SoftBank’s PayPay acquires 40% stake in Binance Japan

PayPay has acquired a 40% stake in Binance Japan, forging a major partnership between one of Japan’s leading cashless payment platforms and the local division of the world’s largest cryptocurrency exchange by trading volume. The collaboration aims to strengthen Japan’s digital finance ecosystem and expand crypto accessibility for everyday users.

As part of the deal, both companies plan to integrate services that will allow Binance users to fund their crypto trades directly with PayPay Money. The move reflects PayPay’s growing fintech ambitions, coming just weeks after its confidential filing for a potential U.S. listing. It also aligns with renewed optimism in global crypto markets, signaling increased institutional interest and innovation in Japan’s regulated digital asset space.

Deal overview and what changes for users

PayPay said it has taken a 40% equity stake in Binance Japan, which became an equity-method affiliate of PayPay in September 2025. The partners plan to “launch integrated services” linking PayPay Money to Binance Japan accounts, enabling local users to buy and sell digital assets through familiar, cashless rails. Further product details and rollout timing were not disclosed.

Why it matters for PayPay

Launched in 2018, PayPay surpassed 70 million registered users in July 2025, cementing its role in Japan’s shift from cash. The Binance partnership could convert a portion of that base into crypto users, expand PayPay’s financial-services footprint, and support growth ahead of a potential U.S. listing of ADSs. PayPay株式会社+1

Why it matters for Binance Japan

For Binance Japan relaunched via acquisition of Sakura Exchange BitCoin in 2022—the partnership offers a distribution channel with deep local penetration and compliance infrastructure. Direct PayPay Money funding could reduce friction for fiat on-ramps and improve retention.

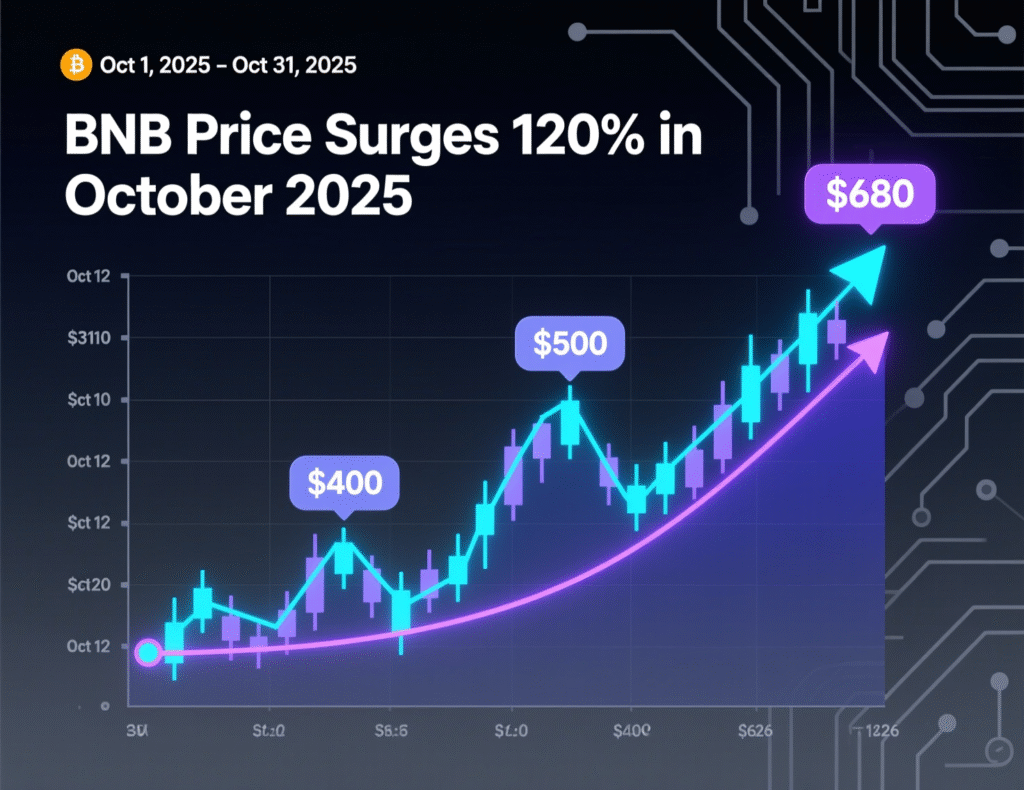

Market backdrop: BNB rally and risk appetite

The acquisition lands as BNB hit fresh highs around $1,300, briefly taking the No. 3 spot by market cap, reflecting resurgent risk appetite in digital assets. While token prices are volatile, stronger rails for compliant fiat access typically correlate with higher onboarding in regulated markets.

Corporate finance angle: PayPay’s U.S. listing path

On August 14–15, 2025, PayPay confidentially submitted a draft SEC registration for a potential U.S. listing of ADSs. A listing could provide capital for expansion and M&A as PayPay evolves from payments to a broader digital finance platform. Timing, size and pricing remain undecided.

Wall Street signals: Citi Ventures invests in BVNK

In a parallel sign of traditional finance’s crypto tilt, Citi Ventures invested in BVNK, a London-based stablecoin infrastructure provider, with the company’s valuation now above $750 million. Executives cited accelerating demand for stablecoin rails, particularly in the U.S. following the GENIUS Act, which set a federal framework for payment stablecoins.

Policy context: the GENIUS Act

The Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act), signed July 18, 2025, created licensing and compliance standards for issuers and clarified participation rules for foreign issuers developments widely seen as catalysts for institutional adoption.

PayPay acquires 40% stake in Binance Japan integration roadmap

Funding rails

Planned enablement of PayPay Money as a direct funding source for Binance Japan accounts.Compliance & KYC

Potential leverage of PayPay’s verified user base to streamline onboarding.User reach

Access to PayPay’s 70m-plus registered users for crypto services.

PayPay acquires 40% stake in Binance Japan what to watch next

Product launch timelines and eligible assets

Fees, limits and promotions for PayPay-to-Binance flows

Any incremental regulatory approvals in Japan

<section id=”howto”> <h3>How to link PayPay Money with a Binance Japan account (once available)</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Update to the latest versions of the PayPay and Binance apps.</li> <li id=”step2″><strong>Step 2:</strong> Complete/confirm identity verification (KYC) in both apps.</li> <li id=”step3″><strong>Step 3:</strong> In Binance Japan, open “Deposit” and select PayPay Money as the funding method.</li> <li id=”step4″><strong>Step 4:</strong> Authorize the PayPay linkage when prompted and set preferred limits.</li> <li id=”step5″><strong>Step 5:</strong> Make a small test deposit, then proceed with buying or selling supported assets.</li> </ol> <p><em>Note: Process may vary by provider and regulation. Confirm requirements before acting.</em></p> </section>

Context & Analysis

The PayPay–Binance Japan deal mirrors a broader convergence of fintech payments and regulated crypto access. Local payment rails have historically been the bottleneck for user activation; embedding PayPay Money could materially lower friction. Meanwhile, Citi’s BVNK investment illustrates banks’ preference for infrastructure exposure earning fee revenue on stablecoin settlement without direct token risk. The GENIUS Act provides policy cover for such moves in the U.S., while Japan’s maturing oversight gives incumbents confidence to partner rather than build from scratch.

Conclusion

PayPay’s 40% stake in Binance Japan establishes a strong payments-to-crypto bridge, signaling a new phase for digital finance in the country. The partnership is expected to introduce seamless on-ramps for users once integration details are finalized, enhancing accessibility and convenience for retail investors.

Meanwhile, Citi’s investment in BVNK highlights how stablecoin infrastructure is rapidly becoming a key layer of global payment systems, supported by improving U.S. regulatory clarity. Upcoming milestones to watch include the launch timeline, fee models, and potential cross-border capabilities that could further blend traditional finance with the crypto ecosystem.