ETH Treasury Firm to Tokenize Nasdaq-Listed Shares on Ethereum With Securitize

FG Nexus has announced plans to tokenize its Nasdaq-listed shares on Ethereum after choosing Securitize as its tokenization partner. Through this move, investors will be able to hold FGNX common stock and FGNXP perpetual preferred stock in the form of Ethereum-based tokens. The company emphasizes that these tokenized shares will carry the same legal rights and protections as their traditional counterparts, ensuring full compliance and investor confidence.

Settlement and trading of these tokenized shares will take place on Securitize’s SEC-registered broker-dealer and Alternative Trading System (ATS). By leveraging blockchain technology, FG Nexus aims to expand accessibility, improve efficiency, and modernize the trading of its securities. This step highlights a growing trend of integrating traditional finance with digital assets, bringing institutional-grade tokenization to mainstream markets.

Why FG Nexus to tokenize Nasdaq-listed shares on Ethereum matters

By enabling native, rights-equivalent tokens instead of synthetic wrappers, FG Nexus joins an emerging cohort of U.S. public companies moving equity onto public blockchains. Executives cite instant/near-instant settlement, automated compliance, and potentially broader access as benefits, with no change to shareholder rights. CoinDesk

Mechanics: FG Nexus to tokenize Nasdaq-listed shares on Ethereum via Securitize

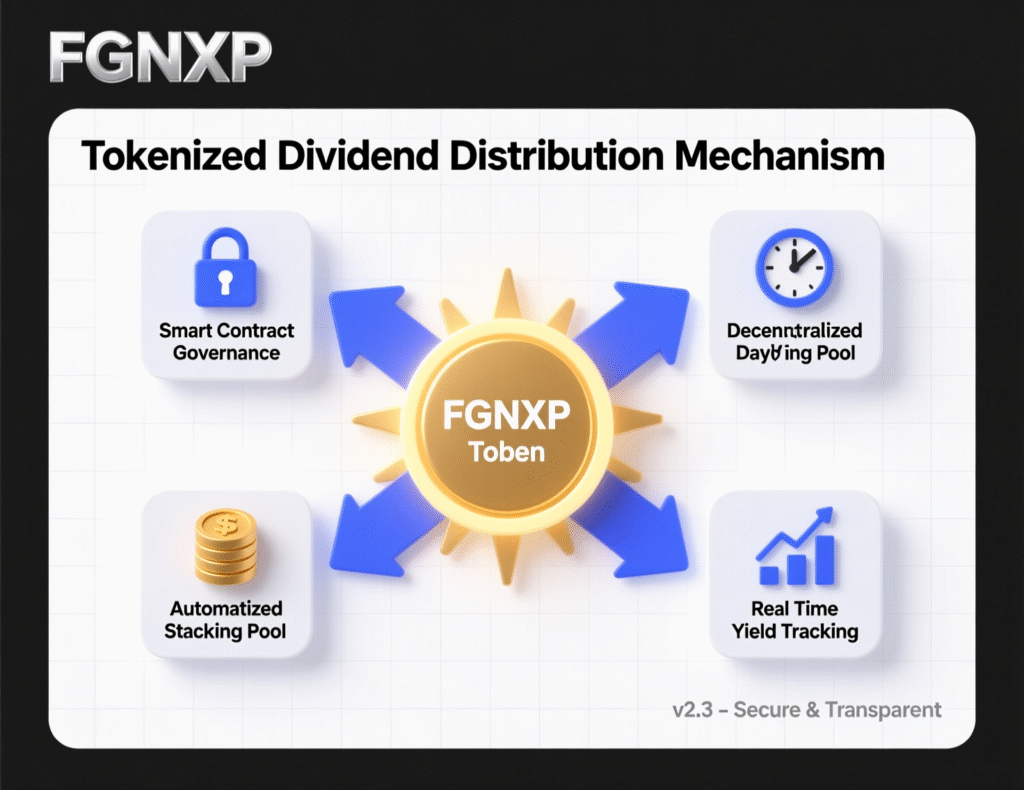

Shareholders will be able to convert book-entry FGNX to Ethereum tokens and, separately, hold tokenized FGNXP that pays regular dividends. Issuance, transfer and trading will occur through Securitize’s SEC-registered broker-dealer and ATS, preserving existing regulatory protections while adding on-chain settlement and tracking.

What changes for FGNX and FGNXP shareholders

FGNX holders may opt in to tokenized shares with identical rights (e.g., voting, corporate actions). FGNXP described as a perpetual preferred paying dividends—will also be tokenized, with CoinDesk reporting it as the first U.S. exchange-listed dividend equity to fully move onto crypto rails. (FG Nexus and Securitize have not publicly provided a go-live date at time of writing.)

Timeline: FG Nexus to tokenize Nasdaq-listed shares on Ethereum

Announcement published Oct. 2, 2025.

Additional coverage indicates program begins with common stock then extends to preferred.

Market context: tokenized equities gain momentum

FG Nexus follows other initiatives offering on-chain access to listed stocks and ETFs. In parallel, SharpLink Gaming (Nasdaq: SBET) announced plans to tokenize its equity on Ethereum through Superstate’s Opening Bell, with SEC filings describing Opening Bell as a regulated on-chain issuance/tokenization platform for SEC-registered equity.

<section id=”howto”> <h3>How to hold tokenized FGNX/FGNXP shares on Ethereum</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Confirm eligibility and review disclosures on Securitize Markets (broker-dealer/ATS) for FGNX/FGNXP tokenization.</li> <li id=”step2″><strong>Step 2:</strong> Open or log into your Securitize account and complete KYC/AML.</li> <li id=”step3″><strong>Step 3:</strong> Decide whether to convert existing book-entry FGNX holdings to tokens, or subscribe to tokenized shares if available.</li> <li id=”step4″><strong>Step 4:</strong> Set up a compatible self-custody wallet if you intend to hold tokens off-platform; verify supported networks and custody options.</li> <li id=”step5″><strong>Step 5:</strong> Execute the conversion/transaction and verify your on-chain balance and statements; review dividend and corporate-action handling for FGNXP.</li> </ol> <p><em>Note: Process may vary by provider/jurisdiction. Confirm requirements, fees, and tax treatment before acting.</em></p> </section>

Notable quotes

“Tokenization is rapidly changing financial markets through increased efficiency and enhanced investor access.” — Maja Vujinovic, CEO of Digital Assets, FG Nexus.

“U.S. investors [will] be able to hold real stock, not a synthetic wrapper, with instant settlement, automated compliance and the ability to trade onchain through our regulated ATS.” — Carlos Domingo, co-founder & CEO, Securitize.

Context & Analysis

Native equity tokenization (rights-equivalent tokens for listed shares) narrows the gap between traditional market infrastructure and public blockchains. The approach promises operational efficiencies (faster settlement, programmable compliance) while keeping the regulatory perimeter intact through a registered broker-dealer/ATS. Execution details conversion flows, dividend distribution on-chain, secondary-market venues will determine investor uptake.

Conclusion

FG Nexus is expanding its Ethereum-first approach from treasury management into capital markets. The initiative signals a major step in bridging traditional finance with blockchain, as the company pushes forward with making its listed securities available on Ethereum.

If executed as planned, both FGNX common stock and FGNXP perpetual preferred stock could rank among the first U.S. exchange-listed equities offered as rights-equivalent Ethereum tokens. This move has the potential to set a precedent for other issuers, showcasing how blockchain tokenization can coexist with established regulatory frameworks while offering investors greater flexibility and accessibility.

FAQs

Q : What is being tokenized?

A : FG Nexus’s FGNX common and FGNXP perpetual preferred shares, with tokens carrying the same legal rights as traditional shares.

Q : How will trading and settlement work?

A : Through Securitize’s SEC-registered broker-dealer/ATS with on-chain settlement and compliance automation.

Q : When will the tokens be available?

A : The announcement is dated Oct. 2, 2025; timing for conversion/availability was not disclosed.

Q : Is this the first dividend-paying equity to move fully on-chain?

A : CoinDesk reports FGNXP is the first U.S. exchange-listed dividend equity to fully transition to crypto rails.

Q : How do I participate?

A : Open a Securitize account, complete KYC/AML, and follow issuer instructions to convert or purchase tokenized shares.

Q : Does this affect my shareholder rights?

A : FG Nexus and Securitize state tokenized shares will maintain the same legal rights as traditional shares.

Q : Does the exact phrase “FG Nexus to tokenize Nasdaq-listed shares on Ethereum” mean it’s done?

A : It signals an announced plan; execution details (start date, venues) remain to be confirmed.