Accumulation Trends Strengthen as Bitcoin Breaks Through $120K

Bitcoin has continued its rebound momentum, pushing past the $120,000 mark and briefly touching $121,000. This move brings the cryptocurrency closer to retesting its August record highs, signaling renewed strength in the market. The sustained rally has drawn investor attention as the asset edges back toward previously set milestones, highlighting improving sentiment among traders.

Adding to the optimism, Glassnode’s accumulation trend score climbed to 0.62 its first consistent reading above 0.5 since August. This metric reflects that buying pressure is once again dominating, with investors actively accumulating rather than distributing coins. The return of accumulation suggests growing confidence in Bitcoin’s long-term trajectory and reinforces the view that buyers are regaining control of the market.

What the market shift means

On-chain data suggests a rotation back toward net buying. Mid-sized entities (10–1,000 BTC) have flipped decisively to accumulation, with 10–100 BTC wallets also turning positive. Retail holders (<10 BTC) have slowed selling, while balances >10,000 BTC remain the primary source of distribution consistent with whale profit-taking near prior highs.

How Glassnode defines the metric

Glassnode’s documentation describes the accumulation trend score as a weighted measure that reflects both the size of participating entities and how their balances change over a recent window, offering a composite read on whether the market is accumulating or distributing. (CoinDesk characterizes the window as ~15 days.) Glassnode Docs+1

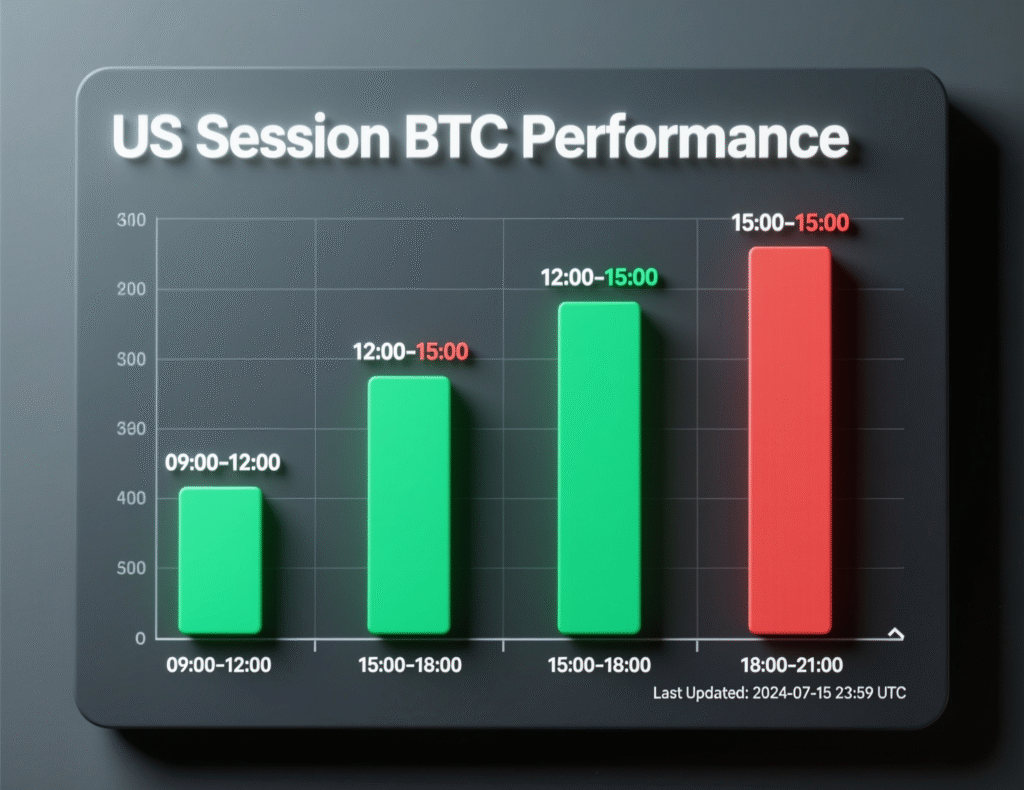

The U.S. trading bid

Across Monday Thursday sessions, bitcoin logged about 8% of its weekly advance during U.S. market hours, underscoring renewed American risk appetite as macro expectations tilt toward easier policy.

Why the Bitcoin accumulation trend score matters now

A sustained score above 0.5 historically aligns with periods where aggregate demand absorbs supply, providing a tailwind for price until distribution resumes. With BTC hovering near ~$120K–$121K, the latest reading supports the notion that dips are being met with bids—albeit with continued overhead selling from whales.

Interpreting the Bitcoin accumulation trend score alongside price

Price alone can obscure who is moving the market. Pairing the score with cohort breakdowns helps distinguish mid-sized accumulation from whale distribution, clarifying whether rallies lean on broad participation or a narrow buyer base.

<section id=”howto”> <h3>How to monitor accumulation trends with on-chain data</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Open Glassnode Studio and locate the Accumulation Trend Score for BTC (indicator: <em>indicators.AccumulationTrendScore</em>).</li> <li id=”step2″><strong>Step 2:</strong> Set the timeframe to recent weeks and note whether the score is above (accumulation) or below (distribution) 0.5.</li> <li id=”step3″><strong>Step 3:</strong> Overlay cohort views (e.g., 10–100, 100–1,000, >10,000 BTC) to see which groups drive the trend.</li> <li id=”step4″><strong>Step 4:</strong> Cross-check price context (e.g., near $121K) using a reliable price page or index.</li> <li id=”step5″><strong>Step 5:</strong> Track session behavior (U.S. vs. Asia/Europe) for flow patterns that may persist.</li> </ol> <p><em>Note: Process may vary by provider; confirm access, definitions, and update intervals before acting.</em></p> </section>

Context & Analysis

Despite whales distributing, the breadth of buying among 10–1,000 BTC wallets suggests deeper liquidity support than earlier in the quarter. That breadth combined with a U.S.-hours bid often coincides with momentum persistence, though proximity to prior highs can increase volatility and headline sensitivity.

Conclusion

Bitcoin is trading close to $121,000, supported by an accumulation trend score of 0.62, which signals renewed buyer dominance. Mid-sized wallets and stronger activity during the U.S. trading session are driving this shift, indicating that market momentum is tilting back in favor of bulls.

However, whale supply continues to act as a key resistance level that could limit upside in the near term. If the accumulation score holds above 0.5 for a sustained period, it would strengthen the outlook for Bitcoin to challenge August’s record highs, adding weight to the bullish narrative in the current market structure.

FAQs

Q : What is the Bitcoin accumulation trend score?

A : It’s a Glassnode indicator weighting entity size and recent balance changes to show if the market is accumulating (>0.5) or distributing (<0.5).

Q : Why did bitcoin jump above $120K this week?

A : Renewed risk appetite and U.S.-session strength pushed BTC toward $121K, near August’s record.

Q: Which cohorts are buying right now?

A : Mid-sized wallets (10–1,000 BTC) are accumulating; retail is slowly turning positive; whales (>10,000 BTC) are still net sellers.

Q : Did U.S. trading hours lead the rally?

A : Yes, around 8% of this week’s rise occurred during U.S. hours, per Velo data cited by CoinDesk.

Q : How often does the score update?

A : It updates as on-chain data changes (Glassnode’s methodology aggregates recent balance shifts over a defined window).

Q: Is a high score a buy signal?

A : It’s context not advice. A sustained >0.5 reading often aligns with demand outpacing supply, but price can still be volatile.

Q : Does the exact “Bitcoin accumulation trend score” show up in price forecasts?

A : Analysts use it as one input; by itself it doesn’t predict price but helps read market positioning.