Crypto VCs are ‘a lot more careful’ and not chasing narratives: Exec

Crypto venture capital has slowed after a strong start to the year. Investors say the era of quick funding for trendy ideas is fading, replaced by a sharper focus on real traction — product adoption, active transactions, and sustainable revenue. The emphasis has shifted from hype-driven narratives to measurable business performance.

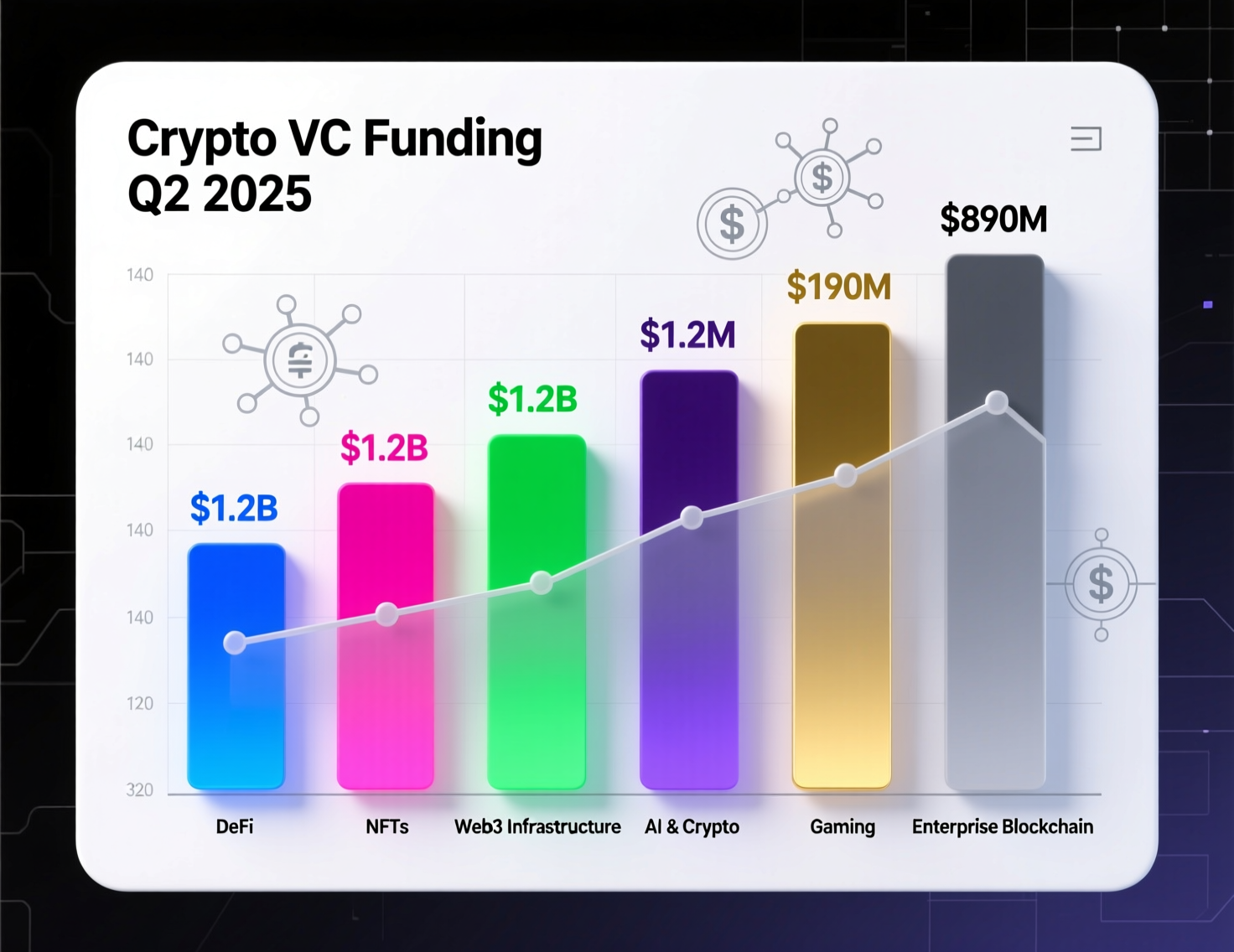

This changing approach is reflected in Q2 2025 data, where crypto VC funding dropped to multi-year lows. Firms are becoming more selective, favoring projects with proven user demand and clear growth potential. The cooling trend signals a maturing market, where capital now flows toward builders demonstrating real-world utility rather than speculation alone.Galaxy+1

VC sentiment pivots from narratives to numbers

Bullish Capital Management director Sylvia To says crypto investors are no longer chasing the “hot flavor of the month.” Instead, they’re asking who actually uses the product and whether volumes justify new capital. “VCs are a lot more careful now… You really have to start thinking… who has been using it?” she told Cointelegraph at Token2049 Singapore.

At Ajna Capital, CIO Eva Oberholzer frames it as market maturation: predictable revenue models, institutional dependency, and “irreversible adoption” matter more than meme-driven cycles.

What the data says about crypto VC funding Q2 2025

Fresh numbers back up the tone shift. Galaxy Research tallied $1.97B deployed across 378 crypto/blockchain deals in Q2 2025, a 59% quarter-over-quarter funding drop and a 15% decline in deal count among the weakest quarters since 2020.

Fundraising remains uneven at the weekly level: Messari tracked 18 projects raising $312M in the week ending Sept. 29, underscoring that large rounds still land even as overall activity softens.

How crypto VC funding Q2 2025 compares with prior quarters

Compared with Q1 2025, Q2 saw fewer early-stage bets and more scrutiny on unit economics. Later-stage deals captured a larger share of capital as investors gravitated to clearer adoption signals, per Galaxy’s breakout.

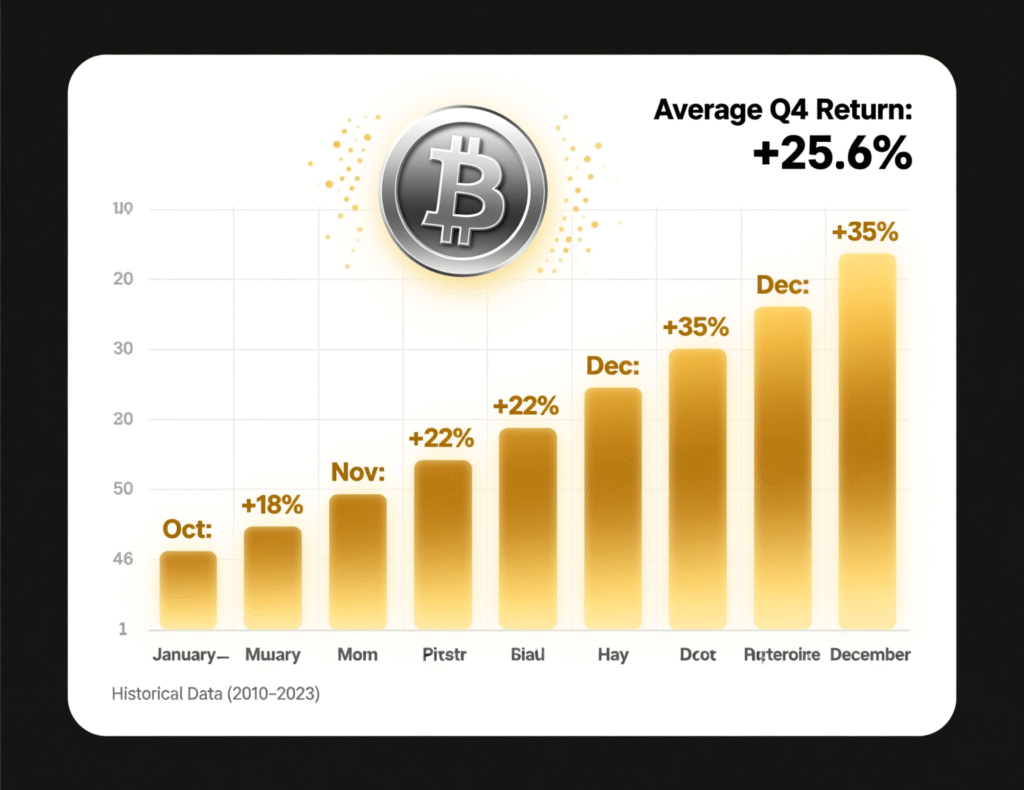

Bitcoin’s cycle: rhythm vs. precision

At Token2049, Saad Ahmed, Gemini’s APAC head, argued the four-year Bitcoin cycle will “very likely” continue “in some form,” driven by human emotion even if institutional flows moderate swings.

October historically matters: Q4 is often Bitcoin’s strongest quarter, and BTC is trading near its Aug. 14, 2025 all-time high (CMC lists $124,457.12). As of this week, price action has approached that range again.

<section id=”howto”> <h3>How to evaluate a crypto deal amid stricter VC filters</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Verify real usage: active users, transactions, on-chain volume, and cohort retention.</li> <li id=”step2″><strong>Step 2:</strong> Test the revenue model: pricing, margins, runway, and path to net retention & profitability.</li> <li id=”step3″><strong>Step 3:</strong> Map competitive moats: switching costs, network effects, IP, or regulatory advantages.</li> <li id=”step4″><strong>Step 4:</strong> Stress-test token design: supply schedule, emissions, utility, and governance incentives.</li> <li id=”step5″><strong>Step 5:</strong> Check institutional readiness: audits, compliance posture, custody, and data/reporting.</li> </ol> <p><em>Note: Process may vary by jurisdiction/provider. Confirm requirements before acting.</em></p> </section>

Context & Analysis

VCs often pivot from story-driven bets to traction-driven diligence late in cycles. The 2021–22 buildout birthed many L1s and infra plays; today’s filter asks whether those rails carry real economic activity. Galaxy’s Q2 snapshot plus Messari’s weekly tallies suggest capital concentration in fewer, larger checks, with investors rewarding durable demand and clearer cash-flow visibility.

Conclusion

Crypto venture capital remains active, but investors are far more selective. Founders can expect tougher scrutiny on product usage, market traction, and revenue models. The easy-money era is over as the focus shifts to fundamentals and sustainable growth instead of speculative hype.

While debates around Bitcoin’s macro cycle persist, the broader market is entering a more disciplined phase. Capital is still flowing, but toward teams proving real adoption and long-term value. This reset marks the start of crypto’s next build phase grounded in clearer metrics, stronger execution, and renewed confidence in practical innovation.

FAQs

Q : Why did crypto VC funding fall in Q2 2025?

A : Tighter diligence, a focus on usage and revenue, and concentration in fewer, larger rounds drove the decline.

Q : What signals do VCs want to see now?

A : Active users, transaction volume, sticky cohorts, monetization clarity, and compliance readiness.

Q : Is the four-year Bitcoin cycle over?

A : Not necessarily. A Gemini exec says it will likely persist “in some form,” with institutions muting volatility.

Q : How much was raised in the latest week?

A : Messari logged $312M across 18 projects for the week ending Sept. 29, 2025.

Q : Did BTC hit a new high?

A : CMC lists an all-time high of $124,457.12 on Aug. 14, 2025; recent prices remain near that range.

Q : What is the outlook for early-stage deals?

A : Selectivity is higher, with investors seeking clearer product-market fit and institutional demand.

Q : Does this mean new L1s are done?

A : Investors are more skeptical of copycat L1s; differentiated technology and real usage are now essential.