Crypto Lending Platforms 2025 Overview

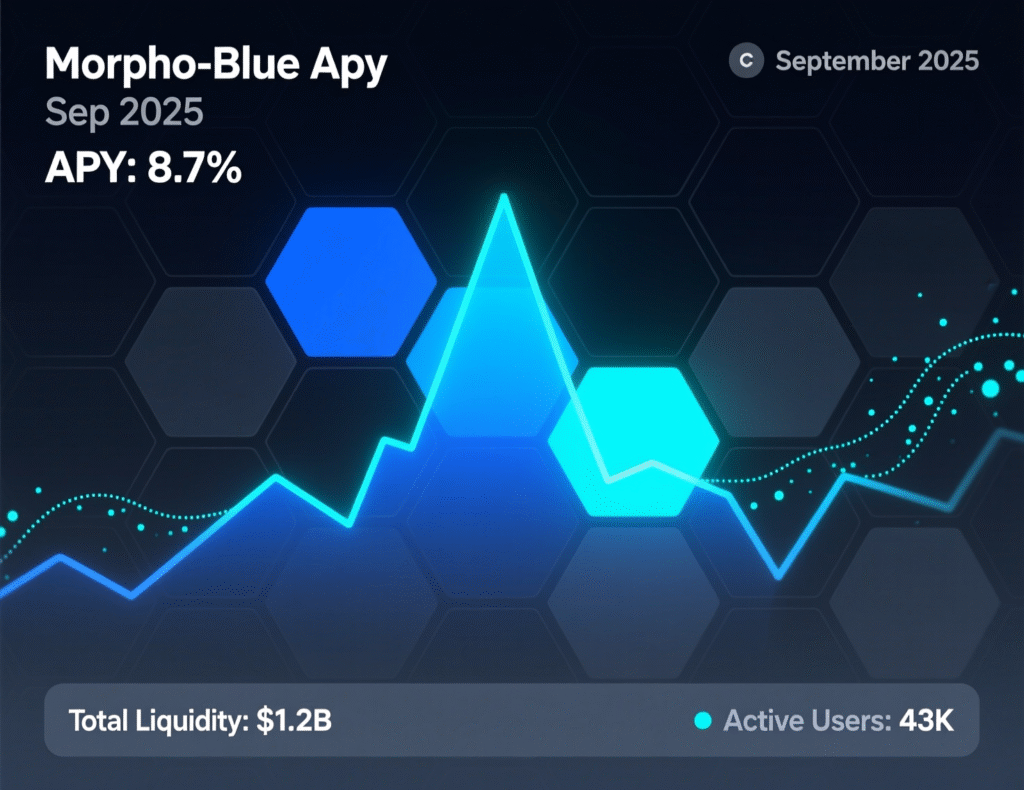

Crypto lending platforms have matured since the 2022 deleveraging, with liquidity and transparency returning across both decentralized (DeFi) and centralized (CeFi) options. In this Crypto Lending Platforms 2025 Overview, we’ll unpack how the market works today, where yields are coming from, which platforms are leading, what regulations matter, and a simple process to pick the right fit. You’ll see real, current snapshots (e.g., Aave USDC supply APRs around ~4.8–5.1% on Ethereum/Polygon v3; Morpho Blue double-digit APYs in some pools; CeFi promos like Binance’s limited 4% APR USDC borrowing; Nexo’s tiered “Earn” rates), plus practical risks and checklists.

TL;DR: DeFi money markets (Aave, Compound, Morpho Blue, SparkLend) remain the backbone for on-chain lending, while CeFi (Nexo, large exchanges) focuses on UX and fixed promo products. Regulation (EU MiCA, UK FCA consultations) is reshaping yields—especially on stablecoins.

Where Crypto Lending Stands in 2025

TVL & momentum: DeFi lending TVL hit fresh highs mid-2025 (~$55B), led by Aave, Morpho, and Maple’s on-chain credit products gaining traction.

Representative rates (Sep 2025):

Aave v3 USDC (Polygon/Ethereum)

Supply APR ~4.8–5.0% recent snapshots.Morpho Blue

Delected USDC pools have shown >10% APY (volatile and market-specific).CeFi promos

Binance ran a limited 4% USDC stable borrow APR (Aug–Sep 2025). Nexo advertises up to mid-teens APY depending on tiers and terms. Always read the conditions.

Stablecoin yield rules

In the EU, MiCA prohibits issuers (and in many contexts CASPs) from paying interest to holders of ARTs/EMTs, influencing how platform yields are structured regionally. UK rules on crypto promotions and the proposed regime continue to evolve.

How Crypto Lending Platforms Work (DeFi vs CeFi)

DeFi Money Markets (Permissionless)

Protocols like Aave and Compound pool deposits and price borrow/supply rates algorithmically; positions are over-collateralized and transparently enforced on-chain. Morpho Blue adds “vault-style” markets with custom collateral/loan parameters, sometimes offering higher APYs for specialized risk. SparkLend (from the Maker/Sky ecosystem) focuses on DAI/USDS liquidity with governance-set rates in some products.

CeFi Platforms (Custodial)

Firms such as Nexo and big exchanges aggregate user assets and extend loans to vetted borrowers or route liquidity on/off chain. They may offer fixed promos, loyalty tiers, and simpler UX while introducing counterparty risk and terms that depend on the company’s balance sheet and jurisdiction.

Top DeFi Crypto Lending Platforms in 2025 (What They’re Best For)

Aave v3 The DeFi Standard

Why it leads

Deep liquidity across chains; granular risk controls; large asset menu.Snapshot

Recent USDC supply APR ~4.8–5.1% (Polygon/Ethereum v3), varies by utilization; risk parameters actively tuned by governance and partners.Best for

Broad-based collateral, conservative DeFi lending, flash loans (pro use).Watch out for

Rate spikes at high utilization; liquidation thresholds vary by asset.

Compound v3 (Comet) Cleaner Markets, Blue-Chip

Why it matters

Simpler “base asset” design; steady USDC markets; mature governance.Snapshot

Live markets and rates via Compound app/markets pages; parameters adjusted via governance (e.g., Gauntlet/Chainrisk risk workstreams).Best for

Developers, DeFi natives wanting predictable, audited money markets.

Morpho Blue Customizable Markets & Higher APY Potential

Why it’s hot

Modular markets often show double-digit APYs in specific pools due to tailored risk; can out-earn pooled markets but requires due diligence on collateral and oracle setups.Best for

Advanced users who evaluate per-market parameters.

SparkLend / Spark Maker-Aligned Liquidity & Savings

Why it’s unique

Governance-set rates for certain stablecoin savings/borrowing; tight integration with DAI/USDS and Maker’s broader “Endgame/Sky” stack. Spark reports multi-billion TVL between Lend and Liquidity Layer.Best for

Users holding DAI/USDS seeking transparent, governance-set yields.

Maple Finance (On-Chain Credit & Cash Management) Institutions & RWAs

Why it’s notable

Brings institution-style credit and cash-management pools (U.S. T-bill exposure for qualified entities) on-chain; 2025 updates cite multi-billion AUM and competitive APYs in “High Yield” pools. Not a pooled over-collateralized market—read pool docs.

Leading CeFi Crypto Lending Platforms in 2025 (Caveat: Counterparty Risk)

Nexo

Flexible and fixed-term “Earn” products, BTC up to ~7% and stablecoin tiers advertising up to mid-teens APY actual rate depends on loyalty tier, term, and payout token. Offers crypto-backed credit lines and app-first UX.Binance Loans/Margin/Savings

Periodic fixed-rate or promo campaigns (e.g., 4% USDC borrow APR window Aug–Sep 2025). Strong liquidity and product choice; terms can be promotional and time-boxed.YouHodler

Advertised high headline APYs for stablecoins/crypto; check loyalty tiers, caps, and terms.Remember

CeFi yields are only as strong as the firm’s risk controls and balance sheet. Always read custody, rehypothecation, insurance, and jurisdictional disclosures on the platform’s site.

What Drives APYs in 2025?

Utilization & demand

In DeFi pools, supply APR rises as borrowing demand increases (see Aave utilization vs. APR). Large borrows can move rates in real time.Collateral & oracle risk

Exotic collateral or non-blue-chip oracles typically command higher APYs but add liquidation/depeg risk.RWAs & governance-set rates

Protocols like Spark use governance to set stablecoin savings/borrowing baselines. Maple’s cash pools route to T-bills for qualified lenders.Promotions & loyalty tiers

CeFi often boosts rates for limited periods or with token-based tiers.

Regulation in Focus (What Changes Your Yield)

EU MiCA

Prohibits interest/remuneration by issuers of ART/EMT stablecoins, and depending on context limits platforms’ ability to pay “interest” to EU retail for simply holding EMTs. Platforms structure yields accordingly (e.g., on-chain borrow fees, governance-set rates).

UK Regime (2025 drafts/consultations)

New FCA proposals set minimum operational standards, expand oversight of crypto promotions, and consult on consumer-duty-style protections as crypto becomes regulated activity. Expect phased implementation.

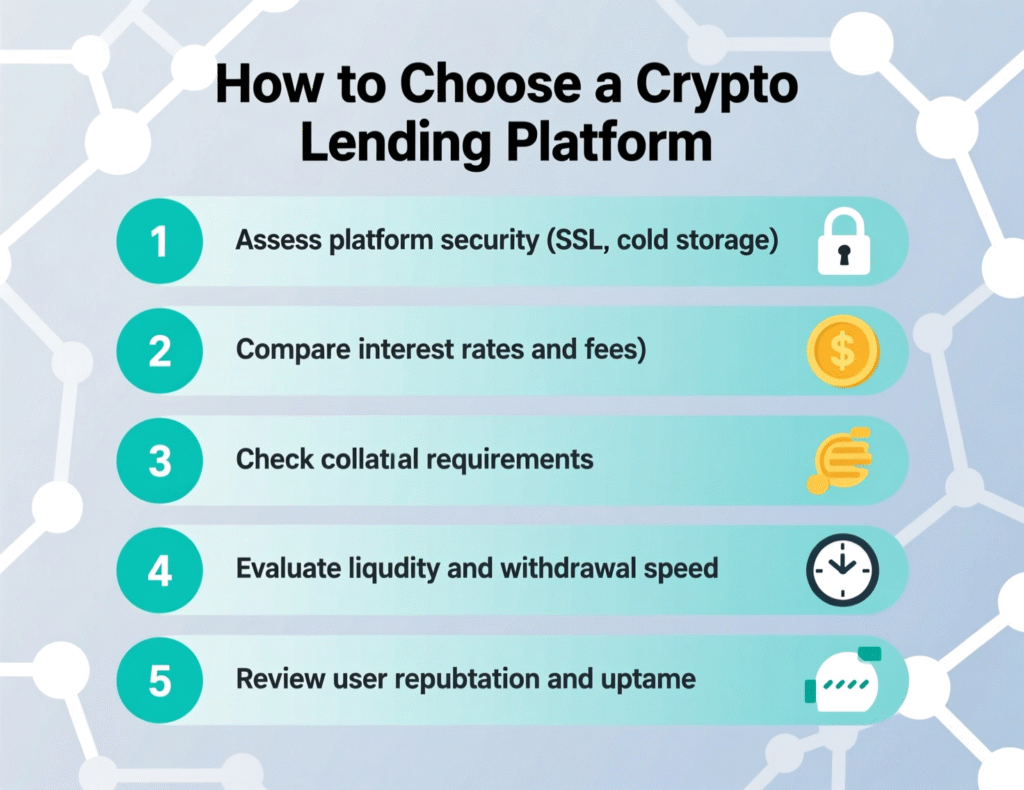

How to Choose Among Crypto Lending Platforms (Step-by-Step)

Define your goal: Cash-style stablecoin yield? Borrow against ETH without selling? Diversify treasury to T-bills (qualified entities)?

Pick your stack:

Conservative DeFi

Aave/Compound blue-chip markets.Higher-APY DeFi

Selective Morpho Blue markets (do per-pool DD).Maker-aligned savings/borrowing

Spark.Institutional treasury/RWAs

Maple cash or institutional pools (eligibility applies).One-app UX

Nexo/major exchanges (scrutinize terms). Check live rates and depth: Look at pool TVL, utilization, and recent APR snapshots (AaveScan, DeFiLlama).Assess risk

Smart-contract risk

Audits, time in market, bug bounties.Oracle & liquidation risk

Collateral LTVs, volatility cushions.Counterparty/custody

For CeFi, review custody, insurance limits, and legal jurisdiction.

Fees & terms

Withdrawal fees? Lockups? Promo end dates? Collateral factors and liquidation penalties.Regulatory fit

EU residents face different “interest” rules under MiCA; UK promotions rules apply—check your region.Pilot small, then scale

Start with a small position; test deposits/withdrawals/liquidation alerts.

Risks You Must Price In

Liquidation cascades

Over-collateralized doesn’t mean risk-free. Sharp price moves can liquidate borrowers, spiking utilization and APRs. Watch LTVs and buffers. (Aave utilization scenarios show APR sensitivity.)Depeg/bridge risk

Stablecoins or bridged assets can depeg; use native assets where possible and diversify.Platform failure (CeFi)

Always assume counterparty risk; prefer segregated custody, transparency reports, and third-party attestations.Regulatory constraints

EU MiCA limits interest on stablecoins by issuers; compliance can change product availability.

Real-World Examples (Brief Case Notes)

Case #1 DAO Treasury Cash Management (Maple)

A DAO governance thread proposed allocating $100k of treasury into Maple’s institutional lending pools to target ~6.3–6.6% base APY, boosted via a rewards program to ~~10% for an initial 3-month test before scaling. It highlights how DAOs evaluate on-chain credit with staged deployment. Gitcoin Governance

Case #2 Rate Sensitivity in Aave

AaveScan shows how a large incremental borrow (e.g., $250M) could push USDC supply APR sharply higher immediately, illustrating utilization-driven pricing. This demonstrates why lenders should check depth before chasing APYs thin liquidity can mean volatile rates.

Best-Practice Checklist

Use alerts for collateral health (liquidation threshold −10–20% buffer).

Prefer blue-chip collateral (ETH/stablecoins), native chain exposure.

Track utilization, TVL, and APR volatility via analytics (AaveScan, DeFiLlama).

For CeFi, verify custody + insurance + terms; beware “up to X%” ads.

Align with regional rules (MiCA, FCA).

Final Words

The Crypto Lending Platforms 2025 Overview shows a market that’s more professional, data-rich, and fragmented by risk appetite. Aave/Compound remain reliable baselines; Morpho Blue offers targeted opportunities for advanced users; Spark brings governance-set rates to DAI/USDS; Maple packages institutional credit and cash management on-chain.

CeFi platforms compete on UX and promos but require extra diligence. Match your goals to the right venue, verify live rates and depth, and implement risk controls before you chase yield.

CTA: Want a tailored platform/risk shortlist for your region and assets? Get in touch—we’ll map your goals to a DeFi/CeFi stack and ship a deploy-ready checklist with monitoring alerts and policy templates.

FAQs

Q1: How do crypto lending platforms generate yield?

A : DeFi platforms set algorithmic rates based on supply/borrow utilization; yields come from borrower interest. Some protocols add governance-set baselines (Spark) or route to RWAs (Maple cash pools for qualified users). CeFi aggregates borrower demand and promos. Always confirm the underlying source of yield.

Q2 : How safe are DeFi money markets compared to CeFi?

A : DeFi is transparent/on-chain but exposed to smart-contract/oracle risk and liquidations. CeFi removes contract risk but adds counterparty/custody risk. Blue-chip DeFi (Aave/Compound) has long track records; CeFi requires evaluating the company’s balance sheet and legal protections.

Q3 : How can I compare live rates across platforms?

A : Check protocol dashboards or aggregators (AaveScan, DeFiLlama). Compare APY, TVL, utilization, collateral types, and historical volatility rather than headline rates alone.

Q4 : How does regulation affect stablecoin yields in 2025?

A : Under EU MiCA, stablecoin issuers can’t pay interest, and platforms face limits on remunerating merely for holding some tokens. This shapes how EU-facing products are structured. The UK is consulting on broader crypto rules and promotions standards.

Q5 : How much collateral do I need to borrow?

A : Most DeFi loans are over-collateralized; collateral factors vary by asset and protocol. Expect lower LTV for volatile assets and higher for stablecoins. Always check the market’s liquidation thresholds before borrowing.

Q6 : How do platforms like Morpho Blue offer higher APYs?

A : They create custom markets with distinct risk parameters and potentially higher utilization. Higher APY typically comes with more specific collateral or oracle assumptions—do per-market due diligence.

Q7 : How can institutions/DAOs get T-bill exposure on-chain?

A : Via Maple cash management pools (for eligible entities), which pass through T-bill yields minus fees; this has been used by DAOs and crypto firms for treasury management.

Q8 : How do I reduce liquidation risk when borrowing?

A : Keep a healthy buffer (10–30% below liquidation threshold), diversify collateral, set alerts, and avoid correlated collateral/loans. In volatile markets, repay or add collateral early to maintain safety. (Utilization shocks can move APRs quickly.)

Q9 : What’s the difference between Aave and Compound in practice?

A : Both are blue-chip DeFi lenders. Aave supports more assets/features (e.g., isolation modes/HLTV on some chains); Compound v3 simplified markets around a base asset with cleaner risk. Choice often comes down to asset availability and chain.