Bitcoin ‘OG’ Whale Raises Bearish BTC Bet Worth Over $400M

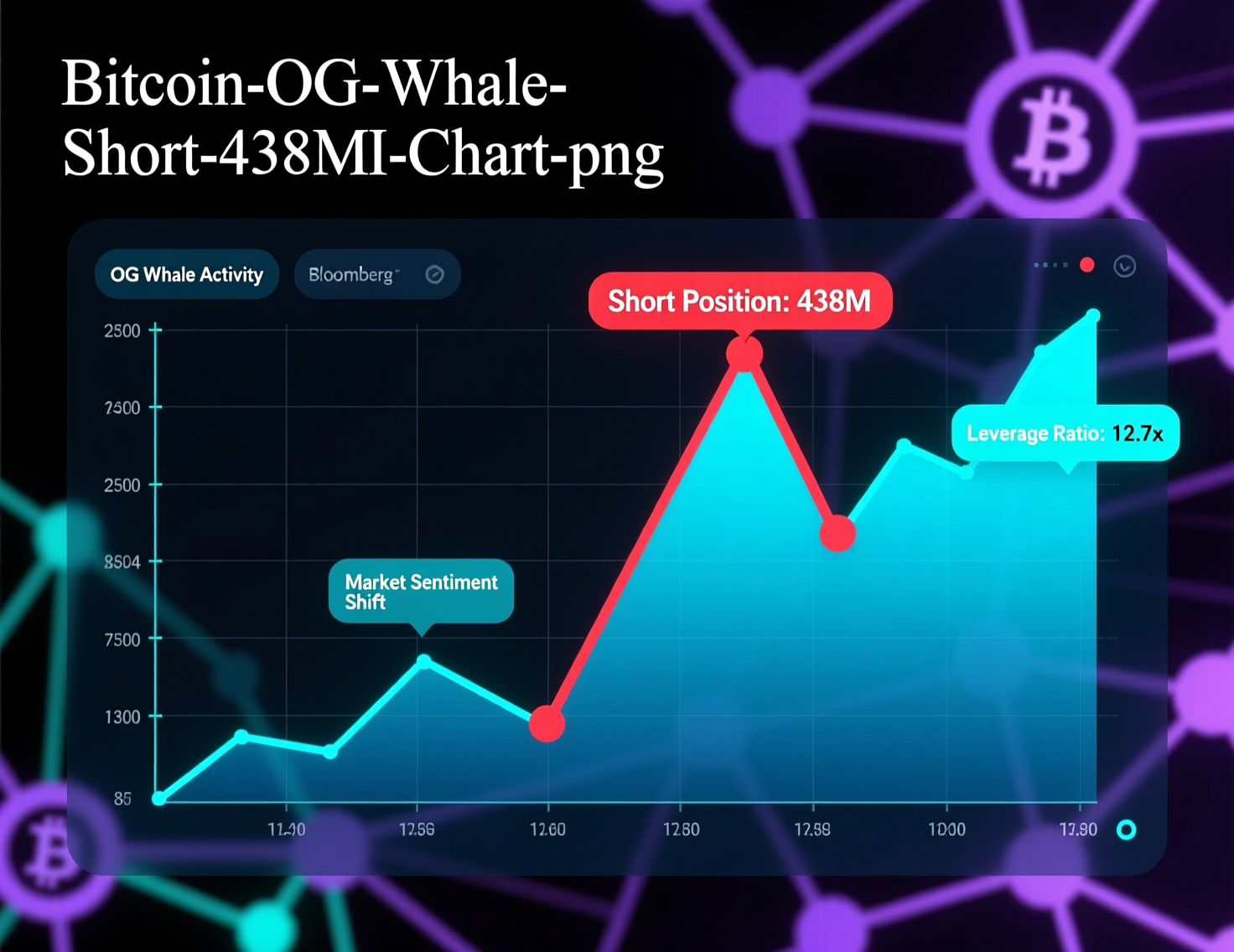

NEW YORK, Oct. 10, 2025 A long-time bitcoin “OG” whale has significantly expanded a leveraged short position to 3,600 BTC (valued around $438 million) on the decentralized exchange Hyperliquid during overnight trading. The trader’s liquidation point is set near $139,900, signaling a high-stakes bet on continued market weakness.

This move follows earlier spot bitcoin sales by the same entity earlier in the week, adding to speculation about broader profit-taking among early holders. Bitcoin (BTC) is currently stabilizing around $121,500 after briefly falling below the $120,000 mark, as traders weigh macro factors and whale activity heading into the weekend.

Why this whale matters

On-chain sleuth Lookonchain has tracked the entity for months. Beyond this week’s spot selling (~3,000 BTC), the address swapped 35,991 BTC for 886,371 ETH between Aug. 20 and Sept. 1—one of the cycle’s largest BTC→ETH rotations. The latest short increases the whale’s directional downside exposure even as broader markets show only modestly positive funding. The Block+3CoinDesk+3X (formerly Twitter)+3

Market snapshot: price, funding and volatility

BTC is trading near $121.6K, within a $120K–$126K range this week, after printing new all-time highs earlier in October. Implied volatility has ticked up into a 2.5-month high, while funding rates remain positive but not extreme on a multi-day average—suggesting bullish positioning persists despite the whale’s bet.

What the Bitcoin OG whale short signals

Large, visible shorts by veteran addresses can pressure sentiment and provide liquidity for longs. However, a single whale’s position rarely dictates trend unless supported by broader derivatives leverage and spot outflows. With funding still positive, the market’s base case remains consolidation with an upside bias, barring further large spot distribution or a macro shock.

Mechanics of the Bitcoin OG whale short

Size: 3,600 BTC notional (~$438M).

Venue: Hyperliquid (decentralized perpetuals).

Liquidation price: ~$139,900.

P&L

Reports showed a small unrealized loss shortly after sizing up.

These details frame the risk: a fast squeeze toward prior highs could threaten the position, while a grind lower would benefit it.

Recent whale behavior and flows

The OG whale sold BTC spot earlier this week and previously executed a substantial BTC→ETH rotation in late summer. Such behavior can add sell pressure near highs and may also reflect portfolio hedging rather than outright trend reversal. Keep an eye on subsequent deposits to Hyperliquid or other venues for clues.

Context & Analysis

Q4 “Uptober” strength backed by new highs and steady ETF inflows has coincided with rising implied volatility and pockets of leverage. A single OG whale short is not determinative on its own; watch funding rate drift, open interest expansion, and spot ETF net flows for confirmation of any trend change.

Conclusion

The Bitcoin OG whale’s large short position adds a clear bearish signal to an otherwise steady market backdrop. While the move suggests caution among early holders, broader sentiment remains moderately constructive as traders monitor funding rates and spot flows for confirmation of direction.

For now, bitcoin appears likely to stay range-bound unless funding turns negative or significant spot outflows emerge. However, if momentum strengthens, short positions near the whale’s $139,900 liquidation zone could face squeeze pressure, potentially driving sharp upside moves despite the cautious tone dominating current market sentiment.