Crypto Derivatives Market Growth

The Crypto Derivatives Market Growth narrative in 2025 is defined by expanding institutional participation, product innovation, and clearer rulebooks across major jurisdictions. After a choppy 2024, derivatives have reasserted dominance over spot markets by value, with centralized exchanges posting fresh yearly highs. July’s rebound alone saw derivatives volumes climb to ~$6.5 trillion even as the mix shifted alongside renewed spot interest underscoring how leverage, hedging, and basis strategies now anchor crypto liquidity stacks.

On regulated venues, momentum accelerated. CME Group reported record average daily notional activity and rising open interest across BTC/ETH complexes, helped by alt-futures and new contract designs that mirror spot execution. Meanwhile, options liquidity continues to deepen Deribit set a new record in Bitcoin options open interest this year, evidence that more sophisticated risk transfer is now central to market structure. CME GroupCoinDesk

Beyond trading mechanics, policy scaffolding matured. IOSCO’s 2025 work program prioritizes implementation monitoring of crypto-asset recommendations, while the EU’s MiCA regime entered application phases, tightening supervision on service providers. Together, these moves are nudging flows into clearer, better-supervised channels—another tailwind for Crypto Derivatives Market Growth.

Size, Mix, and Momentum

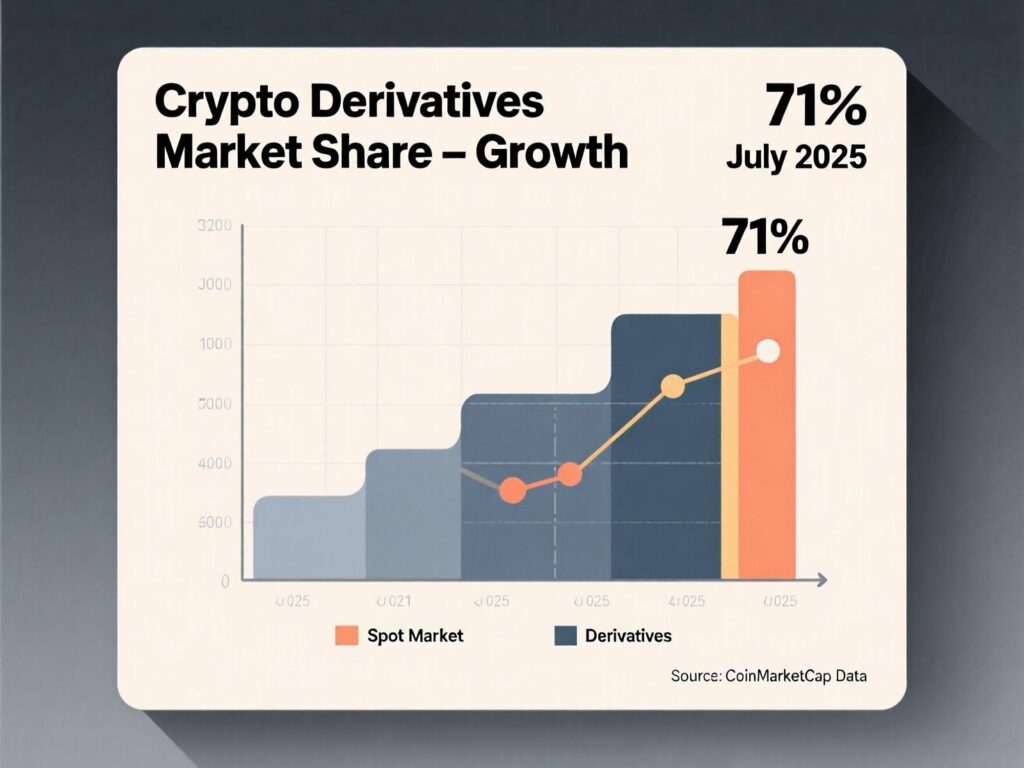

Derivatives share & volumes.

In July 2025, centralized-exchange derivatives volumes reached a yearly high (~$6.5T). Even with a strong spot rebound, derivatives still captured ~71% of total exchange activity down from ~78% earlier in the year, but structurally dominant. Crypto Derivatives Market Growth persists even when spot rallies, indicating a “derivatives-first” price discovery regime.Perpetuals vs. futures vs. options.

Kaiko analysis indicates derivatives exceed three-quarters of crypto trading and that BTC perpetuals alone account for roughly two-thirds of Bitcoin’s traded volume in 2025 perps remain the liquidity workhorse, while listed futures and listed options steadily broaden the institutional toolkit.Regulated venues.

CME reported all-time highs in ether futures ADV and record open interest in BTC/ETH options during Q2 2025, reinforcing regulated-venue adoption among asset managers, corporates, and macro funds an important pillar for Crypto Derivatives Market Growth.

Drivers Behind Crypto Derivatives Market Growth

Institutionalization & Product Design

Institutional desks value tight spreads, deep books, and capital-efficient instruments. On CME, crypto ADV and OI set new marks this year, aided by micro-sized contracts, spot-quoted futures that reduce roll frictions, and reference rates with standardized methodologies. These features support basis trades, delta-hedged strategies, and relative-value portfolios all of which underpin Crypto Derivatives Market Growth by aligning with familiar workflows from rates/FX/commodities.

Options Liquidity as a Risk-Transfer Layer

Option markets facilitate informed views on skew, term structure, and tails. Deribit’s notional OI hit a record ~$42.5B in May 2025, showing institutions and sophisticated traders increasingly hedge or express convexity through listed options rather than via ad-hoc structured products. This deepening options layer attracts more market-making capital and improves price discovery.

Regulation & Clarity

Regulatory clarity reduces execution and custody uncertainty. IOSCO is monitoring implementation of its crypto recommendations in 2025, while MiCA’s service-provider rules entered application (Dec 30, 2024; updated guidelines July 2025). Clearer licensing, disclosure, and supervision make it easier for compliance-focused funds to engage, a subtle yet powerful catalyst for Crypto Derivatives Market Growth especially on venues aligning with MiCA and U.S. CFTC oversight.

Macro Volatility & Basis Opportunities

Volatility clusters magnify derivatives turnover: traders chase carry, funding-rate dislocations, and calendar/venue basis. As spot ETFs, stablecoin flows, and macro events swing liquidity, derivatives become the primary lever to re-risk or de-risk positions without moving collateral on-chain another reason Crypto Derivatives Market Growth remains persistent across market cycles.

Segment Breakdown: Where the Growth Is Happening

Futures & Perpetuals (Perps)

Capital efficiency:

Cross-margining and portfolio margin unlock larger notional exposure for similar collateral.Venue breadth:

Centralized leaders (e.g., Binance, OKX, Bybit, CME) and rising on-chain perps (e.g., Hyperliquid) widen access. CCData highlights Hyperliquid’s on-chain derivatives posting record volumes and OI share growth in July 2025.Use cases:

Hedging basis from spot ETFs; delta-one exposure for asset-allocation overlays; cash-and-carry arbitrage.AEO insight:

Generative engines consistently summarize “how-to hedge/lever up with perps,” so clear FAQs and schema help you win those answers (see AEO/GEO section).

Listed Options

Convexity demand: Funds increasingly prefer listed options for tail-risk hedges and tactical convex exposure around catalysts. Deribit’s OI record confirms that more strategies (risk-reversals, butterflies, calendar spreads) are being implemented at scale fueling Crypto Derivatives Market Growth in the options layer.

Regulated expansion: CME’s BTC and ETH options OI and ADV have climbed; combined with micro-contracts, this broadens participation for smaller institutional mandates.

How Policy Shapes Crypto Derivatives Market Growth

European Union (MiCA): Service-provider rules applied from Dec 30, 2024; ESMA issued knowledge/competence guidelines in July 2025. Expect more CASP licenses, standardized disclosures, and better distribution channels favorable to compliant derivatives venues and brokers.

United Kingdom: Retail crypto-derivatives remain banned; debates continue over whether the blanket ban still serves consumers in a maturing regime. This slows U.K. retail derivatives penetration relative to the EU and offshore venues.

Asia & India: Local dynamics matter. Recent reporting suggests Indian futures turnover outpacing spot amid tax and market-structure quirks—evidence of regional catalysts that can tilt usage toward derivatives.

Real-World Examples (Short Case Notes)

Institutional Basis Strategy on CME

A cross-asset fund allocates to BTC via U.S. spot ETFs, then overlays CME BTC futures shorts to harvest basis during periods of premium (positive annualized spread). The fund rotates collateral to treasuries while managing delta with micro-contracts. Result: stable carry with controlled directional risk made possible by regulated infrastructure and liquidity expansion that underpin Crypto Derivatives Market Growth.

Options-Led Hedging on Deribit

A crypto treasury with concentrated BTC exposure buys long-dated put spreads and periodically sells short-dated calls against inventory (covered calls). The book benefits from improved options depth and tighter spreads; treasury VaR declines without fully capping upside mirroring patterns seen as Deribit’s OI hit records in 2025.

Risks & What to Watch

Leverage & funding stress: Perps can transmit shocks; funding spikes/negative carry can force rapid deleveraging.

Regulatory divergence: Jurisdictions moving at different speeds (MiCA vs. U.K. stance) fragment liquidity and user access.

Data gaps & interconnectedness: European central bankers warn that gaps mask tail risks; better disclosure and harmonized standards remain essential.

Stablecoin plumbing: Stablecoin rules and liquidity profiles affect collateral and settlement pipelines; BIS and FSB guidance continue to evolve.

The Next Leg of Crypto Derivatives Market Growth

Expect Crypto Derivatives Market Growth to stay resilient even if spot cools. The mix will likely continue shifting toward:

Deeper regulated-venue stacks (CME and EU-licensed CASPs),

On-chain perps with better oracles/RFQ and shared collateral,

Options strategies embedded in treasury and asset-allocation workflows.

Taken together with MiCA implementation, IOSCO monitoring, and institutional toolkits expanding derivatives should remain the capital-efficient core of crypto market structure through 2026.

Final Words

The 2025 evidence is clear: Crypto Derivatives Market Growth is structurally entrenched. Despite swings in spot dominance month-to-month, derivatives continue to supply liquidity, risk transfer, and capital efficiency. Records on CME and Deribit highlight maturation at both regulated and specialist venues, while MiCA and IOSCO create clearer guardrails. For institutions, this means scalable basis, convexity, and hedging strategies; for exchanges and protocols, it means product innovation and margin efficiency must remain front-and-center.

CTA: If you’re a trading lead, treasury head, or product manager, now is the time to audit your derivatives playbook optimize margin, formalize options overlays, and align compliance with MiCA/CFTC regimes. Need a tailored plan? Contact our team for a 30-minute strategy session on derivatives growth opportunities in your region.

FAQs

Q1: How does Crypto Derivatives Market Growth compare with spot in 2025?

A : Derivatives maintain structural dominance in the crypto trading ecosystem. July 2025 data shows approximately $6.5 trillion in derivatives volume commanding ~71% market share, even as spot markets experienced a rebound. This derivatives-first architecture has persisted across multiple years, with monthly share consistently favoring derivatives trading. The structural dominance reflects institutional preference for leveraged exposure, hedging capabilities, and the liquidity depth that derivatives markets provide over traditional spot trading.

Q2 : How can institutions hedge exposure efficiently?

A : Institutional hedging strategies center on regulated futures for basis trades and position offloading, combined with listed options for tail-risk management and convexity plays. CME’s record average daily volume (ADV) and open interest (OI), alongside Deribit’s OI peaks, demonstrate sufficient market depth for sophisticated professional strategies. Key efficiency drivers include micro-contracts for precise sizing, spot-quoted futures for direct exposure management, and enhanced margin efficiencies through portfolio margining systems that recognize risk offsets across positions.

Q3 : How do perps fuel Crypto Derivatives Market Growth?

A : Perpetual swaps (perps) serve as the primary growth engine by providing continuous, delta-one exposure through funding-rate mechanics and exceptional liquidity depth. According to Kaiko data, perps account for the majority of bitcoin’s traded volume in 2025. The funding-rate mechanism creates natural basis trading opportunities while eliminating expiration risk, making perps attractive for both directional trades and market-neutral strategies. Funding risk management and basis capture represent key operational considerations for professional traders.

Q4 : How is regulation shaping the market?

A : Regulatory frameworks are creating clearer compliance pathways that support broader market participation. IOSCO continues monitoring crypto recommendation implementations throughout 2025, while MiCA’s provider rules are operational and ESMA has issued specific guidelines on knowledge and competence requirements. The net regulatory effect establishes defined licensing procedures and disclosure standards that function as adoption catalysts rather than barriers, providing institutional comfort for market entry.

Q5 : How do options improve treasury risk management?

A : Options strategies enable sophisticated treasury management through downside protection and yield enhancement overlays, particularly covered call programs. Record open interest levels demonstrate growing adoption by corporate treasuries and investment funds seeking convexity exposure without significant balance sheet expansion. Typical structures include protective puts for downside floors, covered calls for income generation, and collar strategies for defined risk ranges. Tenor selection typically focuses on 1-3 month expiries to balance premium costs with protection duration.

Q6 : How can on-chain derivatives compete with CEXs?

A : On-chain derivatives platforms compete through improved oracle systems, sophisticated cross-margining capabilities, and enhanced counterparty risk controls. CCData highlighted strong on-chain derivatives growth, with platforms like Hyperliquid gaining traction in July 2025. Competitive advantages require robust smart contract audits, well-capitalized insurance funds, and sophisticated liquidation frameworks that prevent cascading failures while maintaining capital efficiency.

Q7 : How should a new desk start with compliant access?

A : New trading desks should prioritize venues with clear CFTC or MiCA regulatory alignment, implement comprehensive KYC/AML procedures that meet policy requirements, and establish robust risk management systems including position limits, circuit breakers, and liquidation ladders. Success requires close coordination with legal and compliance teams to navigate regional regulatory nuances and ensure ongoing adherence to evolving requirements.

Q8 : How can retail gain safer exposure?

A: Retail participants should focus on regulated products, maintain clear understanding of leverage mechanics, and utilize options for defined-risk strategies. Regulatory environments vary significantly—jurisdictions like the U.K. maintain strict limitations on retail derivatives access. Education priorities include funding rate mechanics, options Greeks sensitivity, and liquidity considerations during volatile periods.

Q9 : How do stablecoins affect derivatives plumbing?

A : Stablecoins serve as critical infrastructure powering collateral mobility and settlement liquidity across derivatives markets. Ongoing policy focus from the Financial Stability Board (FSB) and Bank for International Settlements (BIS) will shape reserve requirements, disclosure standards, and capital flows, directly impacting funding rates and basis dynamics. Stablecoin regulation represents a key infrastructure consideration affecting the entire derivatives ecosystem’s operational efficiency.