Fnality Raises $136M to Expand Blockchain Payment Systems for Banks

Fnality has secured $136 million in a Series C funding round backed by major global banks, strengthening its mission to modernize wholesale payments. The firm operates a blockchain-based settlement system that enables on-chain transactions fully backed by central bank funds, ensuring both security and efficiency. This latest investment underscores growing confidence in the need for institutional-grade financial infrastructure built on distributed ledger technology.

With fresh capital, Fnality plans to scale beyond sterling and roll out its services in multiple currencies, broadening its global reach. The company is also set to enhance its platform with deeper tooling designed for the rapidly expanding market of tokenized assets. By bridging traditional finance with digital settlement, Fnality is positioning itself at the forefront of the next wave of financial innovation.

Fnality raises $136M Series C

The $136 million Series C was led by WisdomTree, Bank of America, Citi, KBC Group, Temasek and Tradeweb. Existing investors among them Goldman Sachs, UBS and Barclays also participated. Fnality said proceeds will support multi-currency rollouts and upgrades to liquidity and settlement tools that serve tokenized securities and FX.

What does “Fnality raises $136M Series C” enable for banks?

Fnality’s systems are designed for real-time settlement, including delivery-versus-payment (DvP) for digital securities and payment-versus-payment (PvP) for FX. For wholesale participants, this can reduce intermediaries, compress settlement times and improve capital efficiency e.g., intraday or instant repo settlement versus typical T+1 cycles.

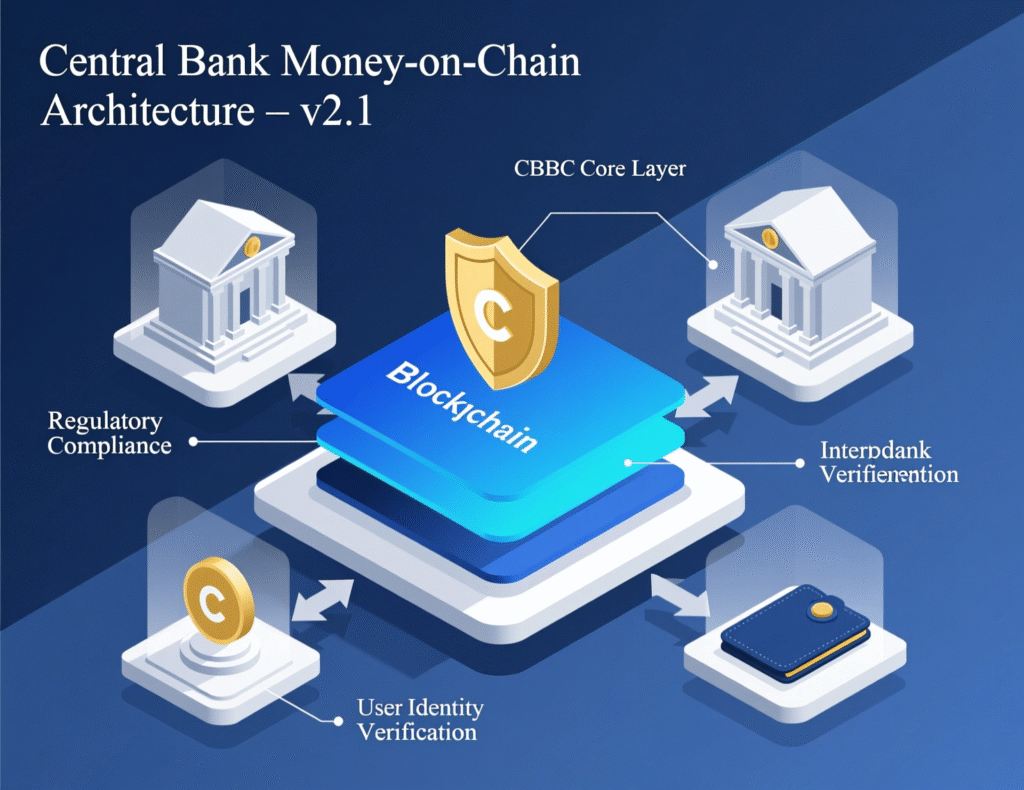

Product & Market: Central-Bank-Money on DLT

The Sterling Fnality Payment System (£FnPS) launched in December 2023 and is the first user of the Bank of England’s omnibus account functionality, enabling on-chain transactions backed by central bank funds. Participants include major UK and global banks. Expansion paths under evaluation include USD and EUR subject to regulatory approvals.

Leadership & Roadmap

Fnality appointed Michelle Neal as CEO in 2025, succeeding founder Rhomaios Ram (now strategic advisor). Neal previously led the Markets Group at the Federal Reserve Bank of New York and held senior roles at BNY Mellon and others. In announcing today’s round, she described a move toward “a hybrid future of global finance” connecting traditional institutions and decentralized markets. Fnality International+2Ledger Insights+2

<section id=”howto”> <h3>How to prepare your institution for on-chain wholesale settlement</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Map use cases (DvP, PvP, repo, intraday liquidity) and quantify expected settlement/capital benefits.</li> <li id=”step2″><strong>Step 2:</strong> Confirm eligibility and regulatory requirements for using central-bank-money rails (e.g., BoE omnibus account framework in the UK).</li> <li id=”step3″><strong>Step 3:</strong> Align internal risk, treasury and ops policies with atomic, real-time settlement flows and collateral management.</li> <li id=”step4″><strong>Step 4:</strong> Integrate with the payment system’s APIs and run sandbox pilots covering end-to-end DvP/PvP scenarios.</li> <li id=”step5″><strong>Step 5:</strong> Roll out production with phased limits, real-time monitoring, and contingency playbooks for 24/7 operations.</li> </ol> <p><em>Note: Process may vary by jurisdiction/provider. Confirm requirements before acting.</em></p> </section>

Context & Analysis

The raise signals continuing institutional interest in tokenized finance despite a mixed venture backdrop. Fnality’s model tokenized deposits backed by central bank funds within a regulated payment system differentiates it from commercial-bank stablecoins or public-chain stablecoins. If multi-currency rails arrive, cross-currency PvP and collateral mobility could reduce intraday liquidity buffers for large dealer banks. Regulatory timelines and interoperability with securities DLT platforms (for atomic DvP) remain the key swing factors.

Conclusion

Fnality has raised $136 million in a Series C round, providing the company with resources to expand its blockchain-based settlement model, which uses central bank money for wholesale payments. Initially launched in sterling, the firm now aims to extend its services to additional currencies, strengthening its role in global financial infrastructure.

The funding will also accelerate development of solutions for tokenized assets, a growing priority in digital markets. Key steps ahead include securing regulatory approvals in new jurisdictions, onboarding a wider base of participants, and building interoperability with distributed ledger technology (DLT) securities platforms to enable seamless settlement.