Visa Tests Pre-Funded Stablecoins for Cross-Border Payments

Visa has launched a new pilot under its Visa Direct program to test pre-funded stablecoins for cross-border payments. The initiative enables banks, remittance providers, and financial institutions to use Circle’s USDC and EURC to pre-fund accounts in real time, streamlining the way money moves globally. By shifting from traditional cash pre-funding to regulated stablecoins, Visa aims to simplify liquidity management and give participants faster, more predictable access to funds.

This approach also addresses common pain points in cross-border transactions, such as delays caused by underfunded accounts or settlement windows that close outside business hours. With stablecoins available 24/7 on blockchain rails, the pilot is designed to enhance efficiency and reliability in international payments while showcasing how digital assets can integrate into mainstream financial infrastructure.

How it works and who benefits

Visa Direct will treat supported stablecoins as pre-funding for payouts, enabling clients to top up liquidity instantly rather than holding days of cash across markets. That flexibility targets use cases like remittances, gig-economy payouts and exchange withdrawals—segments sensitive to weekend and holiday delays. Visa says the pilot starts with select partners and could broaden in 2026. Visa Investor Relations

Network reach and assets used

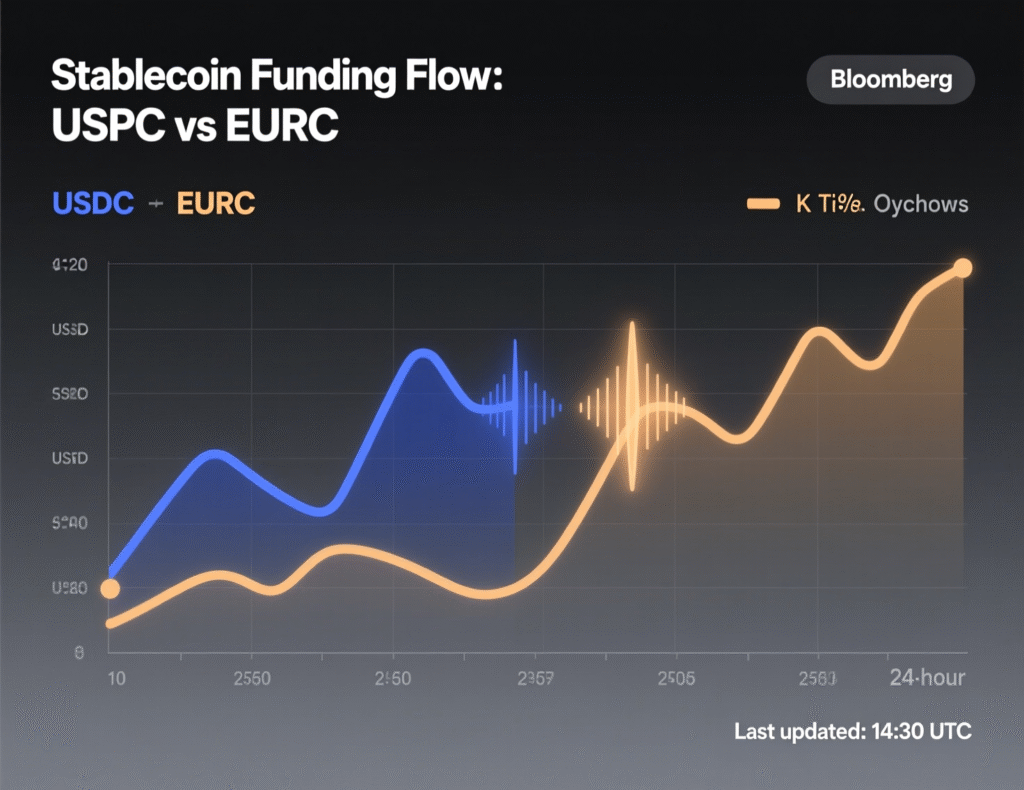

Visa Direct provides connections to roughly 11 billion cards, bank accounts and digital wallets across 195+ countries, now with the option to fund flows using USDC (USD) and EURC (EUR), Circle’s fiat-backed stablecoins.

What the pilot changes for cross-border flows

Today, remittance firms often hold multiple pre-funded accounts to satisfy withdrawals. When requests spike or rails are closed customers can face days-long delays. With pre-funded stablecoins, participants can top up in real-time and continue serving payouts even during off-hours.

Why Visa tests pre-funded stablecoins for cross-border payments now

Stablecoins have matured from crypto niche to enterprise plumbing, and Visa has been expanding stablecoin settlement support (including EURC and additional rails). The pilot extends that work from pure settlement into liquidity pre-funding for payouts.

Competitive landscape

The initiative positions Visa against banks building blockchain-based B2B rails while reinforcing Visa’s role as connective tissue across domestic systems. Reuters also reports Visa is working with select partners and planning expansion next year.

<section id=”howto”> <h3>How to onboard for stablecoin pre-funding with Visa Direct</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Confirm eligibility with Visa and join the pilot cohort.</li> <li id=”step2″><strong>Step 2:</strong> Establish approved custody/wallet rails for USDC/EURC per Visa guidelines.</li> <li id=”step3″><strong>Step 3:</strong> Complete KYC/AML/sanctions checks and treasury policy updates.</li> <li id=”step4″><strong>Step 4:</strong> Pre-fund your Visa Direct account with supported stablecoins.</li> <li id=”step5″><strong>Step 5:</strong> Initiate payouts; monitor balances and auto-replenish as thresholds are met.</li> <li id=”step6″><strong>Step 6:</strong> Reconcile on-chain transactions to ledger; convert to local currency where needed.</li> <li id=”step7″><strong>Step 7:</strong> Review performance (speed, costs, liquidity) and adjust limits/flows.</li> </ol> <p><em>Note: Process may vary by jurisdiction/provider. Confirm requirements before acting.</em></p> </section>

Context & Analysis

Visa’s pilot tackles two pain points idle capital and after-hours downtime. The approach keeps existing payout endpoints intact while swapping the funding layer, which reduces integration lift for clients. That said, operational risk (wallet security, reconciliation) and regulatory treatment of stablecoins will determine pace of adoption

Conclusion

If early outcomes remain consistent, stablecoin pre-funding has the potential to evolve into a standard treasury tool for global payout providers. By leveraging digital assets like USDC or EURC, institutions could manage liquidity more effectively and maintain smoother operations, even when traditional banking windows are closed.

The model is designed to strengthen resilience during off-hours and reduce the risk of interruptions tied to underfunded accounts. For end-users, nothing changes in the payout experience they continue to receive local currency as usual, while institutions benefit from faster, more efficient funding practices behind the scenes.

FAQs

Q : What is the Visa Direct stablecoin pilot?

A : A program letting institutions pre-fund cross-border payouts with USDC/EURC instead of fiat balances.

Q : Which stablecoins are supported?

A : Circle’s USDC (USD) and EURC (EUR), per current reporting and Visa materials.

Q : Does this replace traditional payment systems?

A : No. Visa positions stablecoins as a complement to existing rails and endpoints.

Q : How fast are payouts?

A : Visa says the goal is real-time funding so payouts can continue during off-hours; recipients still get local currency.

Q : Who can join the pilot?

A : Select banks, remitters and financial institutions that meet Visa’s criteria.

Q : Why is Visa doing this now?

A : To reduce idle capital and mitigate weekend/holiday interruptions in cross-border flows.

Q : Does this mean lower costs?

A : Potentially, via better liquidity use and fewer pre-funded accounts, though fees depend on partners and corridors.