‘Very likely’ Bitcoin cycle will continue in some form: Gemini exec

At Token2049 in Singapore, Gemini’s APAC head Saad Ahmed highlighted that the Bitcoin four-year cycle is still “very likely” to continue in some form. He explained that crowd psychology plays a major role in driving periods of overexuberance, subsequent corrections, and eventual market equilibrium. According to Ahmed, these behavioral patterns have historically shaped Bitcoin’s price movements and are expected to remain influential in the years ahead.

Ahmed also noted that increasing institutional participation could moderate the extreme volatility often seen in the cryptocurrency market. While this involvement might reduce the intensity of price swings, it is unlikely to eliminate the underlying cyclical nature of Bitcoin entirely. Investors should anticipate cycles, but with potentially smoother transitions than in the past.

What the Bitcoin four-year cycle means today

Ahmed told Cointelegraph the archetypal four-year rhythm “ultimately stems from people get really excited and overextend themselves,” followed by a downturn and re-equilibration. He expects some cyclical cadence to continue even as institutions broaden market depth. Cointelegraph

Glassnode’s latest cycle analysis similarly notes that recent price behavior “echoes prior patterns,” keeping the halving-linked structure in play though not necessarily on a fixed timetable. Some historical models imply the current move could crest around October 2025, depending on how the post-halving expansion unfolds.

Does the Bitcoin four-year cycle still matter for 2025–2026?

Views diverge. Analyst Rekt Capital has warned, “We have a very small sliver of time and price expansion left,” if the market tracks its 2020 template placing a potential peak around October (~550 days after the April 2024 halving). Conversely, Bitwise CIO Matt Hougan argues the old pattern is fading and that 2026 could still be an “up year.”

Market snapshot and seasonality

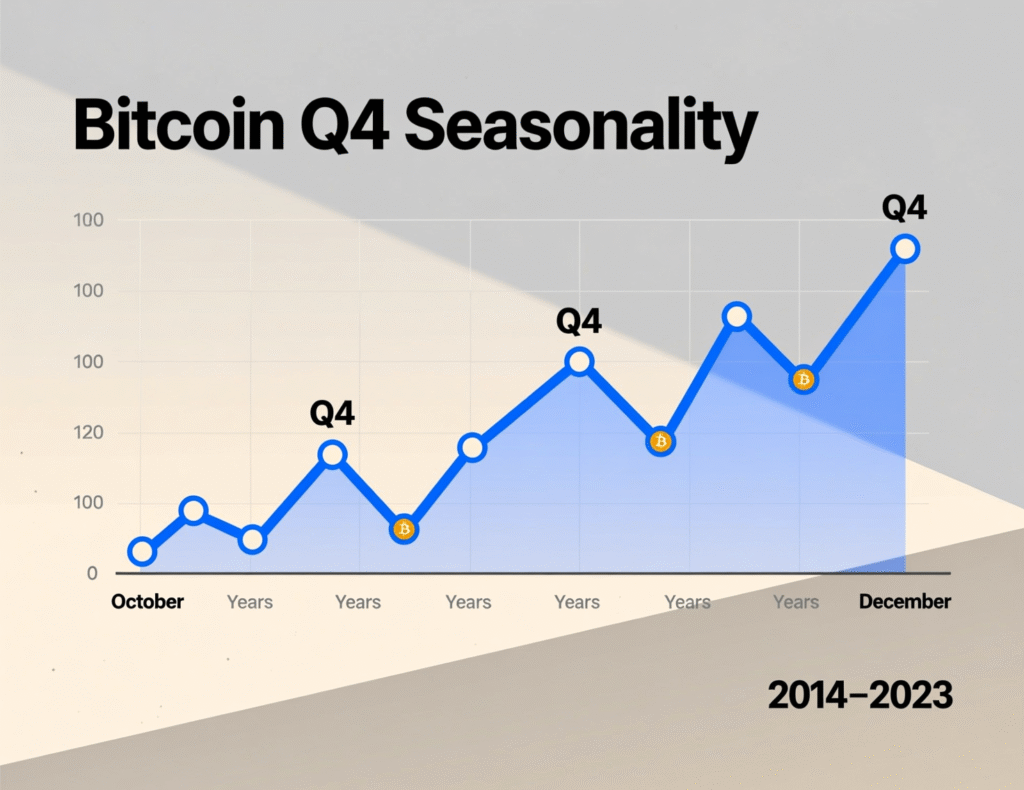

Bitcoin is trading near record levels, with its prior intraday peak around $124.4k on Aug. 14, 2025 (CoinMarketCap). Seasonally, October has been one of BTC’s statistically strongest months since 2013, and Q4 often benefits from constructive flows though past performance is no guarantee of future results.

Coinbase pursues OCC trust charter

Coinbase has applied for a National Trust Company Charter with the U.S. Office of the Comptroller of the Currency (OCC). The company says the move expands regulatory oversight and capabilities (e.g., payments) while emphasizing it has “no intention of becoming a bank.” The filing aligns with a broader push by crypto firms including Circle (June 30/July 1) and Ripple (early July) to secure federal trust bank charters.

“Coinbase has no intention of becoming a bank… clear rules and the trust of our regulators and customers enable Coinbase to confidently innovate while ensuring proper oversight and security.” Coinbase statement.

Regulatory clarity around trust charters could help exchanges internalize fiat on/off-ramps and expand custody and payments products under a consistent federal framework. Analysts note that while trust companies face certain activity limits compared with commercial banks, distinctions have blurred over time.

How to evaluate Bitcoin cycle claims and data (investor checklist)

<section id=”howto”> <h3>How to assess cycle narratives without overreacting</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Track on-chain cycle markers (e.g., long-term holder profit-taking, supply in profit) in Glassnode or similar dashboards.</li> <li id=”step2″><strong>Step 2:</strong> Cross-check seasonality with reliable sources (e.g., CoinGlass quarterly/monthly return tables) rather than social posts.</li> <li id=”step3″><strong>Step 3:</strong> Note halving-date offsets (e.g., ~500–550 days) but treat them as guides, not guarantees.</li> <li id=”step4″><strong>Step 4:</strong> Weigh institutional factors (ETF flows, custody, trust charters) that can mute or extend cycles.</li> <li id=”step5″><strong>Step 5:</strong> Use risk controls (position sizing, stop-loss, rebalance rules) regardless of where the model says we are.</li> </ol> <p><em>Note: Process may vary by jurisdiction/provider. Confirm requirements before acting.</em></p> </section>

Context & Analysis

The debate now centers on whether maturing market structure spot ETFs, corporate treasuries, and federally supervised trust banks dilutes the historically sharp Bitcoin four-year cycle. Even if peaks and troughs stretch or compress, behavioral feedback loops (FOMO, leverage, profit-taking) tend to recur. Investors should triangulate between cyclical templates and contemporary drivers like funding conditions, regulatory developments, and institutional flows.

Conclusion

Cyclical patterns continue to influence how traders interpret Bitcoin’s trajectory, guiding expectations around peaks and corrections. However, growing institutional involvement is changing both the scale and timing of these movements, introducing a layer of stability to the market.

Looking ahead, the emphasis is shifting from short-term price swings to long-term infrastructure. Durable frameworks such as trust charters and payment systems are being built to support broader crypto adoption. Whether a near-term peak emerges in October or later, these foundational developments are poised to shape the next phase of the cryptocurrency ecosystem.

FAQs

Q : Is the Bitcoin four-year cycle dead?

A : Not necessarily. Analysts and Gemini’s Saad Ahmed say cycles persist, even if timing and magnitude evolve with institutional participation.

Q : What does “550 days post-halving” imply?

A : It’s a rough historical marker some use for peaks; models pointing to October 2025 are examples, not guarantees.

Q : How did Q4 historically perform for BTC?

A : October has often been favorable; historically, it’s among BTC’s stronger months since 2013.

Q : What is Coinbase seeking from the OCC?

A : A National Trust Company Charter to broaden services (e.g., payments) under federal oversight; Coinbase says it’s not becoming a bank.

Q : Does the exact term “Bitcoin four-year cycle” still guide traders?

A : Many still reference it for context, but most pair it with on-chain data and macro factors.

Q : Who disagrees with the cycle view?

A : Bitwise CIO Matt Hougan expects 2026 to be an “up year,” diverging from classic cycle expectations.