Tether CEO Dismisses Suggestions Company Sold Bitcoin to Buy Gold

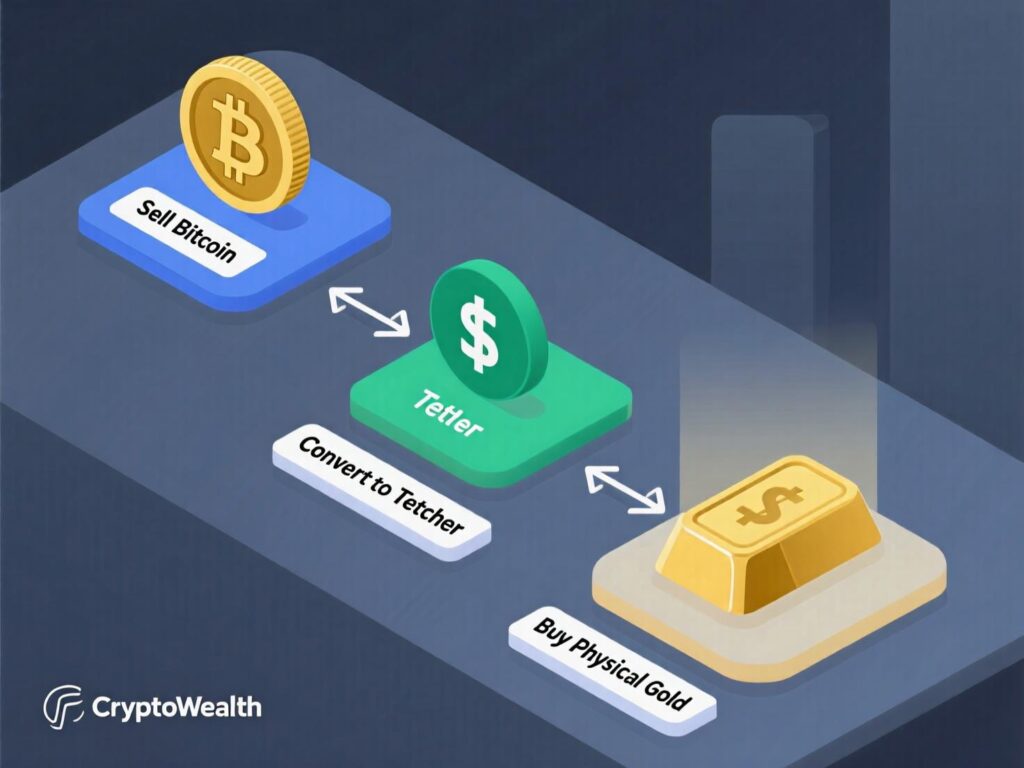

Tether CEO Paolo Ardoino has dismissed new speculation suggesting the stablecoin issuer reduced its bitcoin holdings in favor of gold. The rumors surfaced after observers raised questions about Tether’s quarterly reserve data and certain wallet movements, sparking debate over whether the company had shifted part of its reserves. Ardoino made it clear that such claims were unfounded and reiterated Tether’s position regarding its bitcoin strategy.

Addressing the concerns, Ardoino stated that Tether “didn’t sell any bitcoin,” directly countering the circulating reports. His comments were aimed at cooling market speculation and reassuring investors that the company’s approach to reserve management remains unchanged. The clarification underscores Tether’s ongoing commitment to transparency while putting to rest doubts about a potential pivot from bitcoin into gold.

‘Tether sold bitcoin to buy gold’: what the CEO says

Ardoino addressed the chatter on X, responding to posts that highlighted a decline in BTC reported in Tether’s Q2 reserve attestation. He pointed to an internal treasury move instead: part of Tether’s bitcoin holdings was contributed to Twenty One Capital (XXI), a bitcoin treasury firm in which Tether is a majority shareholder. In other words, the coins didn’t leave the broader Tether ecosystem for bullion. Echoing that view, he wrote that “we didn’t sell any bitcoin,” pushing back on the idea that Tether sold bitcoin to buy gold.

The numbers behind the noise

A YouTuber noted that attested BTC reportedly fell from ~92,650 in Q1 to ~83,274 in Q2.

Samson Mow, CEO of JAN3, said on-chain movements showed nearly 20,000 BTC were sent to XXI.

Ardoino confirmed a contribution “from the stash” to XXI—framed as a strategic allocation rather than a sale.

What we know (at a glance)

Tether remains a significant bitcoin holder and has repeatedly described BTC, gold, and even land as long-term “safe asset” allocations.

The firm already reports multi-billion-dollar gold exposure and has explored gold-related investments, including mining.

A treasury shift into XXI explains on-chain movements without meaning Tether sold bitcoin to buy gold.

Market perception, however, often reacts to headline numbers before understanding the structure of internal transfers.

Context and implications

Stablecoin treasuries are increasingly diversified. For Tether, bitcoin has served both as an investment and a signal to crypto-native users, while gold provides an off-chain hedge that behaves differently across macro cycles. If coins are moved to a controlled affiliate like XXI, the economic exposure can remain substantially intact even if the balance sheet line items shift between entities.

For transparency skeptics, any perceived drop in attested BTC will trigger questions. But the distinction between selling to a third party versus contributing to a majority-owned treasury vehicle is material: one reduces net BTC exposure; the other largely reshuffles it. The takeaway for markets is that reserve disclosure cadence and the way holdings are booked can drive rumor cycles, especially when on-chain flows are noticed before formal explanations arrive. That dynamic is unlikely to fade as more stablecoin issuers publish attestations and pursue mixed portfolios.

What happens next

Attestation season will remain a flashpoint for scrutiny, and Tether’s messaging suggests it will keep allocating profits into bitcoin, gold, and land as macro uncertainty lingers. Unless new data shows actual disposals, the claim that Tether sold bitcoin to buy gold remains unsubstantiated. Expect continued debate over how treasury structuring, affiliate entities, and diversification are reflected in public snapshots and how quickly those details are communicated to the market.

Conclusion

For now, Tether CEO Paolo Ardoino has made it clear that no bitcoin was sold despite rumors suggesting otherwise. While questions over wallet activity and reserves raised eyebrows, Ardoino stressed that there is no evidence backing claims that bitcoin was exchanged for gold.

The bigger picture reflects a broader trend in the crypto industry companies are moving toward more diversified, multi-asset reserves. In this environment, how holdings are presented can be just as important as the actual positions. For Tether, the message is straightforward: its bitcoin remains untouched, even as speculation about gold continues.

FAQs

Q1. Did Tether sell BTC did Tether sold bitcoin to buy gold actually happen?

A . Tether’s CEO says no. He cited an internal allocation to XXI, not disposals, countering the claim that Tether sold bitcoin to buy gold.

Q2. Why did people think Tether sold bitcoin to buy gold?

A . A reported decline in attested BTC and visible wallet flows sparked rumors that Tether sold bitcoin to buy gold, but executives point to a treasury transfer.

Q3. If Tether moved BTC to XXI, does that mean Tether sold bitcoin to buy gold eventually?

A . Not necessarily. A transfer to a majority-owned affiliate preserves exposure and doesn’t prove Tether sold bitcoin to buy gold.

Q4 . What assets besides BTC fuel the Tether sold bitcoin to buy gold narrative?

A . Tether also holds gold and has discussed gold-related investments, which is why Tether sold bitcoin to buy gold rumors gained traction.