The Future of Liquid Staking Derivatives (LSDs)

Liquid staking derivatives have moved from niche to necessary infrastructure in crypto. As Ethereum’s proof-of-stake matures and multi-chain staking options grow, liquid staking derivatives (LSDs) sit at the center of yield, collateral design, and DeFi composability. In 2024–2025, LSTs (like stETH, rETH, cbETH, frxETH, swETH) expanded into LSDfi (protocols that trade or amplify staking yields) and restaking (LRTs), which reuse economic security for additional networks and services. The result is a deeper, more complex yield stack that touches everything from lending and DEX liquidity to risk-managed, institutional strategies.

The future of liquid staking derivatives will be shaped by three forces: market structure (TVL concentration and integrations), product design (withdrawals, slashing insurance, MEV policies), and policy clarity (jurisdictions diverge on what’s a security or collective scheme). Builders need safer abstractions and better UX; investors need clearer risk labeling and diversification; policymakers need frameworks that protect consumers without choking innovation.

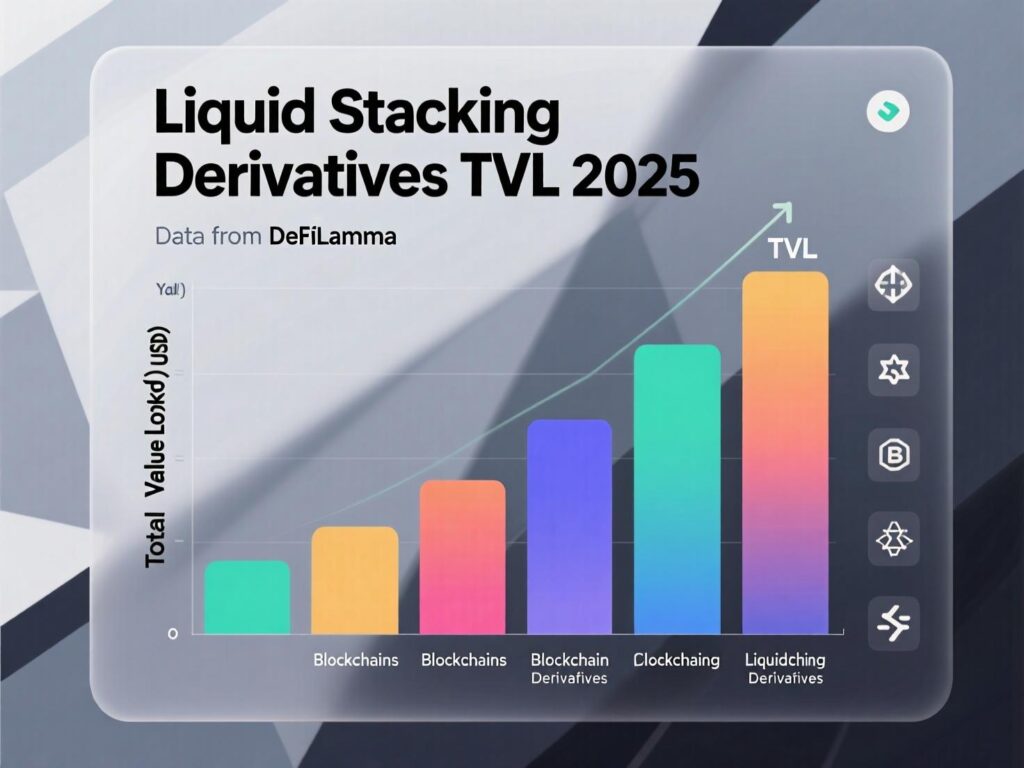

This article synthesizes current data and credible research to map where liquid staking derivatives are likely heading next and how to navigate them with a practical, defensible playbook. We’ll use real case studies, highlight measurable signals, and end with a concise checklist you can put to work today. DefiLlama puts liquid staking TVL above ~$80B+, while restaking has accelerated rapidly two signs of structural staying power.

What are liquid staking derivatives (LSDs) and why they matter

Liquid staking derivatives are tokenized receipts representing staked assets (e.g., ETH), allowing holders to stay liquid while earning staking yield. These receipts (LSTs) plug into DeFi for collateral, leverage, fixed-rate trades on future yield, and more. They unlock capital efficiency versus native staking lockups and enable portfolio strategies that blend carry with optionality. For an accessible primer, see comparative explainers that cover how LSTs accrue rewards and integrate with money markets and DEXs.

Consolidation, competition, and composability

TVL & rankings.

Liquid staking remains one of DeFi’s largest categories by TVL, with DefiLlama’s “Liquid Staking” leaderboards listing Lido, Binance Staked ETH, Rocket Pool, Marinade and others across chains. Protocol-level pages show billions in TVL and fee flows, underscoring product maturity and demand. DeFi Llama+2DeFi Llama+2Provider concentration is easing.

Lido’s ETH staking share has trended down, hitting ~24.4% in August 2025 per CoinDesk/Dune healthy for decentralization and competition. Expect continued dispersion as enterprise validators and institutional platforms expand.Yield plumbing has deepened.

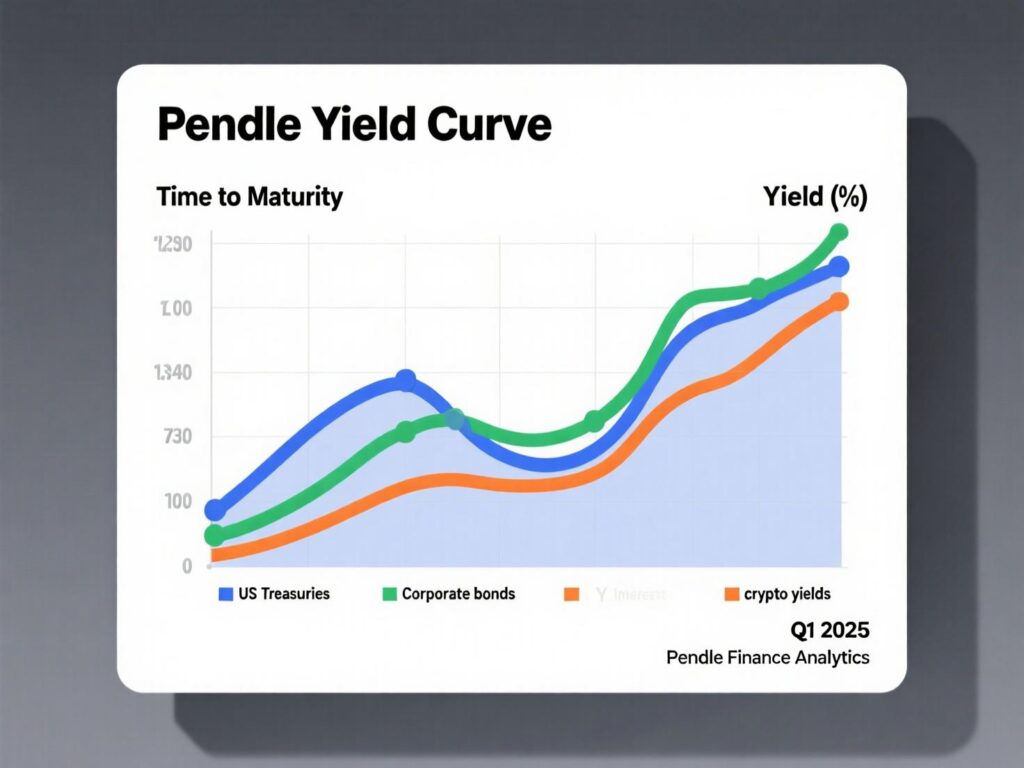

LSDfi protocols (e.g., fixed/floating yield markets, yield tokenization) exploded in 2024–2025. Pendle’s TVL has surged into multi-billion territory, reflecting demand to trade term structure of yield. This expands the utility of liquid staking derivatives as base collateral for higher-order products.

Restaking and the “security reuse” era

Restaking

extends the LSD thesis by reusing staked ETH (or LSTs) to secure additional services via operators exporting Ethereum’s economic security. EigenLayer became the category’s bellwether, scaling from roughly $1B to tens of billions in TVL across 2024–2025, validating appetite for LRTs and operator-based security markets. The opportunity: new reward streams; the risk: stacked slashing vectors and correlated events. Builders are iterating on safeguards (caps, circuit breakers, operator reputation).

Case study #1: stETH’s 2022 depeg lessons that stuck

In 2022, stETH temporarily traded below ETH as liquidity thinned and market stress rose during the UST/LUNA collapse. Post-mortems show the depeg dynamics and eventual re-normalization reminding participants that LSTs are not perfectly fungible with unstaked ETH under stress. Today, deeper AMM pools, withdrawal functionality, and arbitrage design have reduced but not eliminated basis risk. Risk labels and liquidity coverage ratios are now standard in professional decks.

Case study #2: LSDfi’s fixed-income layer via Pendle

Pendle popularized on-chain fixed yield by splitting yield and principal, letting users lock in fixed APR or trade future yield. As LST collateral scaled, so did term markets—helping treasuries and funds shape duration. Reports and dashboards in 2025 highlight double-digit billions in TVL, with narratives positioning Pendle as a “DeFi fixed income” core. For end users, this creates portfolio tools (laddering, hedged carry); for protocols, predictable revenue streams.

The next design wave for liquid staking derivatives

Risk-aware LSTs.

Expect LSTs to ship with built-in slashing insurance, audited validator sets, and transparent MEV/fee policies. Caps and progressive decentralization of node operators will remain key differentiators.

Native multi-chain LSTs.

Solana, Cosmos zones, and modular L2s/L3s are spawning LST variants with chain-specific economics (e.g., JitoSOL’s MEV-aware design on Solana; Marinade’s liquid staking). Cross-chain LST bridges will become safer with canonical routers and improved exit pathways.

LST-as-collateral standards.

Expect hardened interfaces for money markets and perps venues (oracle standards, liquidity requirements, haircut frameworks).

Programmable withdrawal queues.

Matching engines and marketplaces for validator exits/entries will reduce basis spreads in stress.

LRT risk segmentation.

Restaking will bifurcate into risk-rated “tranches” with explicit service-level dependencies and caps.

What could go wrong? Key risks to price in

Liquidity mismatches.

LSTs can widen discounts to underlying during stress. Ensure diversified liquidity venues and lines of credit for market makers.Stacked slashing.

Restaked assets inherit risk from multiple domains. Understand operator sets and slashing conditions; keep exposure caps per service.Centralization creep.

Convenience can concentrate stake and MEV. Watch provider share; Lido’s falling share to ~24% is constructive, but vigilance matters.Smart-contract and oracle coupling.

LSDfi builds layers; audit depth and circuit breakers are non-negotiable.Regulatory shifts.

U.S. enforcement against staking-as-a-service (e.g., Kraken 2023) still shapes centralized offerings. The EU’s MiCA establishes disclosure/authorization regimes; the UK weighs collective investment rules. Global differences will persist.

Adoption and economics in 2025

Liquid staking TVL is entrenched.

DefiLlama’s category pages show liquid staking among DeFi’s largest verticals by TVL, with Ethereum-centric and multi-chain providers. Protocol pages (e.g., Binance staked ETH, Marinade) display fee/revenue profiles evidence of durable product-market fit.ETH staking composition.

2025 analyses suggest liquid staking’s share of ETH staking is ~31–32% with modest shifts toward centralized exchanges and restaking. Interpret any one report cautiously; methodology varies, but directionally we see slight dispersion across categories.Yield context.

Mainnet ETH staking yields tend to drift in the ~2–4% band, before any LSDfi or restaking enhancements consistent with activity cycles and validator economics. (Ranges corroborated by category pages and market commentary.)

How liquid staking derivatives will evolve (2025–2027)

Composability > isolation.

LSTs are becoming default collateral in major lending/DEX/perps, with risk haircuts codified. LSDfi and fixed-income rails will professionalize treasury operations.

Institutional interfaces.

Expect permissioned validator sets, SOC2-class custody, segregated wallets, and portfolio-level reporting to unlock mandates that previously avoided DeFi.

Restaking utility markets.

Operators will compete on risk transparency, uptime, service caps, and insurance. LRTs will increasingly resemble structured products with clear term sheets.

Decentralization incentives.

Reward multipliers and governance nudges will push stake toward smaller/new operators; dashboards will track “effective decentralization,” not just raw TVL.

Policy normalization.

The EU’s MiCA-driven disclosure/authorization regime will set the tone for global compliance packages; U.S. policy will likely continue via case-by-case actions and state-level experiments.

Building and allocating with LSTs/LRTs

Allocate by risk bucket.

Separate plain LST exposure (base yield) from LST+LSDfi (amplified yield) and LRTs (stacked risk). Size each bucket explicitly.Diversify liquidity.

Split across providers and chains; prefer LSTs with deep spot and on-chain liquidity plus live withdrawal rails.Read the slashing fine print.

For restaking, map services, operators, and penalty correlation.Use fixed income tools.

Term out yield via LSDfi (e.g., fixed-rate tranches) for predictability in treasuries.Track share and policy. Monitor provider dominance (e.g., Lido share moves) and policy updates (SEC, ESMA) to adjust distributions and venue choice.

Choose a liquid staking platform in 5 steps

Check validator set quality

(diversity, performance, MEV policy, audits).

Liquidity depth & exits

(AMM depth, CEX listings, withdrawal queue mechanics).

Fees & net APR

(operator fee, protocol fee, MEV rebates).

Integrations

(money markets, perps, LSDfi) and collateral haircuts.

Risk disclosures

(slashing coverage, caps, bug bounties, historical incidents)

Outlook

Liquid staking derivatives started as an elegant fix for illiquid staking but they’ve matured into the backbone of on-chain yield and collateral. The next phase won’t be defined by a single protocol or chain; it will be defined by safer abstractions, diversified operator sets, and clear, comparable risk labels across LSTs, LSDfi, and LRTs. Data today TVL depth, falling single-provider dominance, and structured yield markets suggests the category is durable.

Regulation is catching up, with the EU leading on comprehensive disclosure while the U.S. proceeds through enforcement. For investors, treat LSTs as a core fixed-income sleeve with transparent basis and counterparty risks; for builders, make risk observable and priced. Do that, and liquid staking derivatives can power DeFi’s most pragmatic promise: sustainable, composable, real-economy yield at internet speed.

CTA: Want a custom LST/LRT portfolio policy, risk rubric, and integration roadmap for your product or treasury? Get in touch we’ll build a battle-tested playbook in one week.

FAQs

1) What are liquid staking derivatives (LSDs)?

A : LSDs are tokenized receipts that represent staked assets while keeping them liquid for trading, lending, and DeFi strategies. They accrue staking rewards and can be redeemed for the underlying over time, subject to withdrawal mechanics and market liquidity.

2) How do LSTs differ from LRTs (restaking tokens)?

A : LSTs reflect base network staking. LRTs add a second layer by restaking collateral to secure additional services, introducing extra yield and extra slashing/correlation risks managed by operators and caps.

3) How can investors use LSDfi with LSTs?

A : LSDfi lets investors fix or trade future yield, hedge duration, and lever capital via money markets turning LSTs into building blocks for structured income products.

4) How do liquid staking derivatives maintain their value?

A : They’re backed by staked assets plus accumulated rewards. However, market prices can deviate from 1:1 during stress or when exit queues are long; liquidity depth and arbitrage paths matter.

5) How risky is restaking compared with basic liquid staking?

A : Restaking stacks risk from both the base chain and external services. The probability of slashing events increases with operator/service complexity, which is why caps, insurance, and clear service terms are important.

6) How does regulation treat liquid staking derivatives today?

A: The EU’s MiCA establishes authorization/disclosure regimes for crypto assets; the U.S. has pursued enforcement actions against certain staking-as-a-service programs (e.g., Kraken 2023). Platforms must map venue risk carefully.

7) How can I choose a safer LST?

A: Screen validator decentralization, audits, MEV policy, fees, liquidity, and withdrawal records. Prefer providers with transparent dashboards and multiple DeFi integrations.

8) How do withdrawals affect LST pricing?

A: Efficient withdrawals reduce discounts during stress by tightening the arbitrage loop between LST and underlying. Long queues or limited liquidity can widen spreads.

9) How will liquid staking derivatives evolve over the next two years?

A: Expect risk-aware LSTs, standardized collateral haircuts, institution-ready interfaces, and tranching for restaking. Policy clarity will likely improve in the EU first.