DOGE Holds Above 200DMA, Breakout Needs Daily Close Through $0.24

Dogecoin (DOGE) recently tried to push past the $0.24 level but faced selling pressure, retreating to the $0.23 area as supply re-entered the market near that price point. Despite this, DOGE remains above its 200-day moving average (around $0.22), signaling that the broader trend is still supportive. Market participants note that intraday price action has been mixed, reflecting cautious trading as investors wait for clearer direction.

Traders emphasize that for DOGE to decisively break out above $0.24, it needs a clean daily close accompanied by rising trading volume. Such a move could help transform this resistance level into a strong support zone, increasing the likelihood of further upward momentum. Until then, price action may continue to test nearby supply and demand levels.

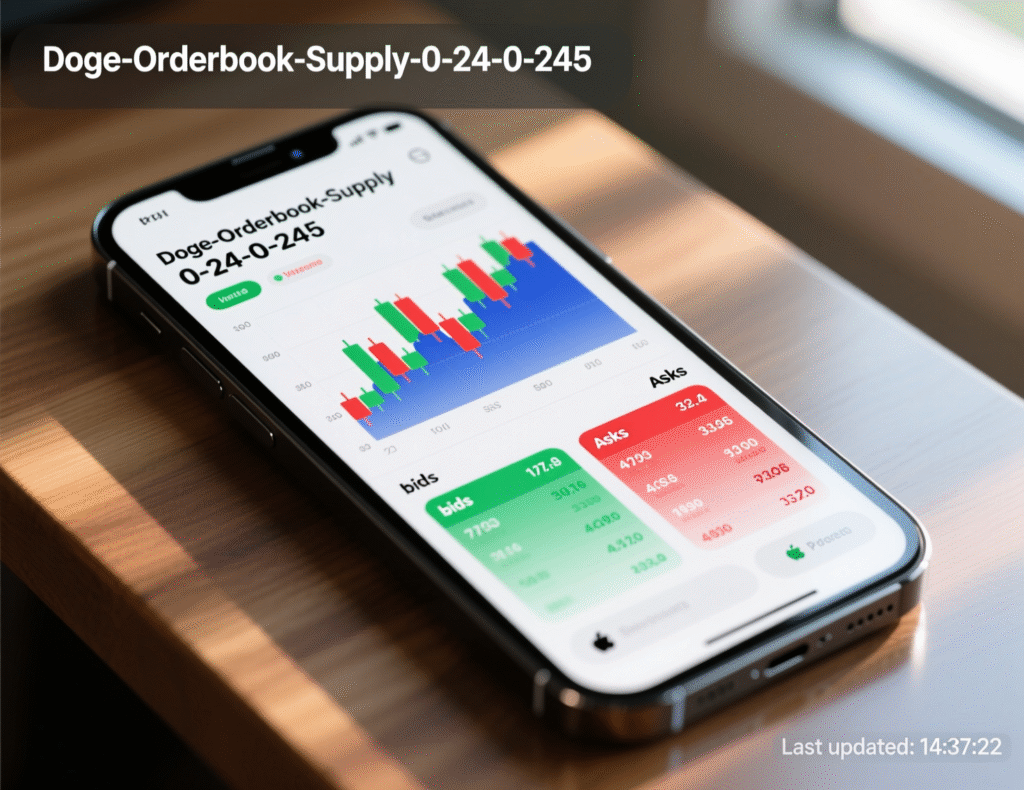

Market Snapshot and Order Flow

DOGE traversed a tight ~$0.01 (~4%) band, tagging highs near $0.24 and lows near $0.23 before settling in the lower half of the range. The midday push was fueled by an estimated ~780M tokens in turnover, but late-session offers restored the range. Whale net outflows of ~40M DOGE aligned with repeated failures at $0.24, suggesting large-lot supply remains parked overhead. CoinDesk

Technical Picture: Moving Averages & Trend

Price action is boxed $0.23–$0.24, with $0.23 acting as near-term defense and the 200DMA (~$0.22) as the trend line in the sand. A short-MA curl higher would preserve the golden-cross watch. Several independent TA reads also cluster key support in the $0.20–$0.22 area (EMA/MA), reinforcing the medium-term bias while range persists.

What would confirm a DOGE breakout above $0.24

A daily close through $0.24 with expanding volume is the primary trigger. Above, bulls target $0.245–$0.25, then $0.255 if momentum follows through. Failure to reclaim and hold $0.24 likely extends chop inside the box.

Scenarios after a DOGE breakout above $0.24

Base-build at $0.24–$0.245

Prior ceiling turns into a staging area; shallow pullbacks bought.Momentum extension to $0.25–$0.255

Breakout chases; watch breadth to avoid a thin, fadeable spike.False break

Close back below $0.24 on light breadth/volume risks swift mean reversion to $0.23.

Order-Book & Flow Watch

Whales / large-holder netflows

If outflows abate and bids persist, the path of least resistance tilts higher; persistent offer walls keep price pinned. (Indicator: Large Holders Netflow.)Defense of $0.23

Consistent absorption keeps skew constructive; a clean break exposes $0.225–$0.22 (200DMA).Volatility with breadth

Rising realized vol with broad participation improves durability; narrow leadership risks fakeouts.

Broader Context

Crypto activity remains elevated: centralized-exchange spot + derivatives volumes reached $9.72T in August, the highest of 2025, underscoring robust participation even as intraday rotations drive whipsaws across majors and memes.

<section id=”howto”> <h3>How to track DOGE breakout levels on your chart</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Add the 200-day MA/EMA and short MAs (e.g., 20/50-day) to DOGE/USD or DOGE/USDT.</li> <li id=”step2″><strong>Step 2:</strong> Mark horizontal levels at $0.23 (support) and $0.24 (resistance) and set price alerts.</li> <li id=”step3″><strong>Step 3:</strong> Monitor daily close relative to $0.24 and note volume expansion on the breakout attempt.</li> <li id=”step4″><strong>Step 4:</strong> Track large-holder netflow or whale wallet activity for supply/demand clues.</li> <li id=”step5″><strong>Step 5:</strong> After any close >$0.24, watch for successful retests (“flip”) before sizing risk.</li> </ol> <p><em>Note: Process may vary by venue and indicator provider. Confirm settings and data sources before acting.</em></p> </section>

Analysis

The tape suggests a healthy digestion above trend support with a clear binary around $0.24. Given repeated supply at the figure and a still-constructive 200DMA, risk-reward skews toward waiting for confirmation (close + volume) rather than anticipating a breakout.

Conclusion

Dogecoin (DOGE) continues to trade in a range but remains supported by its 200-day moving average (around $0.22). While price action has been cautious, traders are watching for a decisive move that could set the tone for the next leg higher.

A confirmed daily close above $0.24, supported by strong breadth and rising volume, would signal a clear path toward $0.245–$0.25 and potentially $0.255. Conversely, a drop below $0.23 could shift focus back to the $0.225–$0.22 zone, delaying the anticipated golden-cross setup and suggesting that consolidation may continue before any sustained breakout.

FAQs

Q : What confirms a DOGE breakout above $0.24?

A : A daily close through $0.24 with rising volume and broad participation.

Q : Is the 200DMA still supportive?

A : Yes. DOGE trades above the ~$0.22 200-day average, keeping the medium-term bias constructive.

Q : Did whales impact today’s rejection?

A : CoinDesk Data flagged ~40M DOGE net outflows from large holders, aligning with the stall at $0.24.

Q : What happens if $0.23 breaks?

A : Market focus shifts to $0.225–$0.22; below that, structure risks a distribution top.

Q : How important is breadth on breakouts?

A : High. Breakouts lacking volume and breadth often fail; watch both alongside price.

Q : Where are near-term upside targets?

A : $0.245–$0.25, then $0.255 if momentum accounts chase.

Q : What broader market context should I watch?

A : Elevated trading activity: CEX volumes hit $9.72T in August 2025.