Crypto-Powered Universal Basic Income (UBI) Models

A new wave of crypto UBI pilots is testing whether blockchain can deliver unconditional cash more transparently, cheaply, and fairly. Identity systems such as Proof of Humanity and Worldcoin aim to stop multi-account fraud; DeFi-based treasuries try to fund stipends sustainably; and community currencies like Circles experiment with local trust networks.

Meanwhile, mainstream research on UBI continues to evolve, with major pilots reporting nuanced results. Taken together, crypto UBI projects force an urgent question: can decentralized identity and programmable money make universal income both verifiable and viable at global scale? Recent developments from Circles 2.0’s launch to GoodDollar’s protocol upgrade suggest we’re entering a second generation of crypto UBI experiments grounded in real-world use.

What is UBI—and what does blockchain change?

Universal Basic Income (UBI) is a regular, unconditional cash payment to individuals, independent of employment status. Academic hubs like Stanford’s Basic Income Lab track decades of results and open questions (e.g., funding, labor incentives, inflation). Blockchain adds potential advantages: global rails, lower fees, programmable disbursement, and auditable flows but it does not replace policy decisions about level, universality, or taxation. For feasibility and equity, UBI debates must integrate digital identity, payments infrastructure, and governance.

Why now?

Digital public infrastructure (DPI), fast payments, and CBDC research reduce delivery friction. IMF/World Bank notes emphasize how interoperable digital payments and DPI can broaden financial inclusion preconditions for any scaled crypto UBI.

The 5 dominant crypto UBI models (today)

Proof-of-Personhood airdrops (identity-first UBI)

These systems distribute tokens to unique humans proven via on-chain identity. Approaches vary:

Worldcoin: biometric “Orb” scans create a World ID; grants or airdrops can be tied to uniqueness. It positions proof-of-personhood as foundational infrastructure for fair allocation (e.g., one-person-one-share distributions). Privacy and centralization trade-offs remain active debates.

Proof of Humanity (PoH): a decentralized registry using social vouching and Kleros arbitration; originally paired with an UBI token streamed to verified humans (paused/iterating over time). Developers continue to treat PoH as a modular identity primitive for crypto UBI designs.

Pros: strong Sybil resistance; transparent issuance.

Cons: biometric risks (where applicable), capture/abuse risks, and uneven global onboarding.

Yield-backed crypto UBI (DeFi income funds)

GoodDollar pioneered a model where a reserve and partner protocols generate yield that funds a daily per-capita G$ claim. In 2025 the project proposed GoodDollar V4 with a new Celo Reserve (with Mento Labs) to improve sustainability and re-activate minting an example of migrating treasuries toward stable, low-volatility backing. Messari’s Celo coverage lists GoodDollar among notable funded ecosystem projects.

Pros: ongoing programmatic funding; transparent treasury.

Cons: exposure to DeFi risk, yield volatility, and governance dependencies.

Community currency UBI (web-of-trust + demurrage)

Circles UBI (CRC) issues personal currencies that become mutually spendable through trust links (a web-of-trust). Circles 2.0 launched on May 21, 2025 with group mechanics, universal access after receiving trust from three users, continuous issuance (e.g., 1 CRC/hour), and 7% demurrage to keep money circulating. Studies of Berlin’s pilot highlight the social coordination challenges and potential local-trade benefits.

Pros: bottom-up inclusion, local stimulus, inflation control via demurrage.

Cons: liquidity fragmentation, limited merchant acceptance, bootstrapping network trust.

Donor-funded stablecoin UBI (NGO-first)

impactMarket on Celo routes philanthropic capital as stablecoin UBI to vetted communities, often with local merchant enablement and cards. Documentation and case notes detail outcomes like food security shares and merchant integrations—useful for NGOs testing crypto UBI in low-connectivity contexts.

Pros: direct delivery, transparent flow-of-funds, global reach via mobile wallets.

Cons: sustainability depends on donors; must solve cash-out/off-ramp UX.

Public-sector/CBDC-enabled UBI (policy-first)

Governments could combine retail CBDC or fast-payment rails with identity to deliver UBI or negative-income transfers. IMF notes outline CBDC positioning and interoperability values; World Bank DPI reports show how identity + payments stacks lower delivery costs. While few governments run full UBI via CBDC today, the rails are maturing fast—relevant for future crypto UBI hybrids.

Design choices that make—or break—crypto UBI

Sybil-resistance & eligibility

Options include biometrics (World ID), social vouching (PoH), or web-of-trust (Circles). Each has different privacy, cost, and inclusion profiles—and each gates how fair your crypto UBI becomes.

Funding mechanics

Yield-backed (GoodDollar-style).

Donor-funded (impactMarket).

Seigniorage/community issuance with demurrage (Circles).

Public finance (potentially CBDC rails).

Choice determines sustainability, volatility, and inflation optics.

Token design: inflation vs. velocity

Demurrage can incentivize spending; time-based minting equalizes allocation. But convertibility matters—if recipients can’t spend or cash out, crypto UBI fails.

Compliance & governance

UBI is not “no rules.” Identity, KYC/AML where mandated, and data protection (esp. biometrics) shape deployments. TIME and other reports flag ongoing privacy scrutiny of biometric models.

User experience & off-ramps

Success hinges on wallets, merchant acceptance, and cash-out options—areas where DPI and fast-payment learnings (e.g., interoperability on India’s UPI) are instructive.

Two short case studies

Case 1: GoodDollar’s DeFi-funded daily claims

Community metrics published by GoodDollar cite a large global member base and continued protocol iteration. The 2025 V4 proposal (Celo Reserve) shows how crypto UBI treasuries shift toward more stable reserves to keep stipends flowing, illustrating a path from “DeFi yield only” to blended reserves. GoodDollarGoodDollar Discourse

Case 2: Circles Berlin → Circles 2.0

Academic and ecosystem write-ups of Circles’ Berlin pilot documented coordination and acceptance issues alongside local exchange prospects. The May 2025 Circles 2.0 release adds group mechanics and demurrage to address hoarding and liquidity. This evolution shows crypto UBI can iterate its economics without biometrics by leaning on social trust and spend incentives.

Where crypto helps and where it doesn’t

Adds value:

Verifiable, auditable disbursement streams.

Programmable conditions (frequency, demurrage).

Cross-border reach with low fees and 24/7 settlement.

Composable identity primitives for fair allocation.

Doesn’t solve by itself:

Political legitimacy and taxation (public UBI).

Macroeconomic trade-offs (inflation, labor effects).

Privacy, equity, and consent in biometric systems.

Offline access and cash-out—still require rails and regulation.

Large-scale UBI evidence is mixed and context-dependent; GiveDirectly’s Kenya studies show strong gains but also suggest lump-sum transfers can outperform short-term monthly stipends in certain settings reminding crypto UBI designers to test schedule and size empirically.

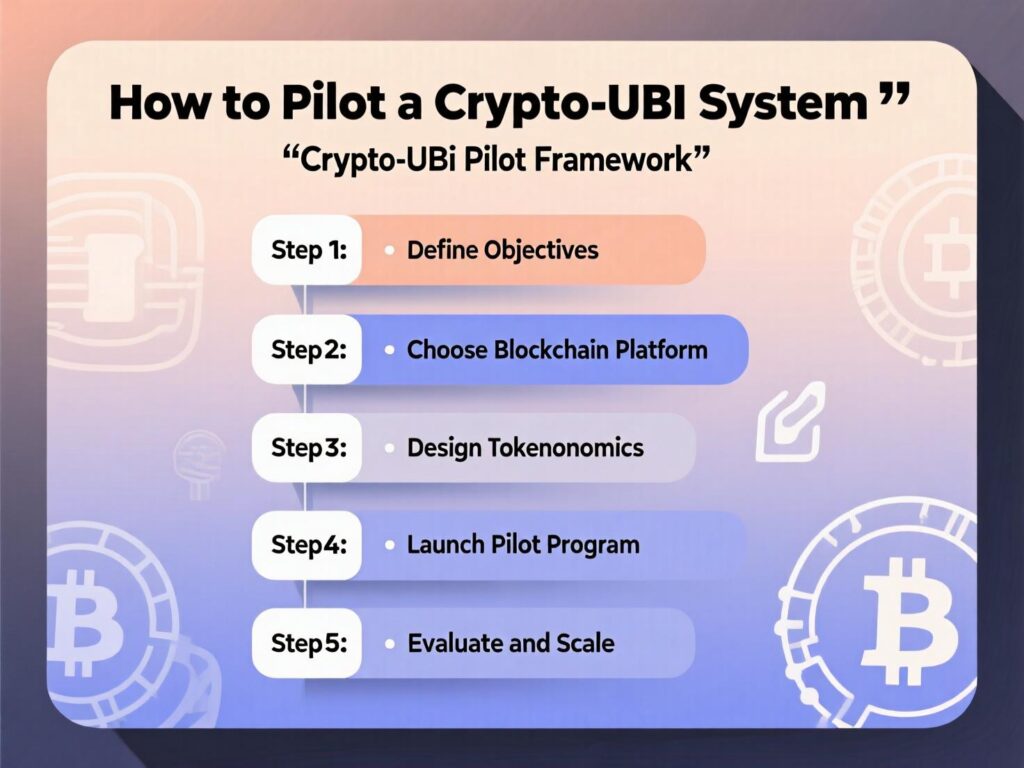

How to launch a city-level crypto UBI pilot

Define the objective & level (e.g., $20/mo for 12 months to 5,000 residents) and success metrics (food security, volatility smoothing, digital inclusion).

Pick identity layer: Biometrics (World ID), social vouching (PoH), or WoT (Circles-style). Decide tolerance for false positives/negatives and privacy expectations.

Choose funding model: Donor fund (impactMarket-style), DeFi yield (GoodDollar-style), or public budget. Diversify reserves (stablecoins, cash equivalents).

Payments & wallet UX: Target low-end Android, SIM-swap resilience, recovery options; add cash-out and merchant acceptance plan (e.g., stablecoin PoS).

Compliance & data protection: Map KYC/AML and biometrics law; implement data-minimization and revocation.

Monitoring & research: Pre-register outcomes; partner with universities; compare monthly vs. lump-sum arms.

Interoperability & DPI: Align with local fast-payments and identity where possible to reduce friction.

Governance & exit: Define treasury triggers, demurrage rate (if any), grievance redress, and post-pilot wind-down.

Concluding Remarks

Second-generation crypto UBI is less about hype and more about governance, identity, and rails. Proof-of-personhood is maturing; community currencies are re-tuning incentives; donor programs are showing how stablecoins reach vulnerable groups with auditable flows.

The playbook is clear: pair strong identity primitives with sustainable funding, merchant off-ramps, and rigorous evaluation. If you’re planning a pilot, start small, publish results, and iterate because legitimacy is earned with outcomes, not promises. Ready to scope your crypto UBI pilot? Reach out and we’ll help blueprint identity, funding, and compliance tailored to your jurisdiction.

FAQs

Q : How does proof-of-personhood stop multi-account abuse in crypto UBI?

A : By binding benefits to a unique human identity (biometric or social-vouching), each person receives one share. World ID (biometrics) and PoH (vouching + arbitration) are two approaches, each with privacy and inclusion trade-offs and different attack surfaces.

Q : How can a city fund crypto UBI without volatile tokenomics?

A : Blend donor funds, stablecoin reserves, and conservative yield sources; cap per-capita level; and publish treasury audits. GoodDollar’s reserve model and impactMarket’s donor rails illustrate two non-speculative paths.

Q : How do demurrage and time-based minting affect behavior?

A : Demurrage (e.g., 7%/yr) discourages hoarding while time-based minting equalizes issuance. This can improve velocity within local networks, but convertibility and merchant uptake still determine real impact.

Q : How does crypto UBI compare to traditional cash transfers?

A : Crypto adds programmability and transparency but doesn’t guarantee better outcomes. Evidence from large cash experiments (e.g., GiveDirectly) suggests schedule and amount matter; in some settings, lump sums outperform short-term monthly transfers.

Q : How can privacy be preserved in biometric systems?

A : Use on-device processing, minimal data storage, zero-knowledge proofs, open audits, and opt-outs. Independent oversight and region-specific DPI rules are essential.

Q : How do we handle cash-out and merchants in low-connectivity areas?

A : Partner with local fintechs, enable stablecoin PoS, pre-negotiate FX spreads, and provision recovery paths (SIM swap, key guardians).

Q : How do we measure success beyond “number of wallets”?

A : Track volatility smoothing, food security, school attendance, business investment, and time use. Pre-register outcomes with an academic partner.

Q : How can crypto UBI scale with public rails like DPI or CBDCs?

A : Align identity and payments with national DPI; explore CBDC as a payout rail while keeping privacy layers. Interoperability guidance from IMF/World Bank helps structure this.

Q : How do we prevent gaming when trust networks issue currency?

A : Use multi-party trust thresholds, slashing for collusion, and periodic audits; complement with merchant/receipt analytics.