Michigan Bitcoin Reserve Bill Moves Forward After Months of Delay

Michigan’s long-stalled bid to create a state-run crypto reserve gained momentum this week as House Bill 4087 was placed on the House’s second-reading calendar and referred to the Government Operations Committee its first movement in seven months.

The Michigan Bitcoin reserve bill would authorize the state treasurer to invest up to 10% of the General Fund and the Countercyclical Budget and Economic Stabilization Fund in cryptocurrency, with detailed safeguards.

What the Michigan Bitcoin reserve bill would do

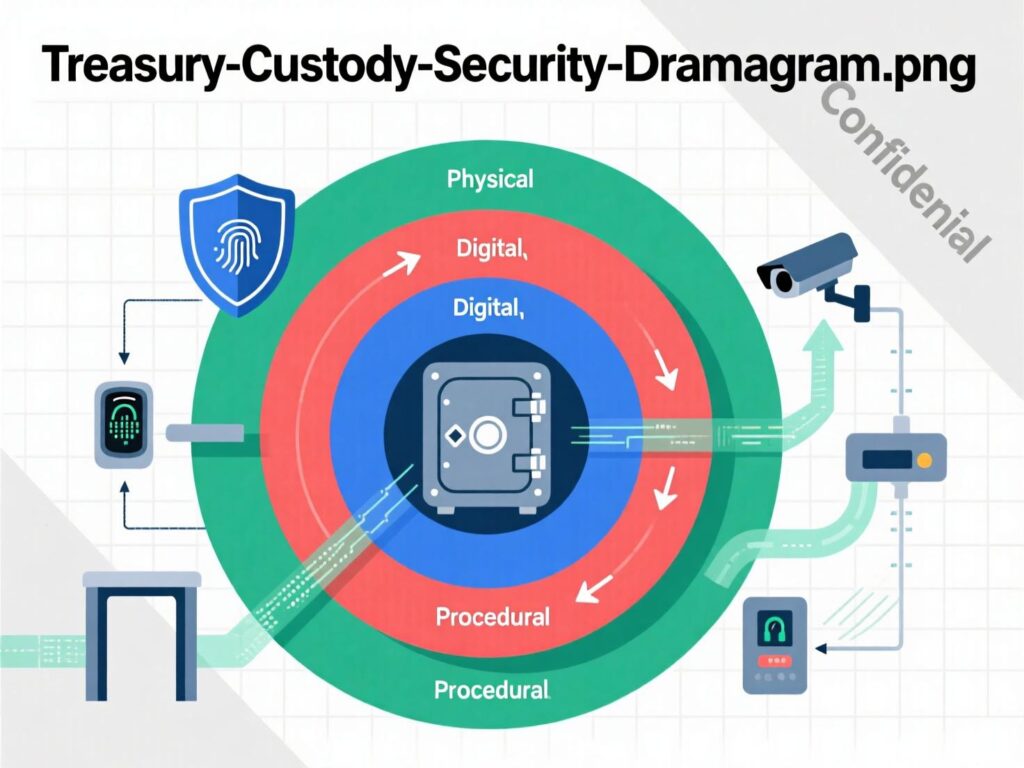

HB 4087 amends the Management and Budget Act to let the treasurer invest a capped share of two major state funds in crypto. The text specifies a 10% maximum per fund, allows holdings via a “secure custody solution,” a “qualified custodian,” or a U.S.-regulated ETP, and calls for multi-party governance, geographically diverse key storage, disaster recovery, and regular code audits/penetration testing. It also clarifies treatment of taxes or fees received in crypto.

Timeline: Where the Michigan Bitcoin reserve bill stands now

Introduced Feb. 13 and initially sent to Communications & Technology, the bill saw no action until Sept. 18, when the House suspended rules, discharged committee, placed the bill on second reading, and referred it to Government Operations. Next steps could include additional readings and potential amendments before a floor vote. Michigan Legislature

Sponsors and context

HB 4087 is sponsored by Reps. Bryan Posthumus and Ron Robinson. Its progress comes as several states formalize digital-asset reserves: New Hampshire (HB 302) and Arizona (HB 2749) approved reserve frameworks in May, and Texas enacted SB 21 on June 20, creating the Texas Strategic Bitcoin Reserve. Michigan would join these states if HB 4087 passes both chambers and is signed into law.

Industry reaction

Kadan Stadelmann, CTO at Komodo Platform, told Decrypt that “hyperbitcoinization will spread across the country at the state level. It can’t be contained,” urging municipalities to consider reserves and praising Michigan’s custody language. (Quote from interview.)

Federal backdrop

At the federal level, a July 30 White House digital-assets report omitted new details on a U.S. Bitcoin reserve, while a House appropriations bill (H.R. 5166) advanced language directing Treasury to study the feasibility and custody architecture of a Strategic Bitcoin Reserve and a broader digital-asset stockpile.

How to follow HB 4087’s progress (procedural guide)

<section id=”howto”> <h3>How to track Michigan’s HB 4087 through the Legislature</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Bookmark the official HB 4087 page and review the “History” log for actions and journals.</li> <li id=”step2″><strong>Step 2:</strong> Read the bill text (look for the 10% cap and custody provisions) under “Texts.”</li> <li id=”step3″><strong>Step 3:</strong> Check the House calendar for second/third readings and scheduled debates.</li> <li id=”step4″><strong>Step 4:</strong> Monitor the Government Operations Committee docket for hearings or substitutes.</li> <li id=”step5″><strong>Step 5:</strong> After any vote, confirm updates via House Journals and press releases.</li> </ol> <p><em>Note: Process and timing can change. Confirm details on the official Legislature site.</em></p> </section>

Context & Analysis

Analysis: Michigan’s text is notable for prescriptive custody and key-management requirements elements that some past state efforts lacked. Momentum at the state level coincides with federal study language in H.R. 5166, while markets hover around ~$117K BTC raising familiar questions about entry points and risk controls for public funds. Passage would still require committee consideration and floor votes in both chambers.

Conclusion

HB 4087 has advanced from dormancy to active deliberation, now moving forward in Michigan’s Government Operations. The bill outlines concrete steps for testing cryptocurrency reserves at the state level, signaling growing interest in exploring digital assets within public finance frameworks.

If enacted, Michigan would join states like New Hampshire, Arizona, and Texas in formally allowing Bitcoin exposure for state treasuries. The proposal includes strict custody rules and investment caps to assess whether public funds can safely participate in crypto markets, potentially setting a model for cautious, regulated adoption of digital assets by government entities.

FAQs

What is HB 4087?

A . It’s a Michigan House bill to let the state invest a capped portion of key funds in cryptocurrency with defined custody and security rules.

How much could Michigan invest?

A . Up to 10% of each of the two funds named in the bill.

Which states already have crypto reserve laws?

A . New Hampshire, Arizona, and Texas have enacted state reserve measures.

Where does the Michigan Bitcoin reserve bill go next?

A . It’s referred to Government Operations after second reading placement; hearings or further readings could follow.

Does the bill dictate how crypto must be held?

A . Yes via secure custody solutions, qualified custodians, or regulated ETPs, with disaster recovery and audits/pen tests.

Is the federal government creating a Bitcoin reserve?

A . A July 30 White House report added no new details; meanwhile, H.R. 5166 would require Treasury to study feasibility and custody.

What about price risk?

A . BTC is volatile; today it’s around $116.8K. Public funds typically use caps, diversification, and strict controls to manage risk.