Google unveils open-source protocol for AI payments with stablecoin support

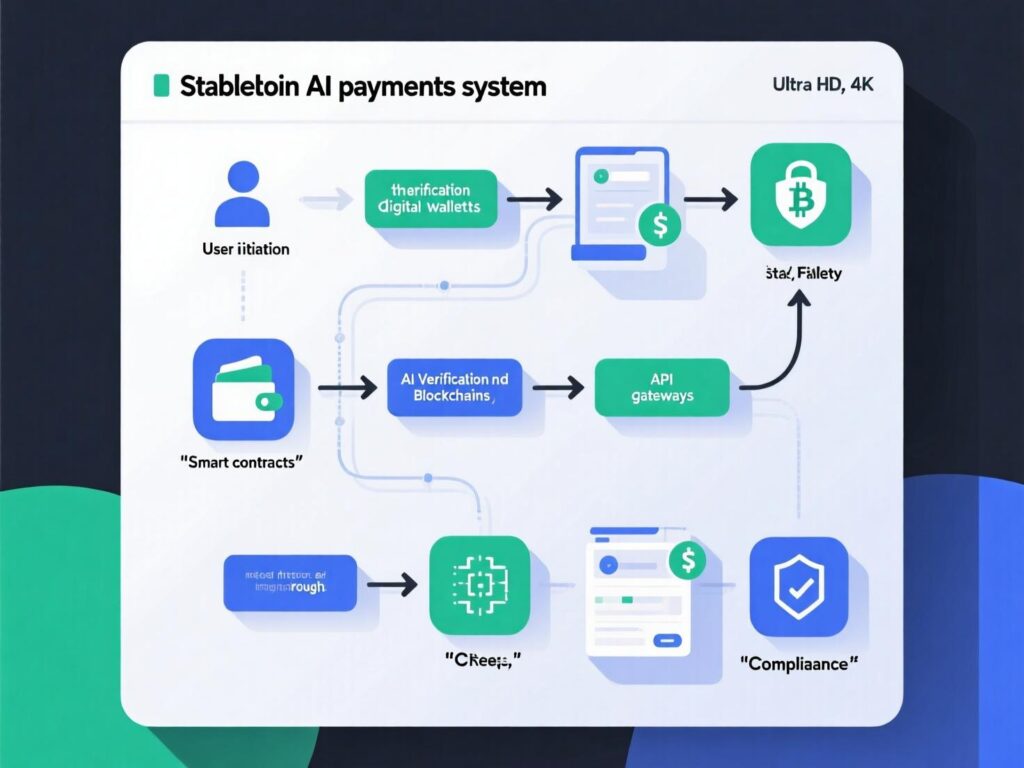

Google has introduced a new open-source payments protocol designed to help AI applications send and receive money seamlessly. A major highlight of this system is its support for dollar-pegged stablecoins, signaling a closer connection between AI agents and blockchain-based financial infrastructure. The move reflects Google’s broader push to integrate AI with real-world financial use cases, reducing friction in digital transactions and enabling smarter automation.

The stablecoin functionality within this protocol was developed in collaboration with Coinbase, while the Ethereum Foundation also provided consultation. Additionally, major enterprise players like Salesforce and American Express were involved, ensuring the framework meets both technical and business standards. By combining AI innovation with crypto rails, Google’s protocol could reshape how digital payments operate in the next wave of financial technology.

Why Google AI payments protocol stablecoin support matters

The protocol gives AI agents a common way to transmit value programmatically, fitting into Google’s broader Agent2Agent (A2A) stack for agent interoperability. By supporting traditional card rails and stablecoins, it aims to cover both existing payment flows and emerging machine-to-machine use cases like paying for APIs, storage, or compute on demand.

What’s new, and who’s involved

Fortune reported the launch includes more than 60 companies, with stablecoin functionality co-developed with Coinbase; Salesforce and American Express are among named participants. Google Cloud’s James Tromans said the design supports current rails “as well as forthcoming capabilities such as stablecoins,” while Coinbase engineer Erik Reppel noted work on interoperability.

How Google AI payments protocol stablecoin support works with A2A

A2A, introduced in April, defines how AI agents discover each other, share context, and orchestrate tasks. The new payment layer adds a standard way to request, authorize, and settle value extending A2A from messaging to money. Partner SDKs and reference implementations are expected to help developers test fiat and on-chain transactions side by side. Google Developers Blog

The policy backdrop: Stablecoins, AI agents, and standards

The U.S. GENIUS Act established a federal framework for stablecoins (100% liquid reserves, disclosures, redemption rights), shaping how compliant dollar tokens can be embedded in AI software stacks. Concurrently, the Ethereum Foundation has highlighted how the long-dormant HTTP 402 “Payment Required” status plus EIP-3009 can let AI agents trigger stablecoin transfers automatically an approach Coinbase developers have demonstrated.

Related developments in crypto market plumbing

Institutional settlement

Deutsche Börse subsidiary Crypto Finance launched AnchorNote, letting institutions trade across venues without moving assets out of custody, settling off-exchange via middleware (BridgePort).Policy momentum

U.S. lawmakers met industry leaders including Strategy’s Michael Saylor and others at a Capitol Hill roundtable to advance the BITCOIN Act, which contemplates building a strategic bitcoin reserve.

Context & Analysis

Analysis: Google’s move formalizes a pattern: AI agents are evolving from “message-passing bots” into economically capable software that can pay for services. Combining enterprise identity, policy controls, and stablecoins may accelerate B2B micro-transactions (per-request API access, per-minute compute, per-GB storage). The key risks are compliance (sanctions screening, travel rule), payment reversibility expectations, and platform lock-in versus open standards.

Conclusion

Google’s open-source protocol, combined with Coinbase’s stablecoin integration efforts, is paving the way for AI agents to conduct transactions directly across fiat systems and blockchain networks. With the added clarity from the GENIUS Act, the groundwork is set for smoother adoption of AI-driven financial interactions.

In the near term, we can expect quick pilots in areas like API paywalls and data marketplaces, where seamless payments are essential. As compliance standards and regulatory frameworks solidify, larger enterprise rollouts are likely to follow, unlocking broader use cases and accelerating the fusion of AI, crypto, and traditional finance.

FAQs

Q : What is Google’s new protocol?

A : An open-source spec that lets AI agents request, authorize, and settle payments across existing rails and stablecoins.

Q : Which companies are involved?

A : Google worked with Coinbase on stablecoin support and engaged partners like Salesforce and American Express.

Q : Does it use blockchain by default?

A : No. It supports traditional rails and optional stablecoins, depending on provider integrations.

Q : How does A2A fit in?

A : A2A (April 2025) provides agent interoperability; the payment layer extends it to value transfer.

Q : Is it compliant with U.S. stablecoin rules?

A : Designers are aligning with the GENIUS Act’s reserve and disclosure requirements; specific issuer rules still apply.

Q : Why do stablecoins matter for AI?

A : They enable instant, programmable, low-value transactions that agents can automate (e.g., HTTP-402 paywalls on Ethereum).

Q : Will fees be lower than cards?

A : Potentially for on-chain transfers, but costs depend on networks, issuers, and compliance tooling.