Bitcoin to $60K or $140K? Traders at odds over where BTC price goes next

The big question driving crypto markets this week is whether Bitcoin will drop to $60K or climb to $140K. After surging to a record near $124K in mid-August, BTC has retreated below $110K, leaving traders divided. Technical analysts are cautious, warning of a potential 2021-style correction if support levels fail to hold. They point to patterns and indicators suggesting that a pullback could intensify before any new rally.

On the other hand, bullish investors remain optimistic, highlighting the 200-day moving average as a key support that could stabilize BTC. They see this as a springboard for Bitcoin to resume its upward trajectory and possibly hit fresh all-time highs. The coming days will be critical, as market sentiment and technical trends collide to determine Bitcoin’s next major move.

Fractals and wedges: What the bear side sees

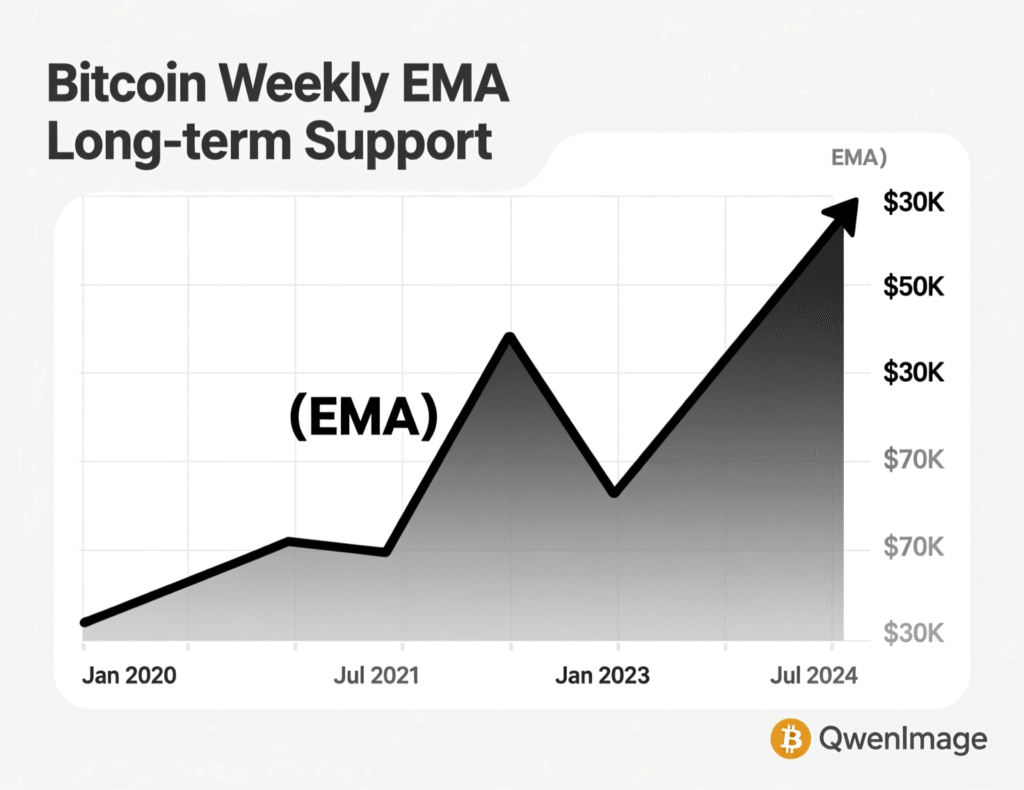

Several technicians note that BTC’s current structure resembles late-2021: a euphoric high, distribution, then a failure at resistance—patterns that preceded a >50% drawdown. On higher timeframes, analysts flag a rising-wedge break that, if confirmed, could send price toward the $60K–$62K region, broadly aligning with long-term moving-average support. Cointelegraph+1

Momentum, levels, and the case for stabilization

Short-term momentum has softened as BTC slipped below the 50-day MA, with traders watching $107K and then ~$102K as near supports. On the upside, $113K and ~$117K are initial hurdles before retesting the ATH zone. A reclaim and hold above those areas would weaken the bear case.

Bitcoin to $60K or $140K what each would take

Toward $60K

Persistent lower highs, failed retests near $113K–$117K, and expanding downside volume would keep wedge-break dynamics in play, opening room to a deeper mean-reversion leg.Toward $140K

A clean move and close back above ~$113K–$117K, followed by a measured-move breakout from a developing flag, could revive a path toward ~$140K in coming months.

Macro & flows: Why bulls still see upside

Some analysts argue the post-halving window, ongoing institutional flows into spot BTC ETFs, and benign funding/liquidity conditions still favor higher-timeframe upside into Q4, despite volatility. Price still sits well above prior-cycle highs, which historically acted as a base in sustained bull cycles.

Solana ETFs and the broader risk backdrop

While separate from BTC’s chart, risk appetite in crypto can be influenced by ETF pipelines. Multiple firms, including Franklin Templeton, Fidelity, CoinShares, Bitwise, Grayscale, VanEck and others, have updated S-1s for spot Solana products that include staking. And in July, the REX-Osprey Solana Staking ETF (ticker: SSK) debuted on Cboe BZX, logging ~$33M volume and ~$12M day-one inflows. Any acceleration in crypto ETF approvals could support broader market sentiment.

<section id=”howto”> <h3>How to map BTC risk levels with moving averages</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Mark the 200-day MA and 50-day MA on the daily chart to define trend vs. momentum.</li> <li id=”step2″><strong>Step 2:</strong> Draw recent swing highs/lows; note confluence near $107K, $113K, and $117K.</li> <li id=”step3″><strong>Step 3:</strong> Watch closes above/below these levels to confirm continuation or rejection.</li> <li id=”step4″><strong>Step 4:</strong> If price reclaims $113K–$117K with volume, plan for a trend-following setup; if not, plan for range or downside tests.</li> <li id=”step5″><strong>Step 5:</strong> Reassess weekly EMAs for deeper targets (e.g., long-term averages closer to $60K) if momentum fails.</li> </ol> <p><em>Note: Process may vary by platform and risk profile. Confirm indicators and data sources before acting.</em></p> </section>

What could send Bitcoin to $60K or $140K

Bear triggers

Loss of $107K, failed retests, risk-off macro, and negative funding skew.Bull triggers

Breakout above $113K–$117K, improving liquidity, and renewed ETF-driven inflows; bull-flag validation would strengthen ~$140K targets.

Conclusion

Bitcoin currently stands at a crucial technical junction. If it fails to reclaim the $113K–$117K zone, a deeper pullback could be expected, keeping bears in control for the near term. Traders are watching these levels closely as key decision points for the next move.

Conversely, a decisive breakout above this range would shift sentiment toward fresh highs, signaling renewed bullish momentum. Investors should focus on clear objective levels and validate trades with supporting indicators such as volume and momentum. Careful planning and disciplined execution remain essential in navigating Bitcoin’s current crossroads.

FAQs

Q : Could Bitcoin to $60K or $140K happen in 2025?

A : Yes downside to ~$60K aligns with long-term EMAs if momentum fails, while a break above ~$113K–$117K could reopen ~$140K targets.

Q : What key BTC levels are traders watching this week?

A : ~$107K support; ~$113K–$117K resistance before any retest of the ATH zone.

Q : Why do some analysts expect a deeper correction?

A : A rising-wedge/2021-style fractal suggests risk of a rejection and a return toward the long-term average near $60K–$62K.

Q : What supports the bullish thesis?

A : A potential bull flag, post-halving seasonality, and institutional ETF flows.

Q : Do Solana ETFs affect Bitcoin?

A : Indirectly. Broader ETF acceptance can lift overall risk appetite, though BTC’s chart still drives its path.

Q : What would invalidate the bullish setup quickly?

A : Consecutive closes below ~$107K with expanding volume and failure to reclaim $113K–$117K.