Ether ETFs log straight week of outflows, $796M pulled as price drops 10%

U.S. spot Ether ETFs have now logged five straight sessions of net redemptions, with total outflows this week climbing to nearly $796 million. The persistent withdrawals highlight waning investor confidence in Ethereum-based products, as sentiment weakens following sharp market volatility.

This wave of redemptions coincided with a roughly 10% weekly drop in ETH’s price, reflecting fragile risk appetite across the broader crypto market. The decline aligns with a wider sell-off in digital assets, where investors are showing caution amid macroeconomic uncertainty and shifting market dynamics. Together, these factors signal a cooling period for Ethereum investment vehicles as traders reassess their exposure.

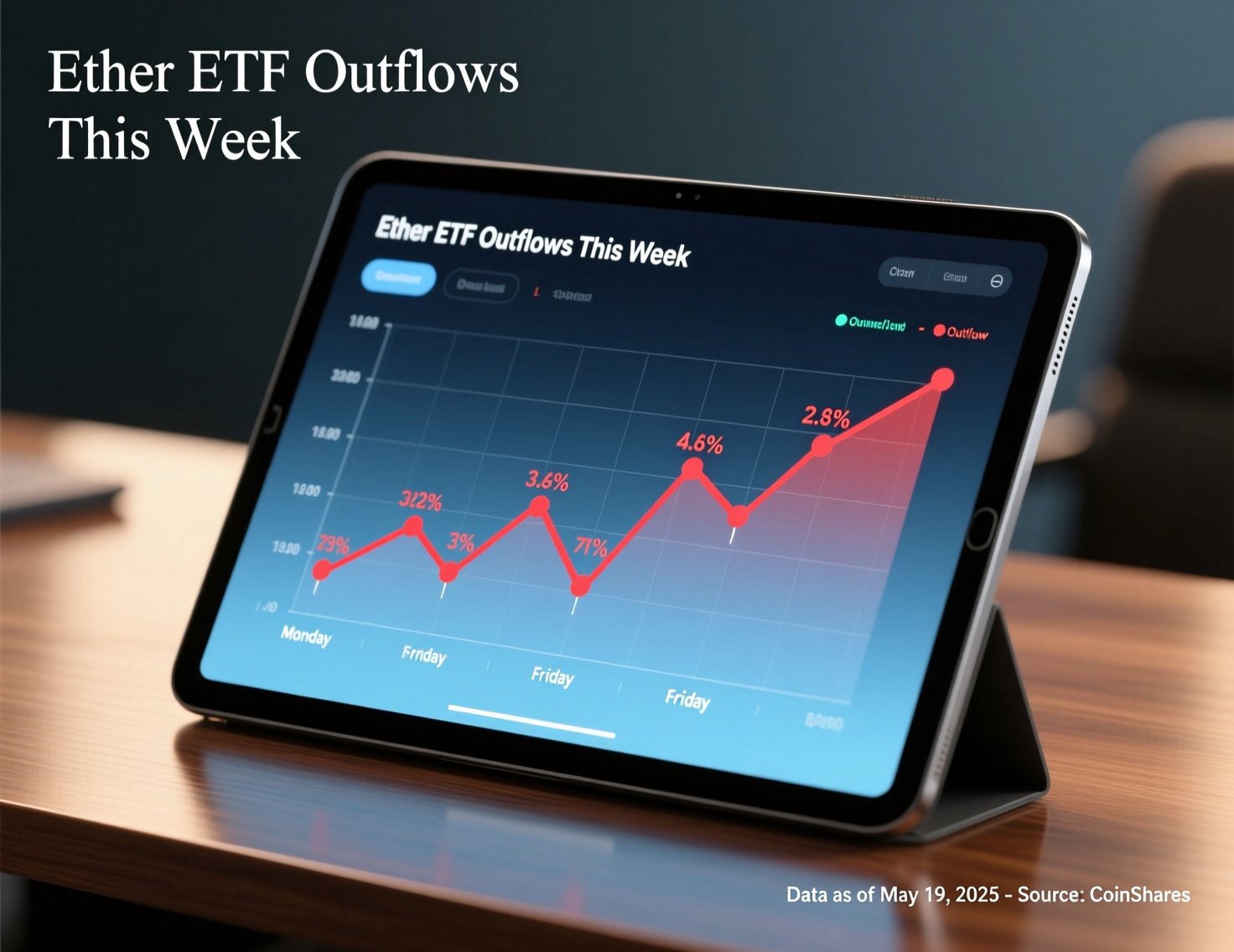

What the numbers show

Aggregate flows into U.S. spot Ether ETFs turned decisively negative: $248.4M left on Friday alone, capping $795.8M in weekly outflows. Price-wise, ETH fell ~10.25% over seven days to about $4,013, and is down ~12.24% over 30 days. Farside+1

Data: Ether ETF outflows this week by the numbers

Friday net flow: -$248.4M

5-day total: -$795.8M

ETH weekly change: ≈-10%; price near $4,013

Comparable streak: last occurred week ending Sept. 5, with ETH near $4,300

Sources: Farside (flows), CoinJournal/CoinMarketCap (price context).

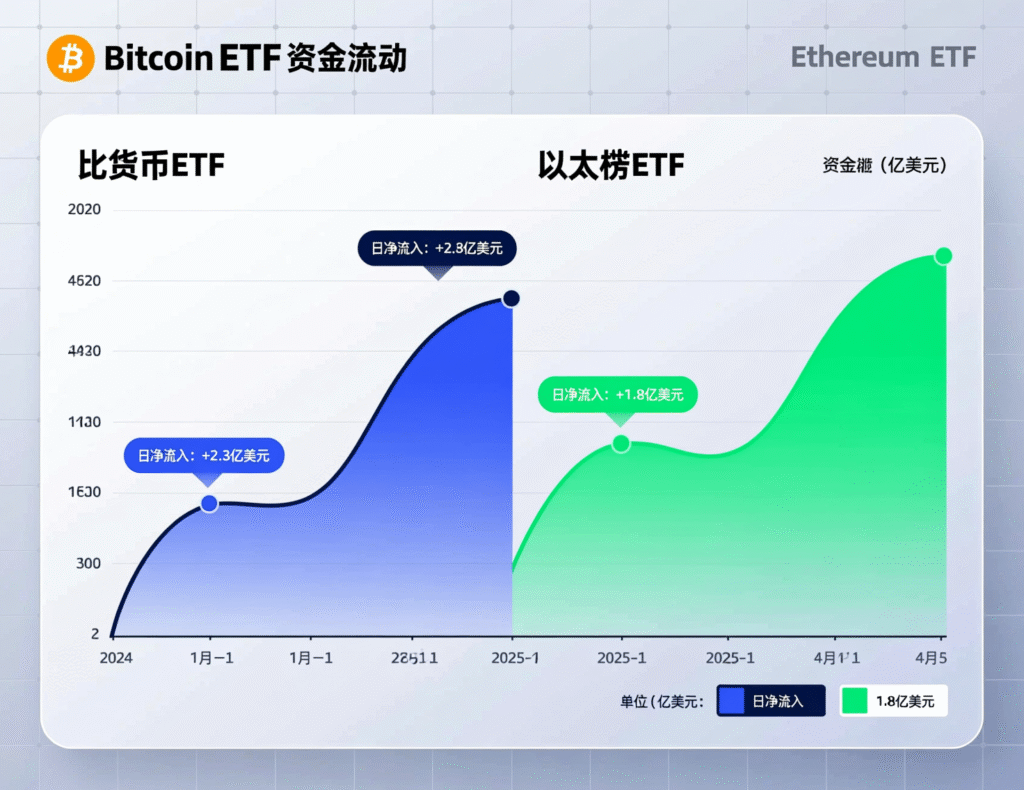

Market context: Bitcoin ETFs and macro backdrop

Spot Bitcoin ETFs also saw five straight days of net outflows (~$897.6M), aligning with BTC’s ~5% weekly slip to the $109k area late week, as risk assets wobbled ahead of U.S. inflation data.

What “Ether ETF outflows this week” signal

Redemptions typically reflect short-term de-risking and profit-taking after a strong summer run. The prior five-day streak in early September suggests flows can swiftly swing with macro headlines and liquidity conditions; a steadier risk backdrop (or clarity on ETF features like staking) could reverse sentiment.

Staking chatter and structural factors

On-chain moves indicate Grayscale prepared to stake a portion of its ETH, fueling speculation the SEC may eventually permit staking in ETF wrappers—though no approval exists yet. Any green light would change ETH’s ETF value-prop by adding yield.

<section id=”howto”> <h3>How to track ETF flows and price impact (without overreacting)</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Bookmark a primary flow dashboard (e.g., Farside’s ETH ETF flow page) and check end-of-day totals, not intraday noise.</li> <li id=”step2″><strong>Step 2:</strong> Pair flows with ETH price/volatility (CoinMarketCap + hourly chart) to see if outflows align with sharp price moves.</li> <li id=”step3″><strong>Step 3:</strong> Compare to Bitcoin ETF flows to gauge if redemptions are ETH-specific or market-wide.</li> <li id=”step4″><strong>Step 4:</strong> Note catalysts (Fed data, SEC actions, staking headlines) in a simple log to contextualize swings.</li> <li id=”step5″><strong>Step 5:</strong> Review weekly, not daily, trends before drawing conclusions.</li> </ol> <p><em>Note: Process may vary by data provider; always confirm methodology and update times.</em></p> </section>

Policy watch: Buterin vs. EU “Chat Control”

Vitalik Buterin argued on X that “we all deserve privacy and security… [backdoors] are inevitably hackable,” linking to a report that EU interior ministers sought exemptions from scanning provisions a point privacy groups say underscores systemic risks. The proposal’s fate may hinge on pivotal EU members in upcoming Council votes.

Conclusion

Recent flows point to short-term risk aversion in Ethereum exposure through ETFs, with investors scaling back positions amid uncertain sentiment. The pullback underscores caution in the near term as markets weigh ongoing volatility and sector-specific pressures.

Looking ahead, attention is on weekly flow momentum, Bitcoin cross-currents, and any SEC updates regarding staking features. A shift in the broader macro environment—or greater clarity on ETF mechanics could influence investor confidence. These factors will be key in determining whether outflows stabilize or extend, shaping the outlook for ETH-linked investment products in the coming weeks.

FAQs

Q : What caused Ether ETF outflows this week?

A : Predominantly risk-off positioning after a broader crypto sell-off and macro uncertainty; ETF features like staking remain unapproved, limiting yield appeal for now.

Q : How big were the outflows?

A : Roughly $795.8M over five sessions, with $248.4M on Friday.

Q : Did this happen recently before?

A : Yes another five-day outflow streak hit in the week ending Sept. 5 when ETH traded near $4,300.

Q : How did Bitcoin ETFs perform?

A : They also saw five days of redemptions totaling about $897.6M this week; BTC hovered near $109k.

Q : Could ETF staking change flows?

A : Potentially. On-chain activity tied to Grayscale suggests preparations for staking, but SEC approval hasn’t arrived.

Q : Where can I track flows reliably?

A : Farside’s real-time dashboards and reputable market data sites (plus issuer disclosures) are good starting points.

Q : What did Vitalik say about EU “Chat Control”?

A : He warned that backdoors are “inevitably hackable,” urging privacy-by-design protections.