With Fed Done, Here’s 3 Stories to Watch: Crypto Daybook Americas

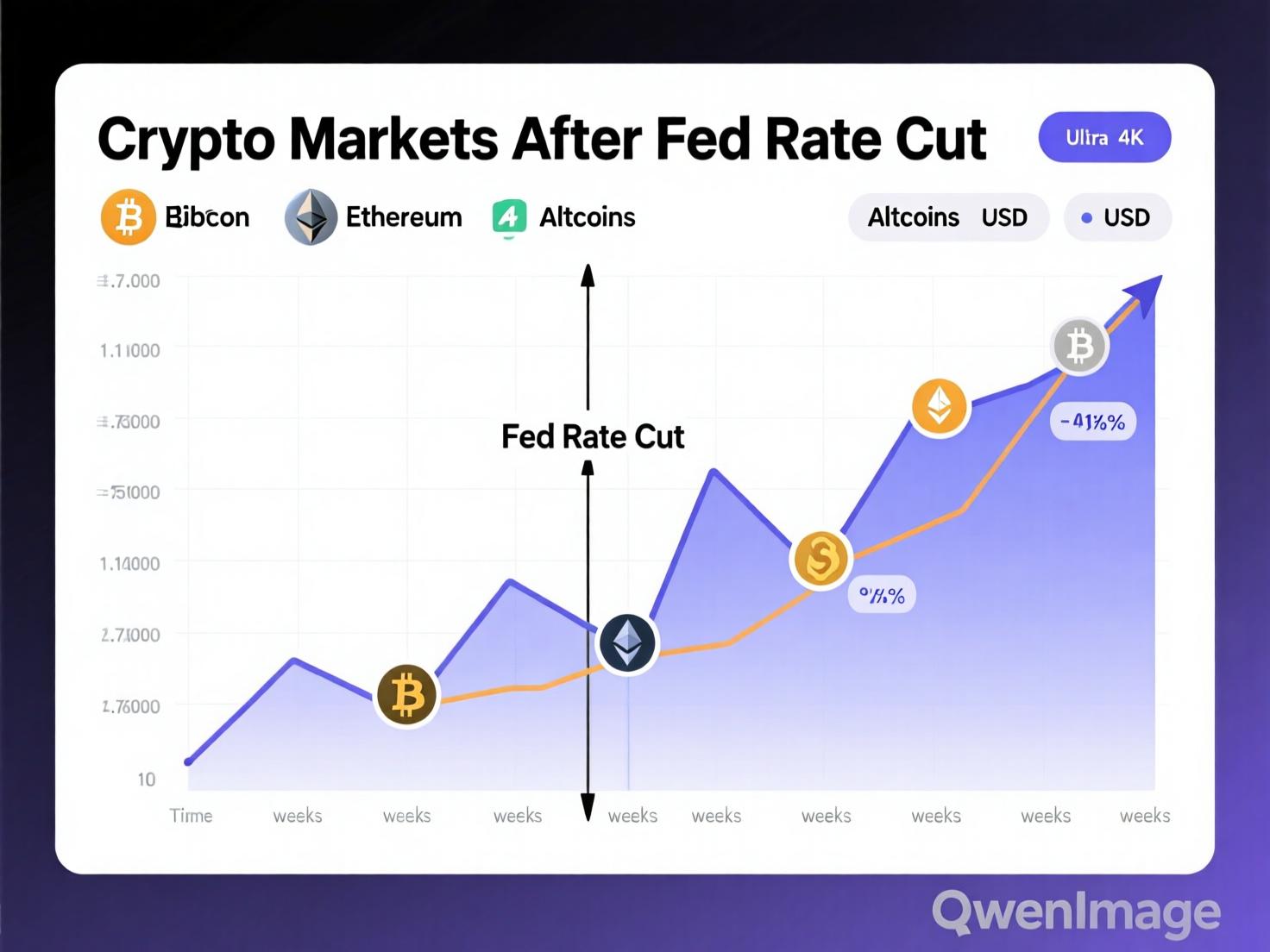

The recent 25 bps rate cut by the Federal Reserve, along with signals of further easing, has created a supportive macro backdrop for risk assets. With markets showing signs of stabilization, traders are beginning to reassess positioning in the crypto space. The shift in monetary policy is seen as a potential catalyst for renewed liquidity, giving digital assets room to attract fresh momentum.

In the near term, investor attention is also turning toward regulatory and structural developments shaping the market. U.S. ETF rules are expected to influence institutional participation, while evolving DeFi roadmaps are setting the stage for innovation and adoption. Together, these factors are likely to guide capital flows and define the short-term trading narrative in crypto markets.

What changed overnight

The FOMC lowered the policy rate by 0.25 percentage point, citing moderating growth and softer labor trends. Historically, easier policy supports liquidity and risk appetite; early market action reflects that dynamic across majors and the CoinDesk 20. Federal Reserve+1

SEC’s faster ETF pathway could be pivotal

The SEC approved generic listing standards for commodity-based trust shares—now encompassing digital assets—allowing exchanges to list qualifying spot crypto ETFs without bespoke 19b-4 approvals. Timelines can shrink from as long as 240 days to ~75 days, potentially broadening ETF access beyond BTC/ETH.

Immediate test case: DOGE & XRP ETFs go live

Cboe’s BZX lists REX-Osprey XRP ETF (XRPR) and REX-Osprey DOGE ETF (DOJE) today, offering 1x exposure before fees and expenses. Prospectuses allow a mix of direct holdings and reference ETPs, creating new brokerage-account on-ramps for both assets.

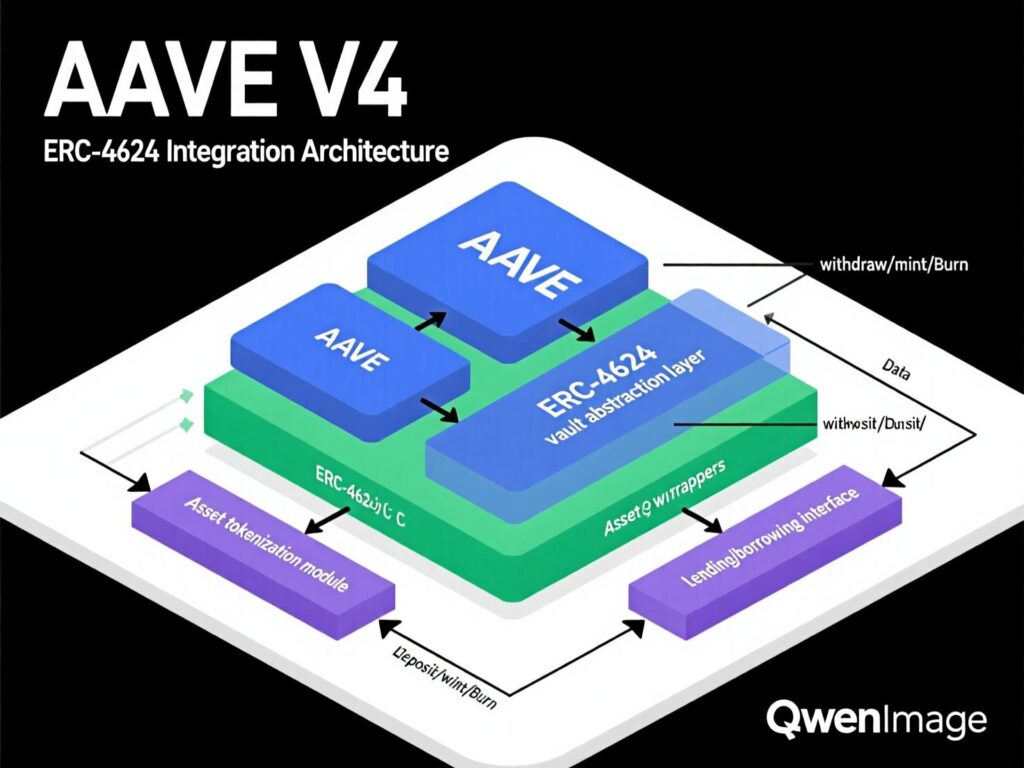

Aave V4 and Wormhole 2.0

Aave V4 will move from rebasing aTokens to ERC-4626 share accounting, making position values accrue via price per share rather than token count cleaner for taxes, integrations, and downstream composability. The roadmap also streamlines deployments.

Wormhole introduced W 2.0 tokenomics: a Wormhole Reserve, a targeted 4% base yield on W, and bi-weekly unlocks replacing annual cliffs aimed at aligning incentives and smoothing supply.

Risks to the crypto markets after Fed rate cut rally

A stronger dollar, softer on-chain volumes, or ETF inflow disappointments could cap upside despite easier policy. Watch correlations around data prints and first-week flows into XRPR/DOJE.

Context & Analysis

The near-term narrative hinges on whether ETF breadth unlocks new buyers. Generic standards reduce friction, but actual inflows will depend on custody, authorized participant readiness, and product design. On-chain, Aave’s shift to ERC-4626 could improve composability across yield strategies, while Wormhole’s Reserve and unlock cadence may dampen supply shocks incremental positives if usage grows.

Conclusion

The Federal Reserve’s shift toward gradual easing has set the tone for markets, placing structural drivers in the spotlight. Key among them are expanded ETF access, which could draw more institutional capital, and improvements in DeFi infrastructure that aim to strengthen market efficiency.

In the short term, traders are closely monitoring early action in XRPR/DOJE pairs as potential signals of retail sentiment. At the same time, progress updates from platforms like Aave and Wormhole will be critical in shaping confidence around adoption. Together, these indicators will determine whether current momentum broadens across crypto or begins to fade.

FAQs

Q : What did the Fed do and why does it matter for crypto?

A : It cut rates by 25 bps, easing financial conditions and generally supporting risk appetite.

Q : What are the new SEC rules and when could new crypto ETFs launch?

A : Generic listing standards let exchanges list qualifying spot crypto ETFs in as little as ~75 days, speeding the process.

Q : Which ETFs start trading today?

A : REX-Osprey’s XRP (XRPR) and Dogecoin (DOJE) ETFs list on Cboe BZX.

Q: What changes in Aave V4?

A : Positions shift to ERC-4626 share accounting, improving predictability for integrators and tax handling.

Q : What is Wormhole’s W 2.0?

A : A tokenomics update adding a Reserve, a targeted 4% base yield, and bi-weekly unlocks.