Strategy’s Cycle Peak Aligned with IBIT Options Debut Last November

The sharp alignment in November between MicroStrategy’s valuation premium and the explosive debut of BlackRock’s IBIT options highlights a deeper narrative about how traders navigate bitcoin exposure. Investors often toggle between equities like MicroStrategy and ETFs such as IBIT to optimize returns, reflecting shifts in market sentiment and risk appetite. This behavior underscores the growing complexity of bitcoin-linked investment strategies as liquidity and institutional interest rise.

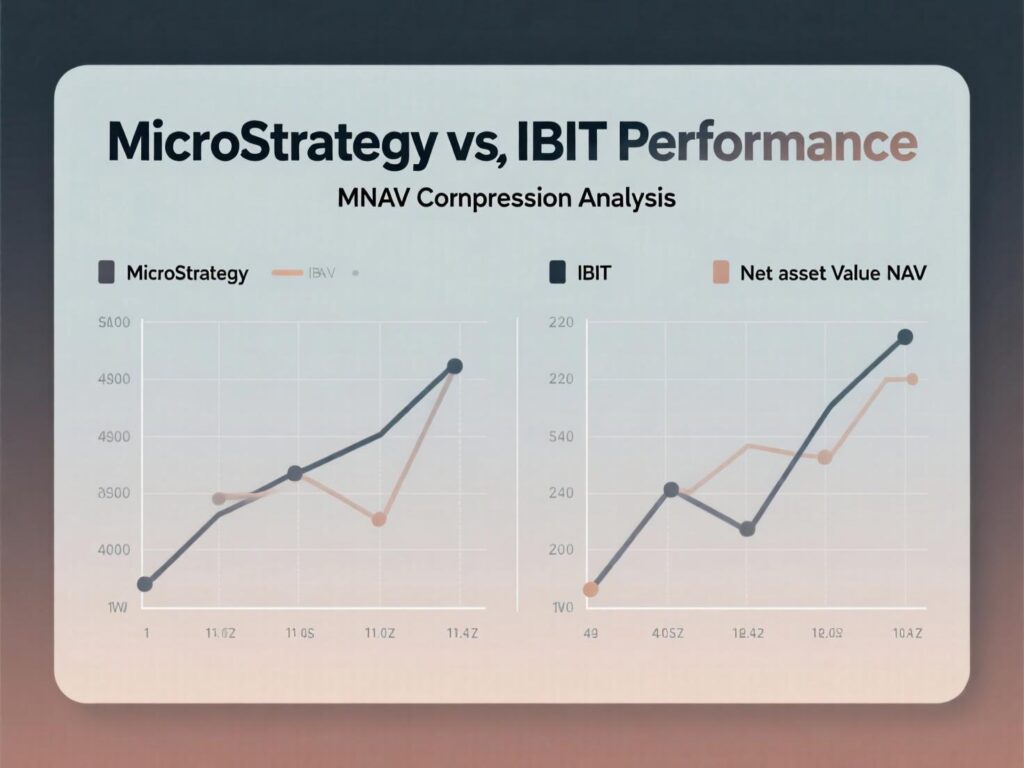

Analyzing the performance of MicroStrategy versus IBIT reveals differing risk-reward profiles that adjust dynamically with market volatility. MicroStrategy offers direct equity exposure with premium valuation considerations, while IBIT provides ETF-based access, often with smoother trading mechanics. The rotation between these instruments illustrates how traders strategically balance potential upside against short-term market swings, shaping the evolving landscape of bitcoin investment options.

What to know

MicroStrategy (MSTR) hit a cycle mNAV peak of 3.141 on Nov 20, 2024, one day after IBIT options launched with $2B in first-day volume.

Since that peak, MSTR is down ~40%, yet still up ~515% since spot bitcoin ETFs debuted in Jan 2024, versus IBIT’s ~128%.

Bitcoin implied volatility (IV) is under 40, a subdued level that tends to dampen demand for leverage and options.

At the peak, MicroStrategy held ~331,200 BTC, roughly 305,000 BTC more than earlier in its accumulation cycle.

The setup underscores how equity-based beta (MSTR) and ETF-based beta (IBIT) behave differently as volatility waxes and wanes.

Why the peaks lined up

IBIT options went live on Nov 19, 2024, drawing more than $2 billion in day-one trading. That same window saw MicroStrategy’s multiple to net asset value (mNAV)—enterprise value divided by the fair value of its bitcoin hit 3.141 on Nov 20, 2024. The date pairing wasn’t coincidental: liquidity, options-driven hedging, and flows into spot and derivatives often cluster around catalysts. As bitcoin flirted with $100,000, MSTR’s equity premium stretched, reflecting not only its embedded bitcoin but also the market’s willingness to pay for operational leverage, treasury strategy, and optionality.

MicroStrategy vs IBIT performance by the numbers

Since spot bitcoin ETFs launched in January 2024, the MicroStrategy vs IBIT performance gap has been striking. MSTR has surged about 515%, while IBIT—a lower-tracking-error, lower-friction vehicle designed to mirror spot bitcoin—has gained roughly 128%. The difference stems from structure: MSTR layers corporate balance-sheet leverage, equity market dynamics, and an active issuance/financing playbook on top of bitcoin beta. IBIT, by design, strips those extras away.

MSTR’s mNAV has since compressed from 3.141 to around 1.55 as the stock retraced ~40% from its high. That reset narrowed the valuation gap to its underlying coin stack, even as MicroStrategy’s holdings climbed to ~331,200 BTC.

How volatility steers MicroStrategy vs IBIT performance

In quieter tape—bitcoin IV < 40—demand for leverage and complex option overlays typically cools. The MicroStrategy vs IBIT performance spread often narrows in such regimes because appetite for equity-like torque fades. Conversely, when volatility re-accelerates, MSTR’s optionality and historical volume profile can attract traders pursuing convexity, while ETF flows (spot and options) reconfigure the hedging landscape.

Equity premium, ETF purity

MSTR has long functioned as a quasi-levered proxy for bitcoin, tradable in equity and options markets with deep liquidity across prime brokers. IBIT offers purity of exposure, tight tracking, and a familiar ETF wrapper. The MicroStrategy vs IBIT performance divergence is therefore not “better vs worse,” but structure vs structure: one embeds operating leverage and funding behavior; the other prioritizes tracking efficiency and simplicity.

What it means now

With IV subdued, leverage-forward products may remain muted until realized and implied volatility rise. In that case, the MicroStrategy vs IBIT performance gap could again widen, with MSTR’s equity premium historically expanding during hot, flow-heavy phases. If volatility stays contained, ETF-based exposure like IBIT may continue to look attractive for investors prioritizing tracking precision and lower complexity.

Conclusion

The November alignment IBIT options surging and MicroStrategy reaching its mNAV peak shows how market microstructure and volatility influence performance dynamics. Traders increasingly weigh the trade-offs between direct equity exposure via MSTR and ETF-based access through IBIT, highlighting the evolving ways to gain bitcoin exposure.

Looking ahead, monitoring bitcoin implied volatility and funding conditions will be key. Shifts in these metrics tend to tilt the balance between the leverage of equity-style instruments and the cleaner access of ETFs. As market conditions evolve, the rotation between MicroStrategy and IBIT will continue to reflect changing risk-reward preferences among investors.

FAQs

Q1 . Why did MicroStrategy’s mNAV peak right after IBIT options launched?

A : The options debut concentrated flows and hedging, stretching MSTR’s premium as bitcoin neared key levels. This is one reason the MicroStrategy vs IBIT performance gap widened around Nov 2024.

Q2 . Which is better for pure spot exposure—MSTR or IBIT?

A : IBIT. It’s designed to track spot bitcoin closely, while MSTR layers equity dynamics, financing choices, and corporate strategy on top of coin exposure.

Q3 . How does low volatility affect returns?

A : When bitcoin IV sits below 40, demand for leverage and options tends to fade, which can compress premiums and narrow equity-ETF return differentials.

Q4 . What could expand the spread again?

A : A volatility upturn, heavier derivatives activity, or renewed risk appetite could lift MSTR’s premium faster than ETF flows, widening the equity-ETF spread.

Q5 . How big are MicroStrategy’s holdings now?

A : Around the peak window discussed, MicroStrategy reported roughly 331,200 BTC, a large step-up versus earlier in its accumulation cycle.