European banks form company to launch euro stablecoin

A consortium of nine major lenders has formed a Netherlands-based company to launch a regulated euro-denominated token in 2026. The move marks a significant step by mainstream financial institutions into blockchain-based payments, aiming to modernize settlement systems and improve efficiency in cross-border transactions. By issuing this token, the group seeks to demonstrate how blockchain can support trusted, large-scale financial operations within Europe’s banking sector.

Often referred to as the European banks’ euro stablecoin initiative, the project is designed to cut costs and speed up settlement for both payments and securities transactions. It also positions the lenders to align with the EU’s evolving MiCAR regulatory framework while remaining under the watchful eye of central banks. This signals growing institutional confidence in blockchain’s role in Europe’s financial future.

What is the European banks euro stablecoin initiative?

The consortium’s new Amsterdam-based company plans to issue a euro-pegged stablecoin in the second half of 2026, designed for on-chain payments and near-instant settlement. The group says the token will be fully regulated and open to additional member banks. A chief executive is expected to be named soon.

Who is involved and what’s the scope?

Founding members are ING, UniCredit, DekaBank, KBC, Danske Bank, SEB, CaixaBank, Raiffeisen Bank International and Banca Sella. The issuer aims for MiCAR-compliant, low-cost transfers, and could extend into securities settlement and cross-border treasury use cases.

Why the ECB remains sceptical

ECB President Christine Lagarde has warned that stablecoins can pose risks to monetary policy and financial stability, arguing that a digital euro would better safeguard Europe’s payments sovereignty. Recent remarks also urged closing regulatory loopholes, especially for foreign issuers. European Central Bank+1

Market context and comparables

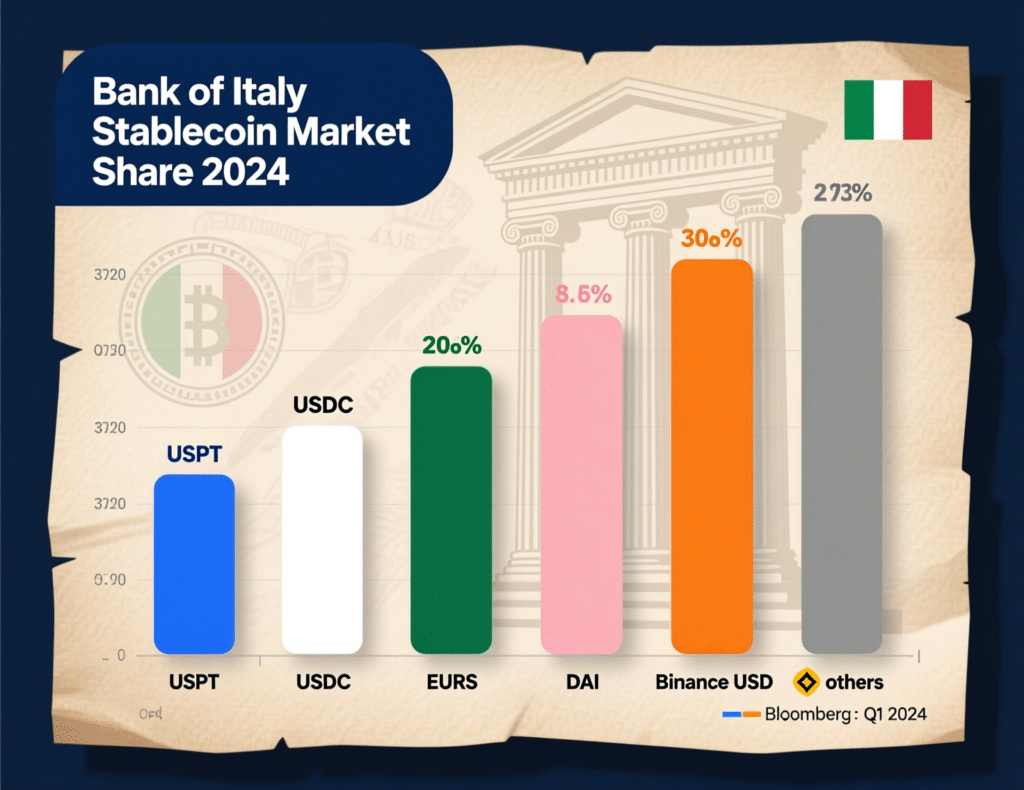

Despite rapid growth, euro-pegged tokens are a sliver of the market—about $620 million versus nearly $300 billion in total stablecoins, with global crypto capitalization around $4 trillion. Société Générale’s SG-FORGE launched EURCV in 2023 and more recently USDCV; uptake of EURCV remains modest relative to dollar tokens.

Timeline and governance for the European banks euro stablecoin

The issuer expects first release in H2 2026, pending Dutch licensing and consortium governance finalization. The structure is open to additional banks and will appoint a CEO in due course, subject to regulatory approvals.

<section id=”howto”> <h3>How to evaluate a bank-issued euro stablecoin for enterprise use</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Confirm regulatory status (e.g., MiCAR e-money token license, Dutch supervision) and read the whitepaper.</li> <li id=”step2″><strong>Step 2:</strong> Review reserve assets, attestation frequency, custody arrangements, and redemption terms.</li> <li id=”step3″><strong>Step 3:</strong> Test settlement flows on supported chains with sandbox wallets and small-value pilots.</li> <li id=”step4″><strong>Step 4:</strong> Map treasury, accounting, and tax treatments; align with internal risk and compliance policies.</li> <li id=”step5″><strong>Step 5:</strong> Negotiate SLAs with the issuer and participating banks for mint/burn, cut-off times, and incident response.</li> </ol> <p><em>Note: Process may vary by jurisdiction/provider. Confirm requirements before acting.</em></p> </section>

Context & Analysis

The consortium is opting for a bank-issued, MiCAR-aligned model to compete with dominant dollar tokens without waiting for a retail digital euro. Bank of Italy’s recent data underscore the uphill task: euro stablecoins remain niche. ECB caution suggests the issuer’s credibility will hinge on transparency of reserves, redemption mechanics, and interoperability with existing rails.

Conclusion

If regulatory approvals and governance frameworks proceed as planned, Europe could see the launch of a bank-backed euro stablecoin by the second half of 2026. This development would mark a milestone in merging traditional banking with blockchain technology, offering a regulated and trusted digital asset for faster, more secure transactions.

The initiative is viewed as a potential bridge between established financial institutions and on-chain finance. Its rollout will unfold alongside ongoing policy debates over the role of stablecoins versus the European Central Bank’s vision for a digital euro, shaping the future of Europe’s financial infrastructure.

FAQs

Q : Who is behind the new euro stablecoin?

A : Nine European banks including ING, UniCredit, DekaBank, KBC, Danske Bank, SEB, CaixaBank, Raiffeisen Bank International and Banca Sella.

Q : When will it launch?

A : Target: second half of 2026, pending licensing and readiness.

Q : What regulation will apply?

A : MiCAR e-money token rules and Dutch supervision are expected for the issuer.

Q : How does this compare with EURCV?

A : SG-FORGE’s EURCV launched in 2023; uptake is limited compared with dollar tokens; SG-FORGE has since launched USDCV.

Q : Why is the ECB cautious?

A : ≈$620m versus nearly $300bn global stablecoins; crypto ≈$4tn.

Q: How big is the euro stablecoin market today?

A : ≈$620m versus nearly $300bn global stablecoins; crypto ≈$4tn.

Q : Will the token work for securities settlement?

A : The consortium cites payments and settlements as use cases; specific rails and venues are TBA.

Q : Does this article’s keyword matter?

A : Yes, searchers often look for “European banks euro stablecoin” to find this specific initiative.