Bitcoin Traders Should Pay Attention to Japan as Top Economist Warns of Debt Implosion

Japan’s record-high public debt and the recent spike in long-term bond yields are once again raising alarms about a potential debt implosion scenario. Such an event could send shockwaves across global markets, impacting currencies, interest rates, and even crypto assets. The pressure has intensified as investors question the sustainability of the country’s fiscal position amid rising inflation expectations and shifting monetary policy.

Although a possible U.S. recession might temporarily push down global yields and provide some relief, experts caution that Japan cannot rely on external factors alone. The country’s debt dynamics, paired with lingering inflation risks, require deeper structural reforms. Without meaningful policy action, concerns over financial stability will persist, leaving markets vulnerable to renewed volatility and spillover effects worldwide.

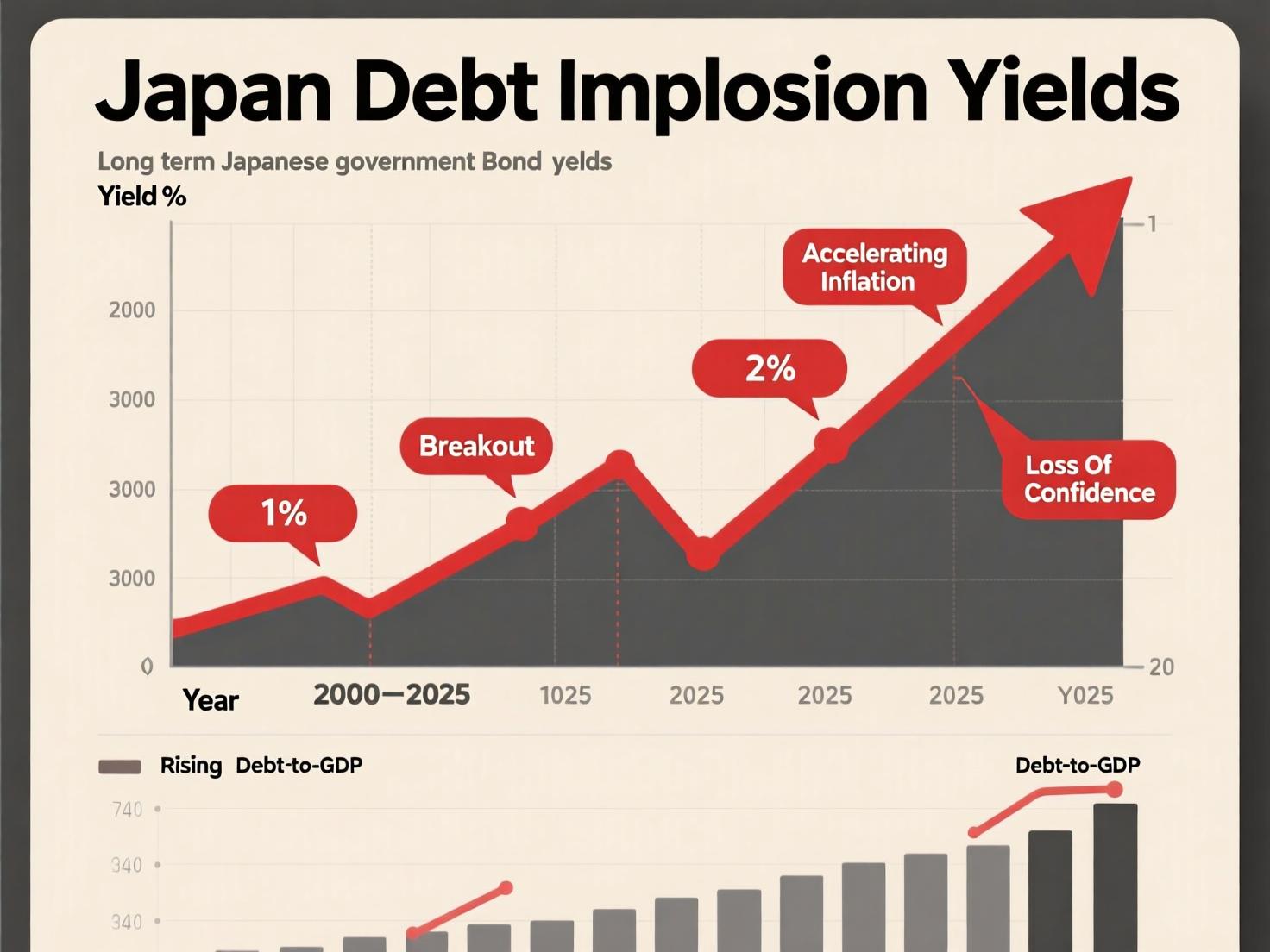

Why the Japan debt implosion risk is back in focus

Japan’s general government debt stands near ~250% of GDP by far the highest in advanced economies leaving public finances highly sensitive to interest-rate moves. In 2025, 10-year JGB yields traded around 1.6%, the highest since 2008, and 30-/40-year JGBs printed record yields above 3.1% 3.6% amid weak auctions and reduced central-bank buying. Recent CPI readings remain above the Bank of Japan’s 2% target, underscoring sticky price pressures that complicate policy.

Signals that could precede a Japan debt implosion

Super-long JGB underperformance vs. 10-year notes

Auction tails/low bid-to-cover in 20–40Y tenors

Persistent CPI >2% with weak real wage gains

Yen depreciation bouts tied to rate-differentials or fiscal headlines

Policy chatter (buybacks, issuance tweaks, supplemental budgets)

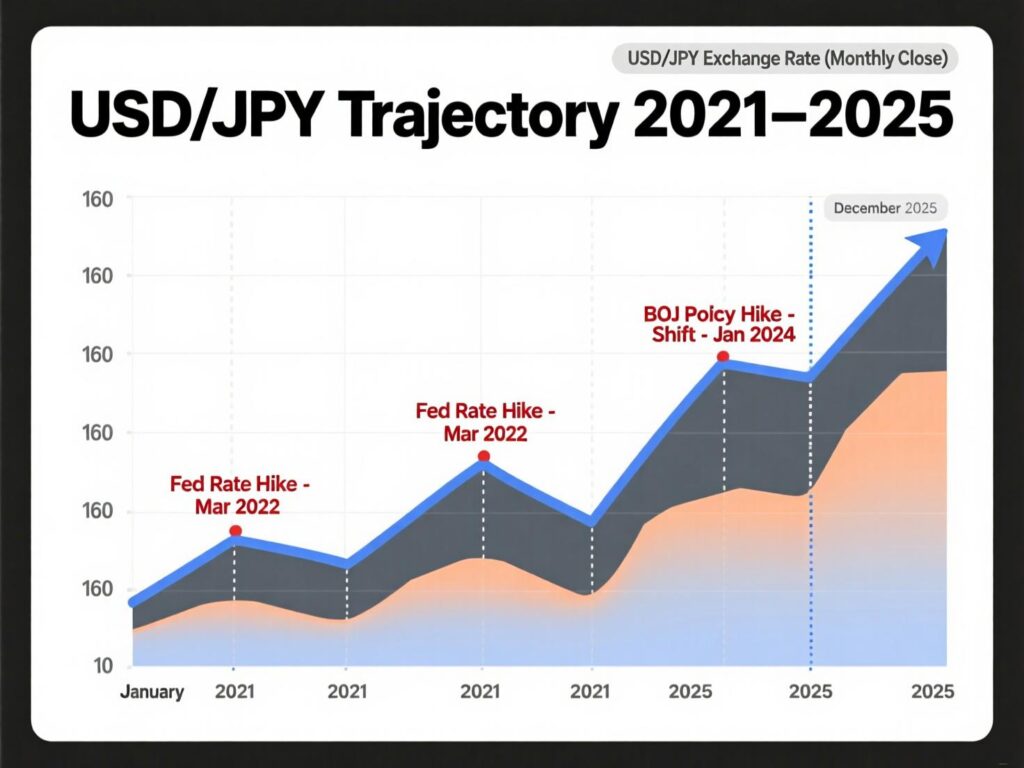

FX: Yen’s near-term strength vs. long-term weakness

This year, USD/JPY ~146.5, with the dollar down ~6–7% YTD vs. the yen as Fed-cut expectations lifted JPY. But zooming out, from early 2021 (~105) to today, USD/JPY is up ~40%—a stark yen depreciation that has fed domestic inflation. Reuters+2Exchange Rates+2

What a U.S. recession would do

Robin Brooks (Brookings) argues a U.S. downturn could pull global yields lower, buying Japan time. His broader point: Japan faces a policy catch-22 keep rates low and risk inflation via a weaker yen, or let yields rise and strain debt sustainability.

Stablecoins and crypto as “escape valves”

Japan’s regulated stablecoin framework is advancing, and JPYC says it plans the first licensed yen-pegged stablecoin later this year. If bond stress or yen volatility intensifies, demand for digital cash-like instruments and bitcoin as a macro hedge could increase at the margin though regulatory and liquidity frictions still matter.

Analysis (clearly labeled)

Japan’s debt math hinges on the interest-rate–growth differential and investor confidence in long-duration issuance. Elevated super-long yields suggest a market asking for more term premium. If U.S. rates fall in a recession, temporary relief could mask Japan’s structural budget gap; consolidation (spending cuts and/or taxes) likely remains the durable path.

Conclusion

In the near term, a U.S. economic slowdown may offer Japan temporary relief by easing global yields. This could help reduce immediate strain on government bonds, but it would not resolve deeper fiscal pressures. The longer structural adjustments are delayed, the greater the risk that Japanese government bond (JGB) term premia rise again, creating renewed instability.

For markets, this translates into potential turbulence for the yen and other key assets. Crypto traders, in particular, should stay alert. Stress in Japan’s debt market can spill into foreign exchange, global interest rates, and digital-asset flows faster than expected.

FAQs

Q : What is driving concerns about a Japan debt implosion?

A : Record debt (~250% of GDP) and rising long-dated JGB yields are stressing fiscal sustainability.

Q : Would a U.S. recession help Japan?

A : Likely global yields usually fall in recessions, easing Japan’s debt-service pressure temporarily.

Q : How could this affect bitcoin and crypto?

A : Macro stress can push some investors toward alternative assets; regulated yen stablecoins may see interest as digital “cash” rails.

Q : Is inflation still an issue in Japan?

A : Yes. Core CPI has stayed above the BOJ’s 2% target through mid-2025.

Q : Where is USD/JPY now, and how has it moved?

A : Around 146.5 today; the dollar is down ~6–7% vs. JPY in 2025 YTD but up ~40% since early 2021.

Q : What is JPYC planning?

A : JPYC says it will issue the first licensed yen-pegged stablecoin later this year under Japan’s framework.

Q : What would confirm rising systemic risk?

A : Failed super-long auctions, further record yield highs, sharp yen swings, and emergency policy measures.