Bitcoin Implied Volatility Reaches 2.5-Month High as Seasonal Strength Kicks In

Bitcoin’s implied volatility has surged to a 2.5-month high as the market enters October — a month historically known for strong swings and solid returns. Volmex’s BVIV index, which tracks annualized four-week implied volatility, climbed above 42%, marking its highest level since late August. The move mirrors similar October volatility spikes seen in past years, hinting at renewed trader activity and positioning.

Despite the volatility uptick, Bitcoin’s price has paused after reaching fresh all-time highs near $126,000. The cryptocurrency is now consolidating within a tight $120,000–$126,000 range as investors gauge whether momentum will extend or cool further. With volatility returning and seasonal patterns in play, October could set the stage for decisive moves in Bitcoin’s next trend direction.The Economic Times+3CoinDesk+3TradingView+3

Why Bitcoin implied volatility 2.5-month high matters

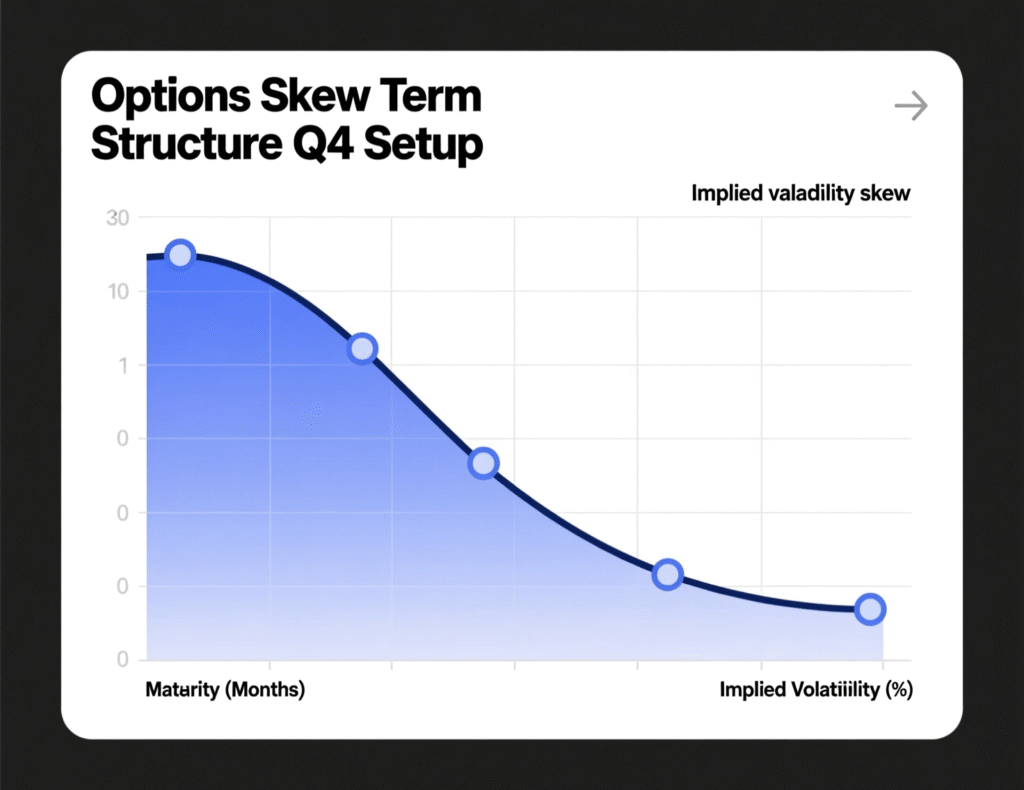

Implied volatility (IV) is derived from options pricing and reflects the market’s expectation of future price swings without implying direction. A rising BVIV typically signals larger anticipated moves ahead, often clustering around macro catalysts or trend inflections. Current levels above 42% suggest traders are positioning for wider trading ranges through late October into November.

Seasonal setup into late October and November

Historical patterns show the second half of October tends to outperform the first, and November has been BTC’s best month on average, with ~45% average gains in some datasets. CoinDesk’s review of CoinGlass figures notes late-October strength, while CoinGlass seasonality datasets show October/November as standout months in post-halving years.

Price context: new highs, then consolidation

After notching record highs around $125K–$126K in early October, BTC has eased back toward ~$121K–$122K, moving largely sideways as traders reassess positioning. Consolidation amid elevated IV can precede breakouts or sharper pullbacks, keeping risk management in focus.

Signals when Bitcoin implied volatility 2.5-month high appears

Momentum + IV

Rising IV alongside price strength can indicate demand for topside protection—or speculative call interest into price discovery.Pullbacks + IV

IV frequently pops when spot retraces, reflecting hedging demand and uncertainty; the relationship is often (but not always) inverse over short windows.

Context & Analysis

Elevated IV into seasonally strong months suggests larger swings are probable, but direction remains path-dependent. With BTC near record territory and macro catalysts ahead, options markets are pricing in wider ranges rather than a one-way trend.

Conclusion

BVIV’s rise to a 2.5-month high reflects Bitcoin’s usual late-October and November seasonality, when volatility and price momentum often expand together. The recent push higher follows Bitcoin’s fresh price discovery near record levels, signaling that traders are preparing for more dynamic market conditions ahead.

This setup suggests broader trading ranges in the coming weeks as participants react to shifting macro data, capital flows, and positioning around all-time highs. With sentiment oscillating between profit-taking and renewed bullish bets, volatility could remain elevated, keeping both upside breakouts and sharp pullbacks on the table as the market navigates its next phase.

FAQs

Q : What is BVIV and why is it rising?

A : BVIV is Volmex’s 30-day Bitcoin implied volatility index; it rose above ~42% as markets price in larger near-term moves.

Q : Does higher IV mean price will fall?

A : Not necessarily. IV reflects expected magnitude, not direction; it can rise during rallies or pullbacks.

Q : When is Bitcoin historically strongest?

A : Late October often outperforms early October, and November has historically been the strongest month on average.

Q : Where is BTC relative to recent highs?

A : BTC recently set new all-time highs near $125K–$126K and is consolidating around $120K–$126K.

Q : How do traders use IV readings?

A : They size risk, price options, and time entries/exits; elevated IV can favor premium-selling strategies for some, or hedges for others.

Q : Is seasonality reliable each year?

A : Seasonality offers context, not certainty; macro events can override historical patterns.

Q : Does this article’s focus include the exact term “Bitcoin implied volatility 2.5-month high”?

A : Yes, this piece explains what the Bitcoin implied volatility 2.5-month high means for traders and seasonality.