shifts.</li> <li id=”step4″><strong>Step 4:</strong> Follow reputable outlets for confirmation of listing approvals and launch dates.</li> <li id=”step5″><strong>Step 5:</strong> Use prediction/derivatives markets as sentiment gauges not as certainty about timing.</li> </ol> <p><em>Note: Processes vary by issuer and exchange. Confirm requirements before acting.</em></p> </section>

Context & Analysis

The market’s optimism leans heavily on September’s generic-standards decision, which truly lowers procedural friction. But process isn’t the only bottleneck—capacity is. With staff limited to essential functions, throughput on novel products stalls. Given calendar compression in late Q4, a few weeks of paralysis can compound into months when combined with backlog triage. Investors should factor this timing risk when pricing ADA-related catalysts.

Conclusion

Fast-track rules were designed to accelerate altcoin ETP approvals, but progress has stalled amid the ongoing regulatory standstill. The SEC’s partial closure and halted review process have left several filings in limbo, slowing what was expected to be a smoother route for digital asset products.

For Cardano (ADA), the impact could be significant. While investors still hope for quicker movement, a delay pushing an ADA ETF into early 2026 now appears increasingly realistic. The situation underscores how even brief administrative disruptions can reshape market expectations and timelines across the crypto investment landscape.

FAQs

Q : Could the shutdown cause a Cardano (ADA) ETF delay into 2026?

A : Yes. With staff unable to process filings, a multi-week shutdown could push timelines into early 2026.

Q : Did the SEC really ‘fast-track’ altcoin ETPs?

A : The SEC approved generic listing standards for certain commodity-based trust shares, reducing reliance on Rule 19b-4.

Q : Are filings still being accepted during the shutdown?

A : EDGAR accepts filings, but staff generally can’t review or comment until funding is restored.

Q : What’s the status of ADA’s ETF application?

A : Coverage indicates issuers are proceeding under the generic-standards framework; no approval has been announced.

Q : How reliable are prediction markets for timing?

A : They offer a real-time crowd view but fluctuate and are not guarantees.

Q : Did the SEC halt all IPOs?

A : IPO processes are heavily constrained; recent guidance provided limited relief workarounds, underlining the broader review slowdown.

Q : What happens when the SEC reopens?

A : Expect triage across IPOs, enforcement, and ETPs, which can stretch timelines before approvals resume at a normal pace.